- China

- /

- Consumer Durables

- /

- SZSE:001387

Zhejiang HangminLtd And 2 Other Small Caps With Strong Financials

Reviewed by Simply Wall St

As we step into the new year, global markets have shown a mixed performance with major indices like the S&P 500 and Nasdaq Composite closing another strong year, despite some end-of-year volatility. While economic indicators such as the Chicago PMI and GDP forecasts have highlighted challenges, small-cap stocks represented by indices like the Russell 2000 have demonstrated resilience with notable gains. In this environment, identifying stocks with robust financials becomes crucial for investors seeking stability amidst uncertainty. This article explores three small-cap companies, including Zhejiang Hangmin Ltd., that exhibit strong financial health and potential for growth in today's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Zhejiang HangminLtd (SHSE:600987)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Hangmin Co., Ltd, along with its subsidiaries, operates in the textile printing and dyeing industry in China with a market capitalization of CN¥7.27 billion.

Operations: Hangmin generates revenue primarily from its textile printing and dyeing operations in China. The company focuses on managing its cost structure to optimize profitability, with a particular emphasis on maintaining competitive pricing within the industry.

Zhejiang Hangmin, a smaller player in the luxury sector, has seen its debt to equity ratio shrink from 1.7% to 0.3% over five years, indicating improved financial health. Despite a significant one-off loss of CN¥245 million affecting recent results, the company achieved earnings growth of 6.5%, outpacing the industry average of 3.3%. Trading at nearly 28% below estimated fair value suggests potential upside for investors eyeing undervalued opportunities. Recent earnings showed sales climbing to CN¥8.68 billion from CN¥7.33 billion last year, with net income rising slightly to CN¥475 million from CN¥452 million previously.

Hefei Snowky Electric (SZSE:001387)

