- China

- /

- Electronic Equipment and Components

- /

- SHSE:688768

Discovering None Exchange's Hidden Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with the S&P 500 marking its best two-year stretch in decades and economic indicators like the Chicago PMI highlighting challenges in manufacturing, investors are keenly observing small-cap stocks for opportunities. In this environment, identifying promising stocks often involves looking beyond immediate market fluctuations to find companies with strong fundamentals and potential for growth despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Master Trust | 33.35% | 28.01% | 41.50% | ★★★★★☆ |

| Network People Services Technologies | 0.11% | 84.31% | 84.48% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shanghai Smith Adhesive New MaterialLtd (SHSE:603683)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Smith Adhesive New Material Co., Ltd specializes in the manufacture and sale of adhesive tapes and adhesives in China, with a market capitalization of CN¥2.25 billion.

Operations: The company's primary revenue streams come from the sale of adhesive tapes and adhesives. It has a market capitalization of CN¥2.25 billion.

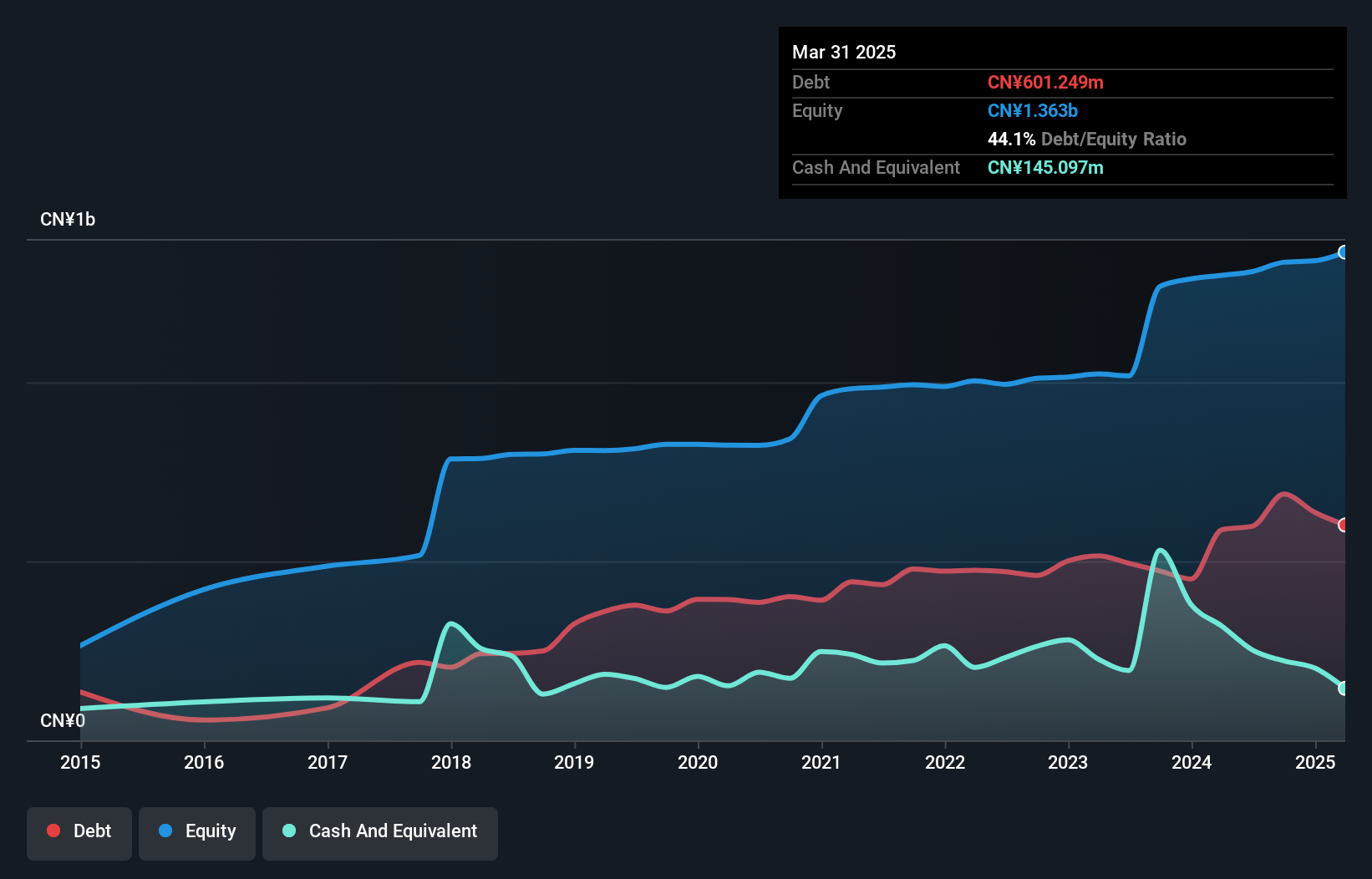

Shanghai Smith Adhesive New Material Ltd. showcases impressive earnings growth of 106% over the past year, outpacing the broader chemicals industry. The company reported a net income of CNY 66.99 million for the nine months ending September 2024, up from CNY 38.85 million in the previous year, reflecting robust performance despite a challenging market environment. With a price-to-earnings ratio of 29x, it trades below the CN market average, suggesting potential value for investors. While its debt to equity ratio has risen to 51% over five years, interest payments remain well-covered by EBIT at six times coverage.

Anhui Ronds Science & Technology (SHSE:688768)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Anhui Ronds Science & Technology Incorporated Company offers solutions for machinery condition monitoring in the predictive maintenance field in China, with a market cap of CN¥3.03 billion.

Operations: Ronds generates revenue primarily through its solutions for machinery condition monitoring. The company's net profit margin was 15.2% in the most recent financial period, reflecting its ability to manage costs effectively while maintaining profitability.

