- Japan

- /

- Specialty Stores

- /

- TSE:3660

Discovering Undiscovered Gems In Japan August 2024

Reviewed by Simply Wall St

Japan’s stock markets have shown a strong rebound recently, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, buoyed by better-than-expected U.S. economic data and a weaker yen aiding exporters. This positive sentiment is further supported by Japan's robust GDP growth in the second quarter, which exceeded expectations. In this favorable market environment, identifying promising stocks involves looking for companies with solid fundamentals, innovative products or services, and potential for growth within their sectors. Here are three lesser-known Japanese stocks that could be considered undiscovered gems in August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Icom | NA | 4.02% | 13.06% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| CAC Holdings | 14.97% | -0.57% | 5.02% | ★★★★☆☆ |

| Toho Bank | 98.27% | 0.43% | 22.80% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

istyle (TSE:3660)

Simply Wall St Value Rating: ★★★★★☆

Overview: istyle Inc. operates a beauty portal site called @cosme in Japan and internationally, with a market cap of ¥40.17 billion.

Operations: Revenue streams for istyle Inc. include Retail (¥42.24 billion), Global Business (¥3.94 billion), and Marketing Solution (¥9.24 billion). The company incurs costs associated with these segments, impacting its overall profitability.

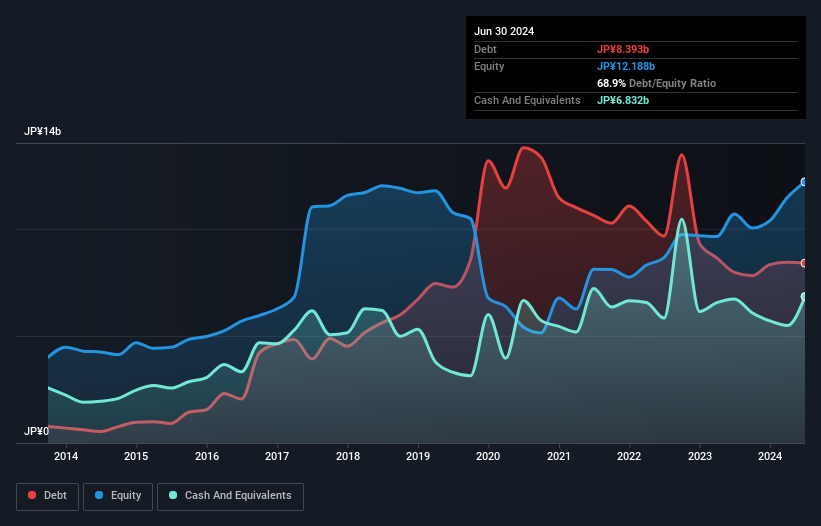

isstyle Inc. has shown impressive earnings growth of 341.5% over the past year, outpacing the Specialty Retail industry’s 6.5%. The company forecasts net sales of ¥64 billion and operating income of ¥2.4 billion for FY2025, with net income per share expected at ¥20.31. Despite a highly volatile share price recently, istyle's interest payments are well covered by EBIT (55x), and its net debt to equity ratio stands at a satisfactory 12.8%.

- Get an in-depth perspective on istyle's performance by reading our health report here.

Assess istyle's past performance with our detailed historical performance reports.

Fukushima GalileiLtd (TSE:6420)

Simply Wall St Value Rating: ★★★★★★

Overview: Fukushima Galilei Co. Ltd. manufactures, sells, and maintains commercial freezer refrigerators, refrigerated showcases, and other refrigeration devices in Japan and internationally with a market cap of ¥111.50 billion.

Operations: The company generates revenue primarily through the manufacture and sale of commercial refrigeration devices. It has a market cap of ¥111.50 billion, with notable trends in its net profit margin over recent periods.