Simply Wall St Value Rating: ★★★★★☆

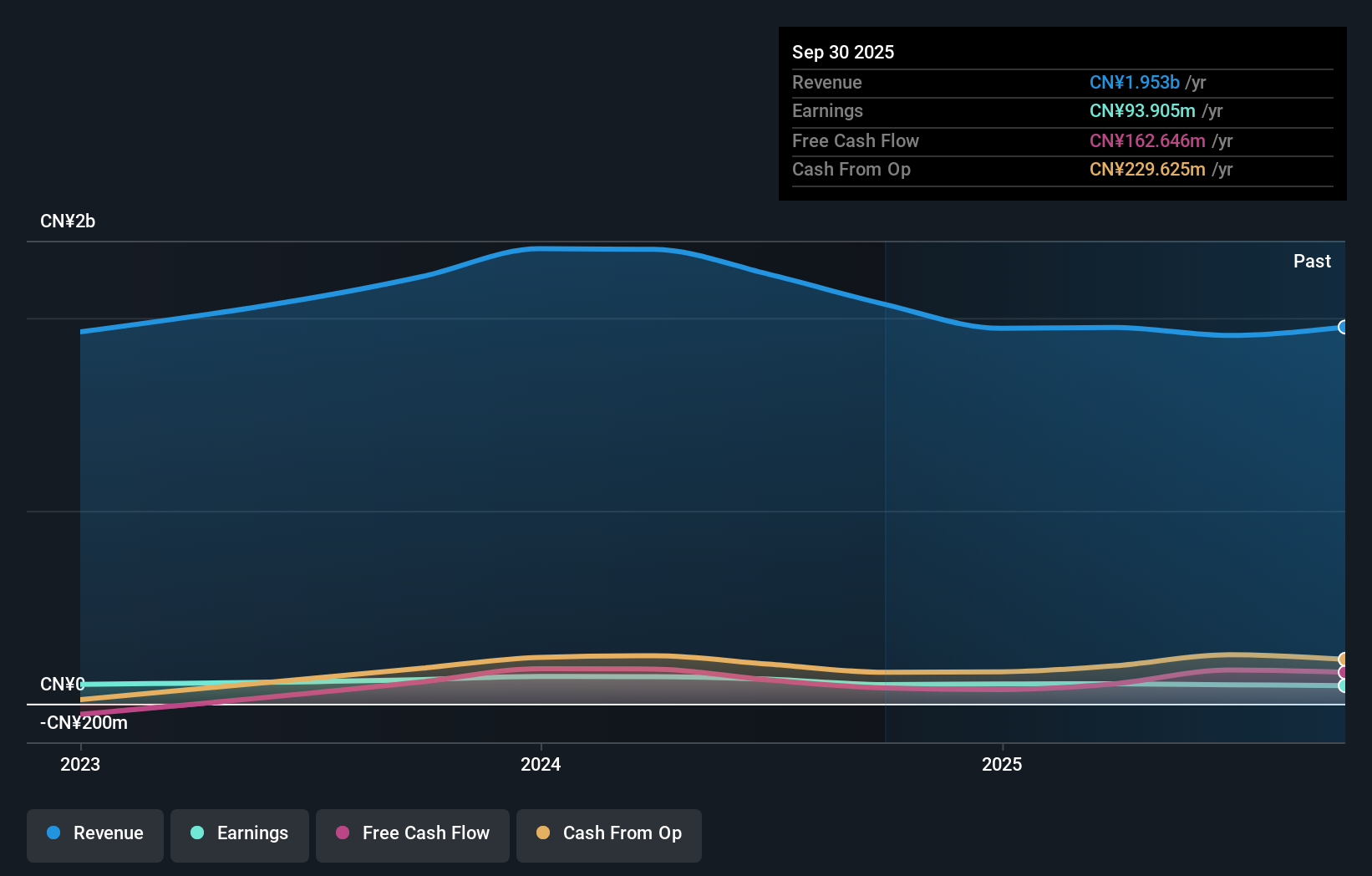

Overview: Hefei Snowky Electric Co., Ltd. specializes in the research, development, production, and sale of refrigerators and commercial display cabinets across various global markets including China, Asia, Europe, the United States, Africa, and Oceania with a market capitalization of CN¥2.52 billion.

Operations: Hefei Snowky Electric generates revenue primarily from its Housewares & Accessories segment, amounting to CN¥2.22 billion.

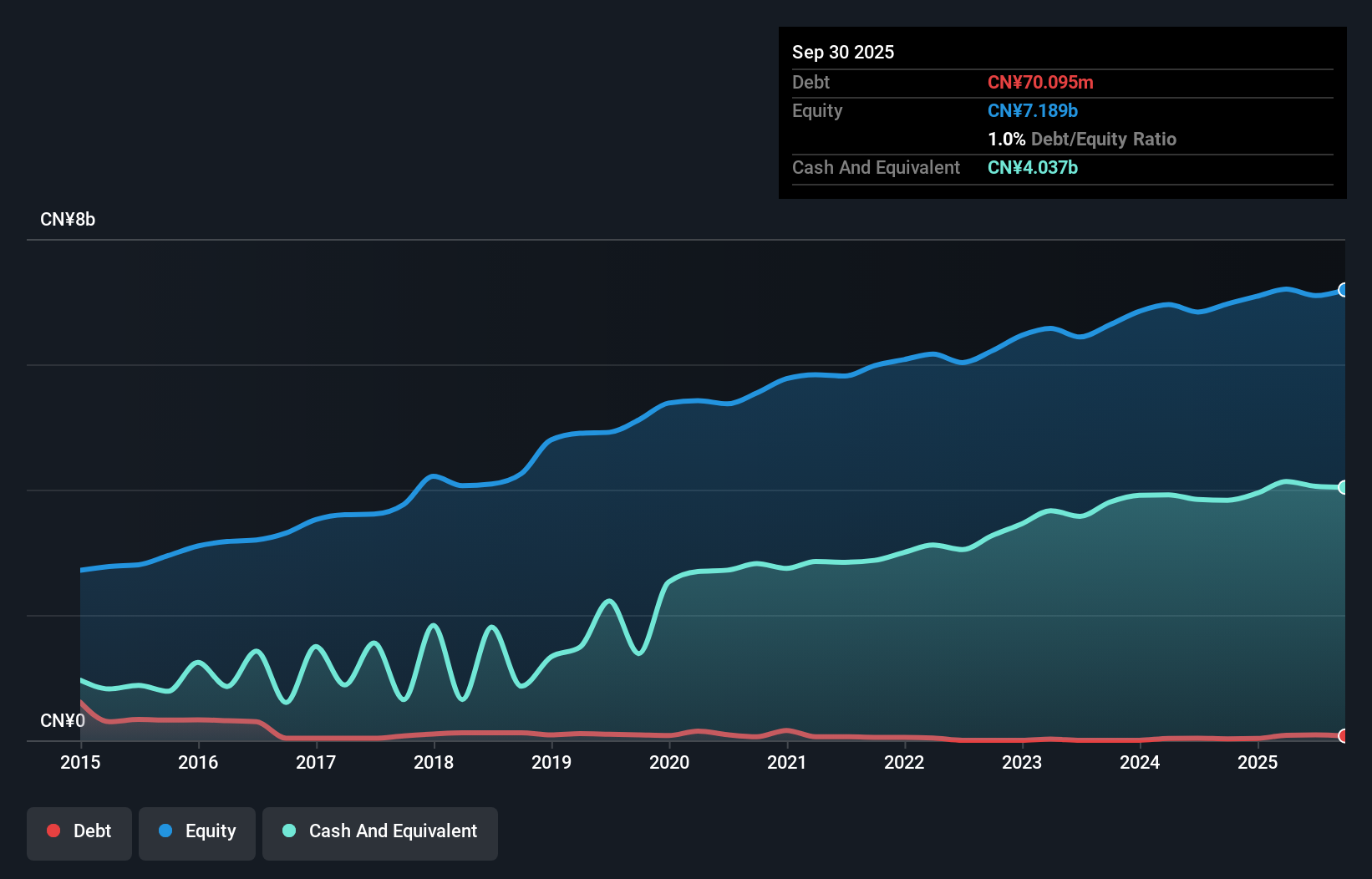

Hefei Snowky Electric, a smaller player in the industry, presents an intriguing profile with its earnings growing by 30.8% over the past year, outpacing the Consumer Durables sector's -0.2%. Despite this growth, recent financials show a dip in sales to CNY 1.40 billion from CNY 1.69 billion and net income falling to CNY 54.57 million from CNY 96.67 million year-over-year. The company proposed a dividend of CNY 0.80 per ten shares for Q3 2024, reflecting confidence despite challenges like increased debt-to-equity ratio now at 1.2% over five years and lower earnings per share at CNY 0.31 compared to last year's CNY 0.67.

- Unlock comprehensive insights into our analysis of Hefei Snowky Electric stock in this health report.

Evaluate Hefei Snowky Electric's historical performance by accessing our past performance report.

Hyakujushi Bank (TSE:8386)

