- Japan

- /

- Construction

- /

- TSE:1787

Did You Participate In Any Of Nakabohtec Corrosion ProtectingLtd's (TYO:1787) Fantastic 203% Return ?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For instance, the price of Nakabohtec Corrosion Protecting Co.,Ltd. (TYO:1787) stock is up an impressive 149% over the last five years. It's also up 21% in about a month. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

See our latest analysis for Nakabohtec Corrosion ProtectingLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

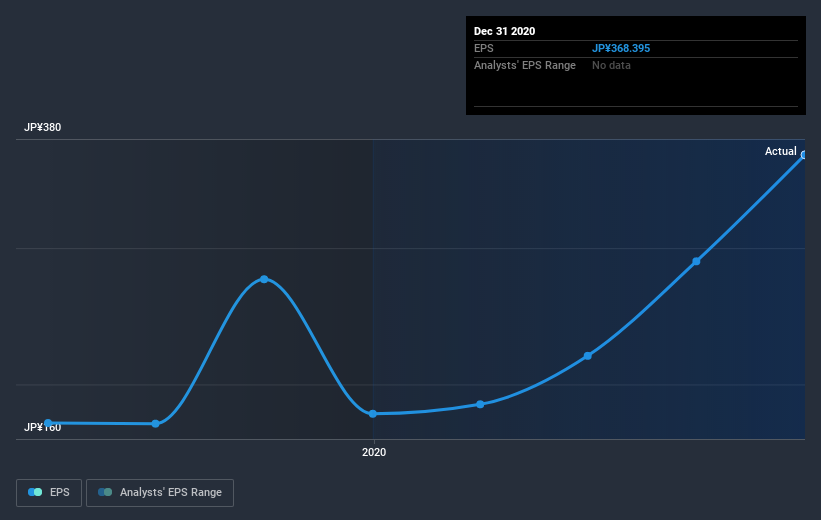

During five years of share price growth, Nakabohtec Corrosion ProtectingLtd achieved compound earnings per share (EPS) growth of 13% per year. This EPS growth is slower than the share price growth of 20% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Nakabohtec Corrosion ProtectingLtd's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Nakabohtec Corrosion ProtectingLtd's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Nakabohtec Corrosion ProtectingLtd shareholders, and that cash payout contributed to why its TSR of 203%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that Nakabohtec Corrosion ProtectingLtd shareholders have received a total shareholder return of 58% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 25% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before deciding if you like the current share price, check how Nakabohtec Corrosion ProtectingLtd scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

When trading Nakabohtec Corrosion ProtectingLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Nakabohtec Corrosion ProtectingLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nakabohtec Corrosion ProtectingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:1787

Nakabohtec Corrosion ProtectingLtd

Provides survey, analysis, design, engineering, work supervision, and material supply services for protecting metallic structures from corrosion in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives