In a week marked by busy earnings reports and economic data, global markets saw mixed performances with small-cap stocks showing resilience compared to their larger counterparts. As the S&P 600 for small-cap stocks navigates this complex landscape, investors are increasingly on the lookout for undiscovered gems that exhibit strong fundamentals and potential for growth amidst current market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Value Rating: ★★★★★★

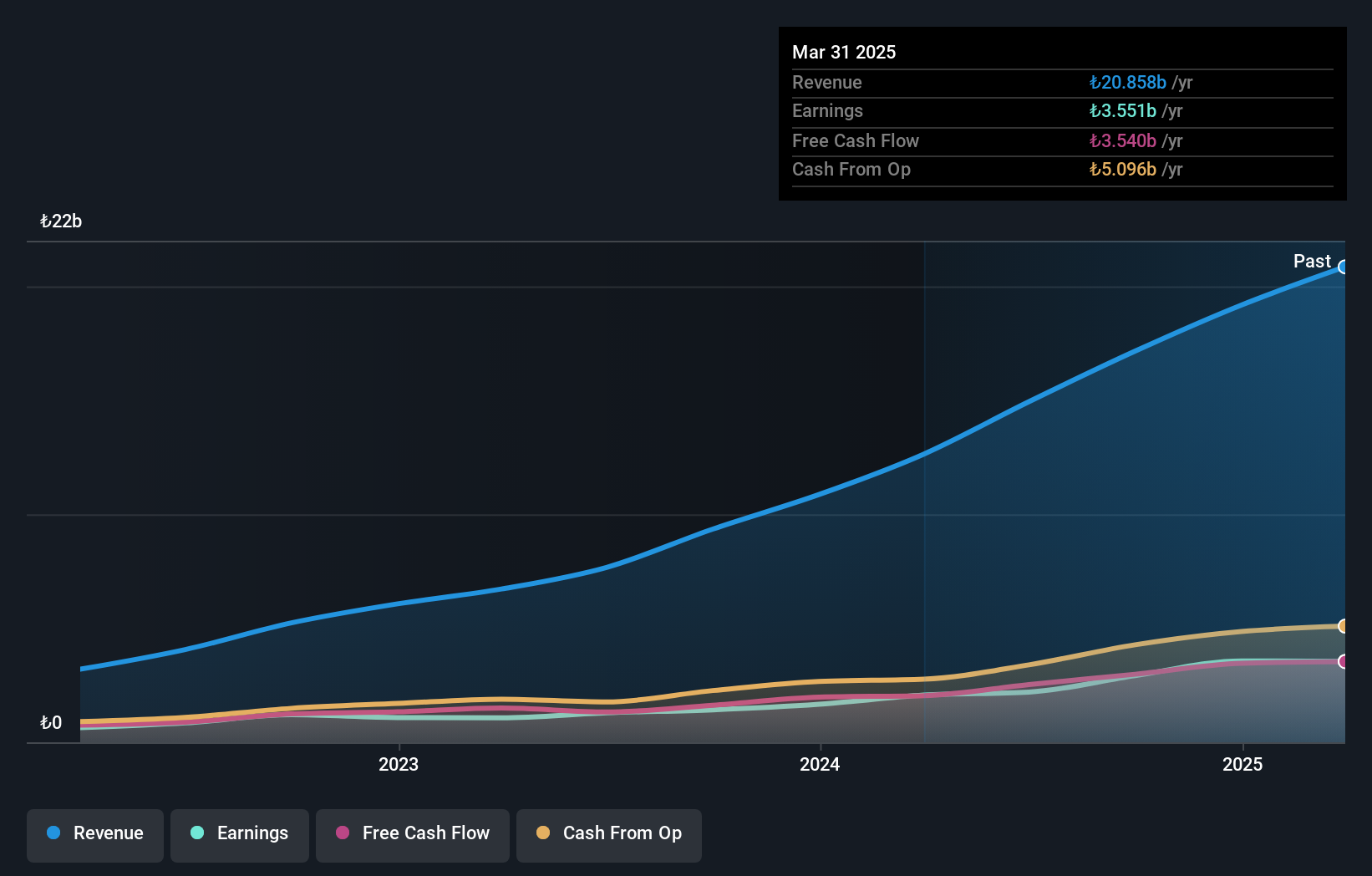

Overview: Çelebi Hava Servisi A.S. offers ground handling, cargo, and warehouse services to both domestic and international airlines as well as private air cargo companies, primarily operating in Turkey with a market capitalization of TRY42.57 billion.