Simply Wall St Value Rating: ★★★★★☆

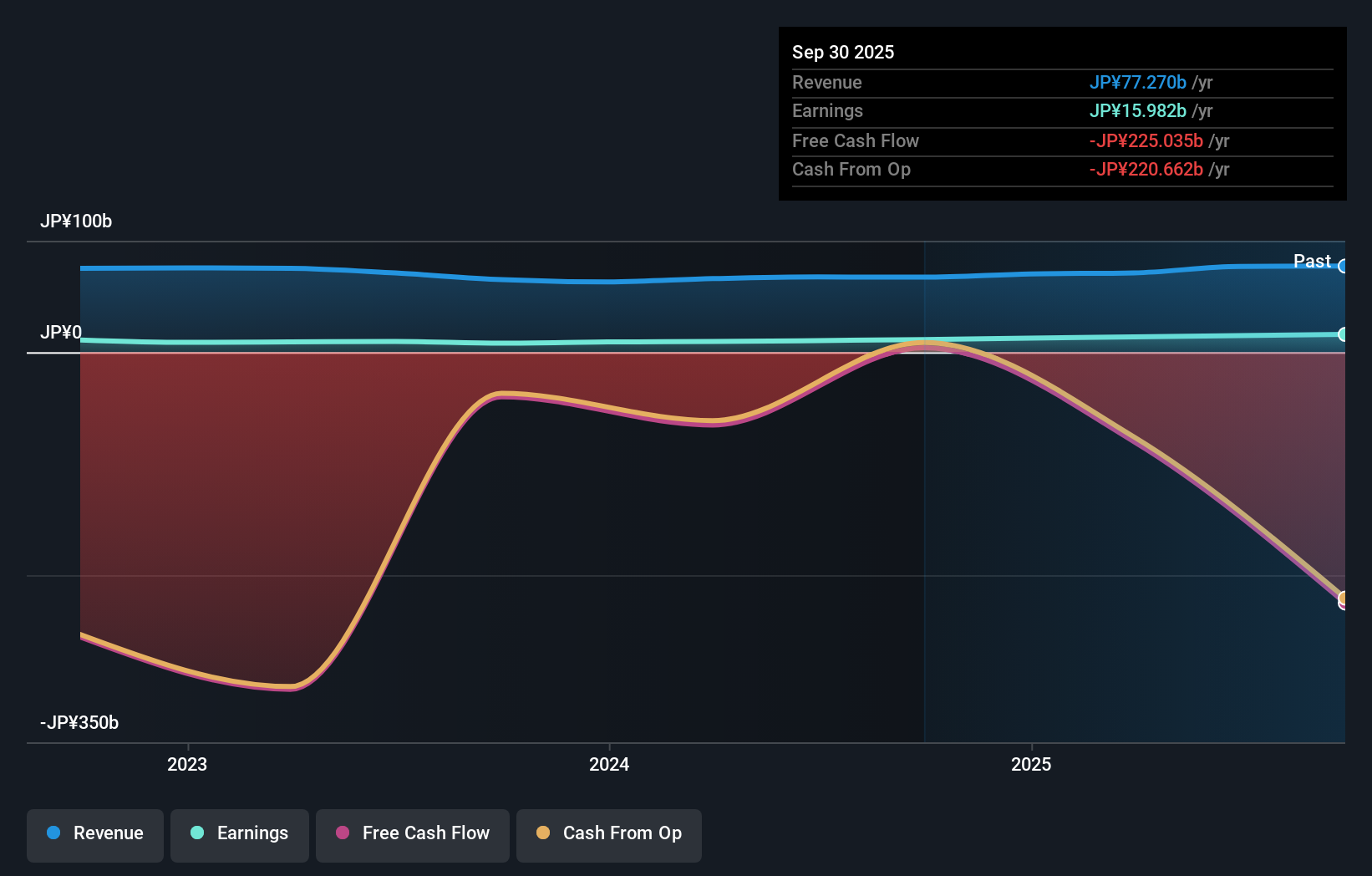

Overview: The Hyakujushi Bank, Ltd. primarily engages in banking activities in Japan and has a market capitalization of approximately ¥94.22 billion.

Operations: Hyakujushi Bank generates its revenue primarily from the banking segment, which accounts for ¥74.89 billion, and a smaller contribution from the lease segment at ¥7.43 billion.

Hyakujushi Bank, a smaller player in the financial sector, showcases robust fundamentals with total assets of ¥5.78 trillion and equity reaching ¥338.5 billion. Its reliance on customer deposits for 86% of liabilities highlights its low-risk funding approach. Though earnings surged by 39% last year, outpacing the industry average of 22%, an insufficient allowance for bad loans at 1.4% raises concerns. The bank's price-to-earnings ratio stands attractively at 8.3x compared to the JP market's 13.7x, suggesting potential undervaluation despite challenges like a modest net interest margin of 0.7%.

- Click here to discover the nuances of Hyakujushi Bank with our detailed analytical health report.

Explore historical data to track Hyakujushi Bank's performance over time in our Past section.

Summing It All Up

- Delve into our full catalog of 4659 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Snowky Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001387

Hefei Snowky Electric

Engages in the research and development, production, and sale of refrigerators and commercial display cabinets in China, rest of Asia, Europe, the United States, Africa, and Oceania.

Not a dividend payer minimal.

Market Insights

Community Narratives