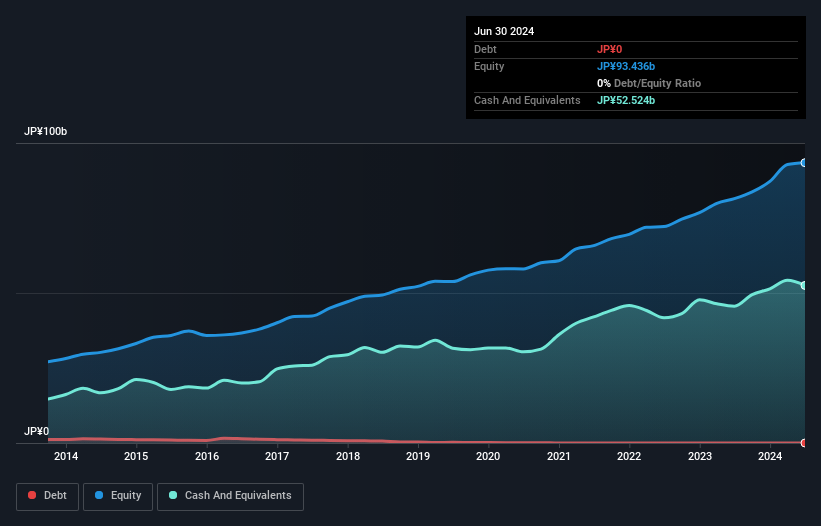

Fukushima Galilei Ltd. has shown impressive performance, with earnings growing by 42.2% over the past year, outpacing the Machinery industry’s 13.1%. The company repurchased shares in 2024, indicating confidence in its valuation. Trading at 77.7% below our fair value estimate, it offers potential upside for investors. With no debt and a history of high-quality earnings, Fukushima Galilei stands out as a strong contender among Japan's smaller firms poised for growth.

Kiyo Bank (TSE:8370)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Kiyo Bank, Ltd. offers a range of banking products and services to individuals, corporate entities, and business customers in Japan with a market cap of ¥119.91 billion.

Operations: Kiyo Bank generates revenue primarily from interest income, service fees, and other banking operations. The net profit margin for the most recent fiscal year was 12.34%.

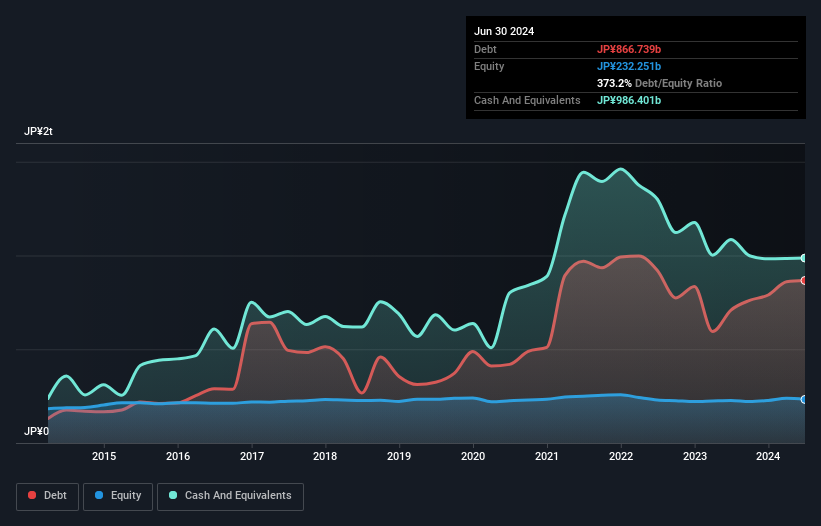

Kiyo Bank, with total assets of ¥5,925.8B and equity of ¥232.3B, has a solid foundation supported by customer deposits totaling ¥4,779.2B. The bank's loans amount to ¥3,930.9B with a net interest margin of 0.9%. Although its allowance for bad loans is insufficient at 1.6%, it has repurchased 430,200 shares for ¥805.74 million recently. Notably, Kiyo's earnings surged by 618% last year compared to the industry’s 19%.

- Dive into the specifics of Kiyo Bank here with our thorough health report.

Examine Kiyo Bank's past performance report to understand how it has performed in the past.

Next Steps

- Unlock our comprehensive list of 749 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if istyle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3660

istyle

Operates a beauty portal site @cosme in Japan and internationally.

Solid track record with excellent balance sheet.