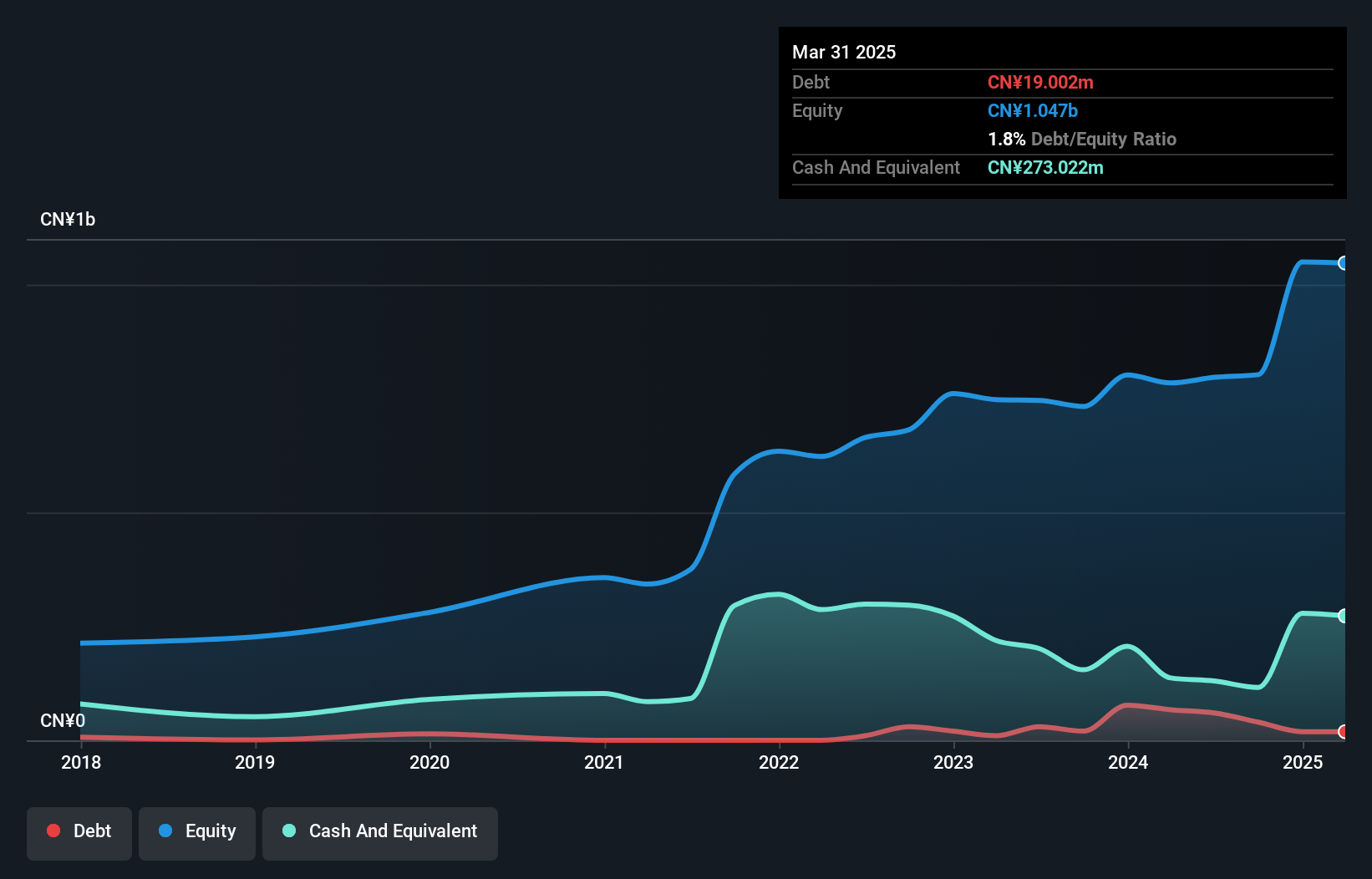

Ronds Science & Technology has shown promising growth, with earnings surging 49% over the past year, outpacing the electronic industry’s modest 2%. The company’s debt-to-equity ratio has edged up slightly from 4% to 5% in five years, yet it holds more cash than its total debt. Despite a recent shareholder dilution due to a private placement raising CNY 160 million, Ronds maintains high-quality earnings and covers interest payments comfortably. Recent financials highlight a turnaround with net income of CNY 2.72 million compared to last year's loss of CNY 16.37 million, indicating potential for continued improvement.

- Navigate through the intricacies of Anhui Ronds Science & Technology with our comprehensive health report here.

Learn about Anhui Ronds Science & Technology's historical performance.

San-in Godo BankLtd (TSE:8381)

Simply Wall St Value Rating: ★★★★☆☆

Overview: San-in Godo Bank Ltd., along with its subsidiaries, offers a range of banking products and services to individual and corporate clients in Japan, with a market cap of ¥192.91 billion.

Operations: San-in Godo Bank Ltd. generates revenue primarily from its banking industry segment, contributing ¥108.72 billion, and its leasing business segment, adding ¥16.31 billion.

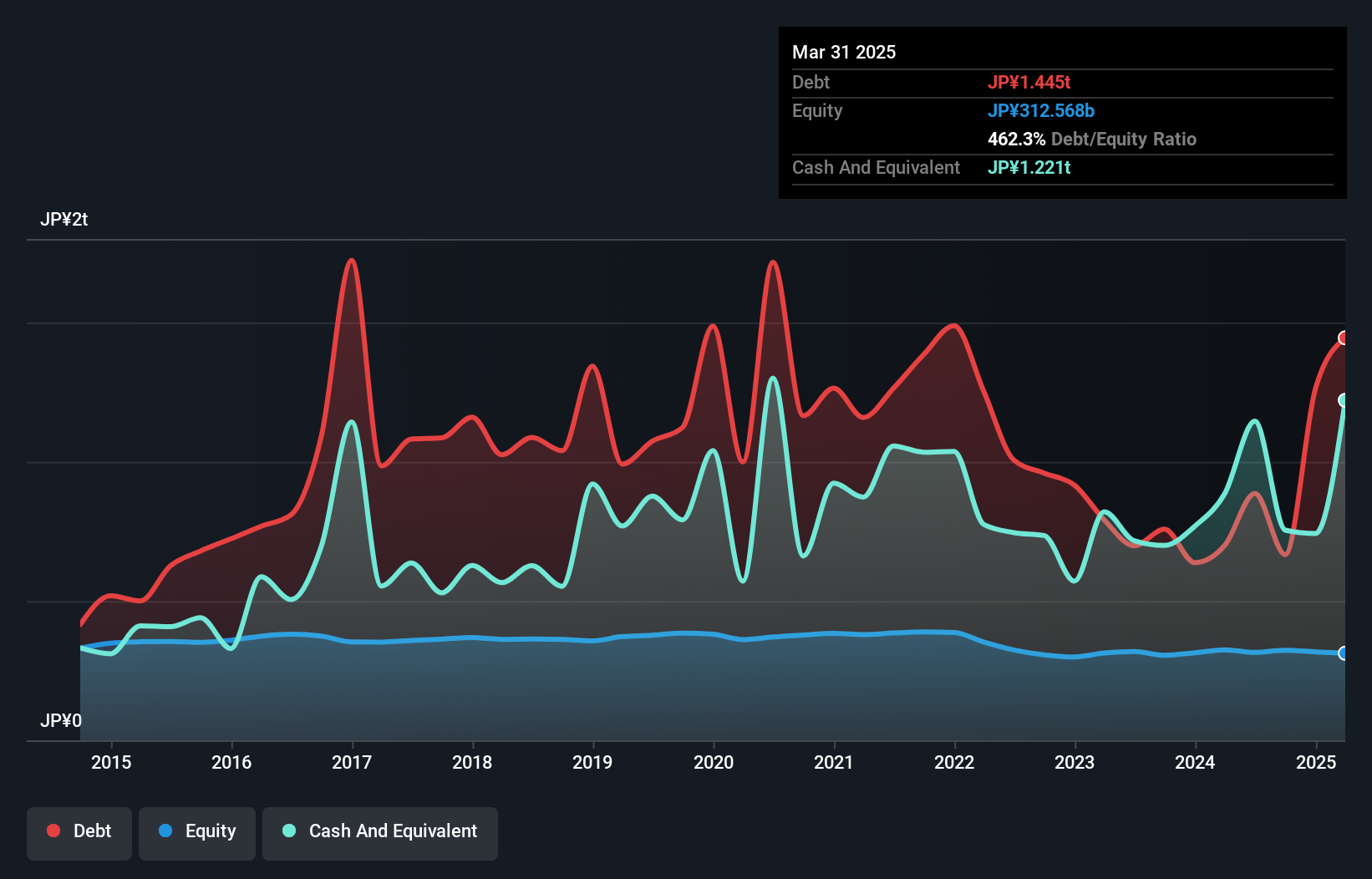

San-in Godo Bank, with assets totaling ¥7.55 trillion and equity of ¥323.5 billion, stands out for its robust growth in earnings, which surged by 40% over the past year—outpacing the industry average of 22%. The bank's funding strategy is primarily low-risk, relying heavily on customer deposits that account for 89% of liabilities. However, it faces challenges with a low allowance for bad loans at only 73%, while non-performing loans are at an appropriate level of 1.4%. Despite these hurdles, it's trading below estimated fair value by about 22%, suggesting potential upside.

Where To Now?

- Get an in-depth perspective on all 4669 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688768

Anhui Ronds Science & Technology

Provides solutions for machinery condition monitoring in the predictive maintenance field in China.

Undervalued with high growth potential.

Market Insights

Community Narratives