Operations: The company generates revenue primarily from Airport Ground Services, accounting for TRY9.82 billion, followed by Cargo and Warehouse Services at TRY5.18 billion.

Çelebi Hava Servisi has made notable strides, with earnings surging 70.5% over the past year, far outpacing the Infrastructure industry’s 7.5% growth. The company's debt management appears robust, as evidenced by a net debt to equity ratio of 8.9%, down from 208.3% five years ago, and interest payments are comfortably covered by EBIT at a multiple of 27.8x. Recent inclusion in major indices like S&P Global BMI and FTSE All-World Index highlights its growing prominence. For the second quarter of 2024, sales reached TRY 4,632 million and net income was TRY 609 million with basic earnings per share at TRY 25.1.

- Click to explore a detailed breakdown of our findings in Çelebi Hava Servisi's health report.

Gain insights into Çelebi Hava Servisi's past trends and performance with our Past report.

Yamashin-Filter (TSE:6240)

Simply Wall St Value Rating: ★★★★★☆

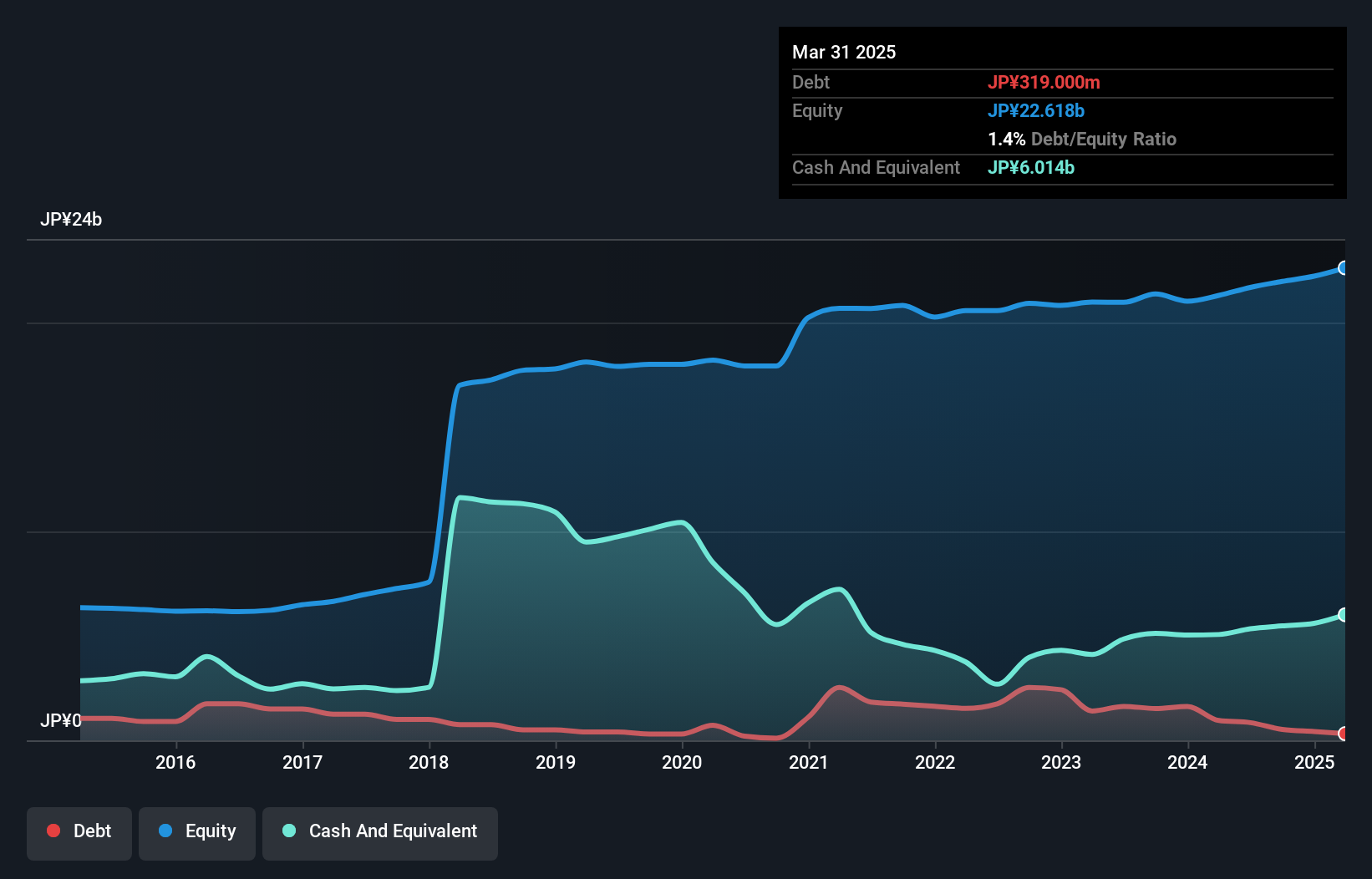

Overview: Yamashin-Filter Corp. is a filter manufacturer with a market capitalization of ¥41.44 billion.

Operations: Yamashin-Filter generates revenue primarily from its Construction Machine Filter Business, contributing ¥15.99 billion, and its Air Filter Business, adding ¥2.55 billion.

Yamashin-Filter, a nimble player in the machinery sector, has revised its earnings guidance significantly upward for fiscal year 2025. The company now anticipates net sales of JPY 19.3 billion and an operating profit of JPY 2.22 billion, reflecting robust performance compared to earlier projections. Their earnings growth last year soared by 76.8%, outpacing industry peers at just 8.3%. Despite a volatile share price recently, Yamashin boasts high-quality past earnings and strong debt coverage with EBIT covering interest payments by over 90 times. Additionally, they plan to increase dividends to JPY 7 per share this fiscal year.

- Take a closer look at Yamashin-Filter's potential here in our health report.

Assess Yamashin-Filter's past performance with our detailed historical performance reports.

San-in Godo BankLtd (TSE:8381)

Simply Wall St Value Rating: ★★★★☆☆

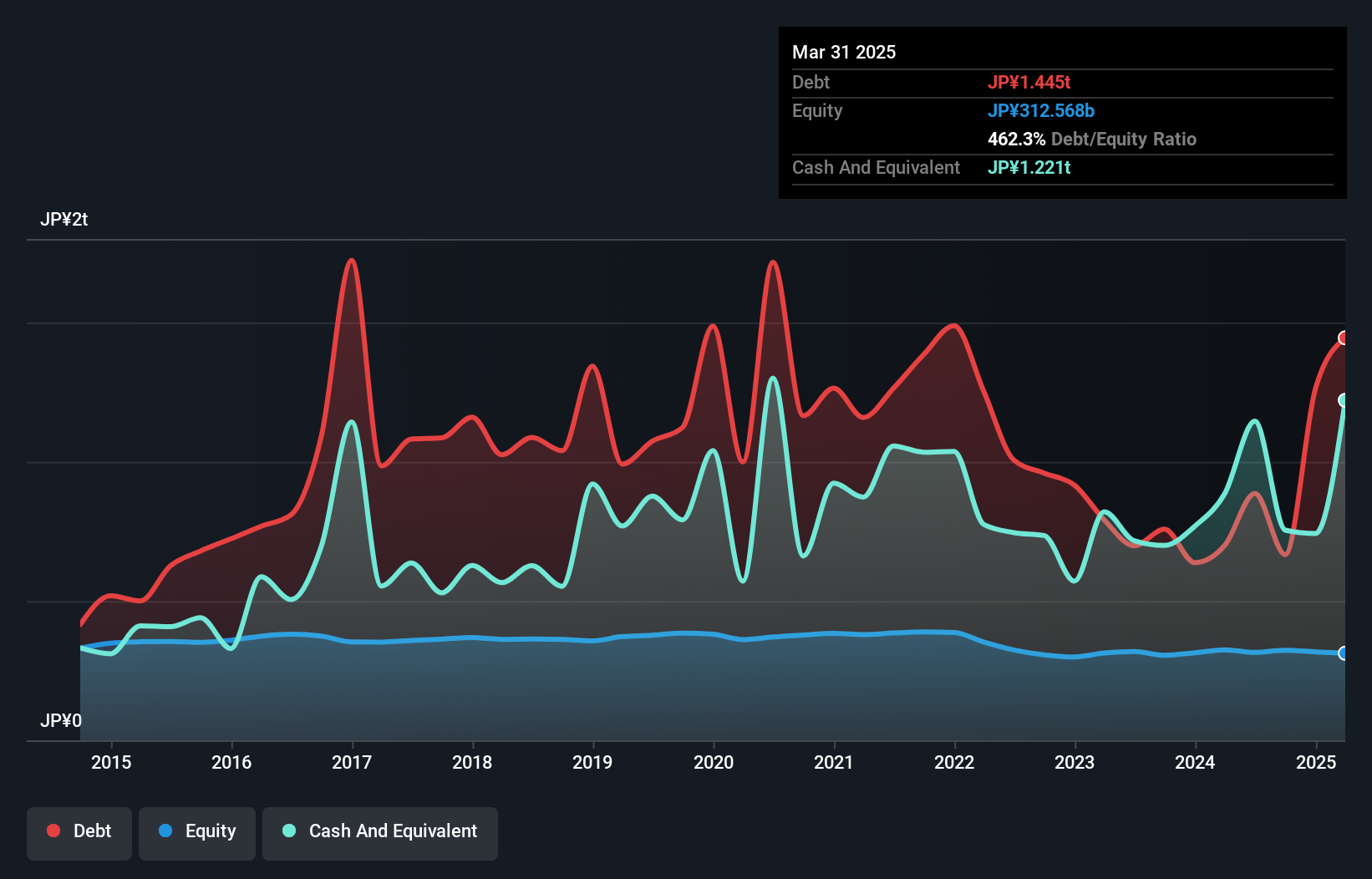

Overview: The San-in Godo Bank, Ltd., along with its subsidiaries, offers a range of banking products and services to both individual and corporate clients in Japan, with a market capitalization of approximately ¥197.68 billion.

Operations: San-in Godo Bank generates revenue primarily through its banking products and services for individual and corporate clients in Japan. The bank's financial performance is reflected in its market capitalization of approximately ¥197.68 billion.

San-in Godo Bank, with assets totaling ¥7.90 billion and equity of ¥315.90 billion, is an intriguing player in the financial landscape. The bank's deposits stand at ¥6.62 billion, while loans reach ¥4.78 billion, coupled with a net interest margin of 1%. Despite having a bad loan ratio of 1.5%, it maintains high-quality earnings and benefits from low-risk funding sources like customer deposits covering 87% of liabilities. Its recent share buyback program saw the repurchase of 1,456,200 shares for ¥2 billion by August 2024, hinting at strategic capital management efforts to enhance shareholder value amidst trading below estimated fair value by over 20%.

- Delve into the full analysis health report here for a deeper understanding of San-in Godo BankLtd.

Explore historical data to track San-in Godo BankLtd's performance over time in our Past section.

Make It Happen

- Explore the 4718 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8381

San-in Godo BankLtd

Engages in the provision of various banking products and services for individuals and corporate customers in Japan.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives