- Japan

- /

- Medical Equipment

- /

- TSE:7779

Top Japanese Growth Stocks With High Insider Ownership August 2024

Reviewed by Simply Wall St

Japan’s stock markets have rebounded strongly, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, driven by better-than-expected economic data and a weaker yen that has benefited exporters. This positive momentum in the Japanese market provides an opportune backdrop to explore growth companies with high insider ownership, which can be indicative of strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 32.9% |

| Hottolink (TSE:3680) | 27% | 61.9% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Medley (TSE:4480) | 34% | 30.2% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 21.3% | 90% |

| AeroEdge (TSE:7409) | 10.7% | 28.5% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hoosiers Holdings (TSE:3284)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hoosiers Holdings Co., Ltd., with a market cap of ¥36.94 billion, operates, manages, and sells real estate properties in Japan.

Operations: Revenue segments for Hoosiers Holdings Co., Ltd. include ¥11.47 billion from the CCRC Business, ¥15.93 billion from Real Estate Investment, ¥47.01 billion from Real Estate Development Business, and ¥8.13 billion from Real Estate Related Service Business.

Insider Ownership: 29.8%

Revenue Growth Forecast: 10.6% p.a.

Hoosiers Holdings is poised for significant earnings growth, forecasted at 21.07% annually over the next three years, outpacing the Japanese market average of 8.5%. Despite a dividend yield of 5.58%, it is not well covered by free cash flows. The company’s revenue growth rate of 10.6% per year surpasses the broader market's 4.3%. With a price-to-earnings ratio of 10.3x below the market average, Hoosiers appears undervalued relative to its peers in Japan.

- Click here to discover the nuances of Hoosiers Holdings with our detailed analytical future growth report.

- Our expertly prepared valuation report Hoosiers Holdings implies its share price may be too high.

WealthNavi (TSE:7342)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WealthNavi Inc. develops and delivers an online asset management and risk management platform, with a market cap of ¥72.24 billion.

Operations: The company's revenue primarily comes from its Robo-Advisor segment, which generated ¥4.75 billion.

Insider Ownership: 18%

Revenue Growth Forecast: 28.4% p.a.

WealthNavi's earnings are forecast to grow significantly at 73.71% annually over the next three years, far exceeding Japan's market average of 8.5%. Revenue is expected to increase by 28.4% per year, also surpassing the market growth rate of 4.3%. Recent corporate guidance for fiscal year-end December 2024 projects operating revenue of ¥11.19 billion and an operating profit of ¥531 million, highlighting strong growth potential despite past shareholder dilution and a volatile share price.

- Click to explore a detailed breakdown of our findings in WealthNavi's earnings growth report.

- Our valuation report unveils the possibility WealthNavi's shares may be trading at a premium.

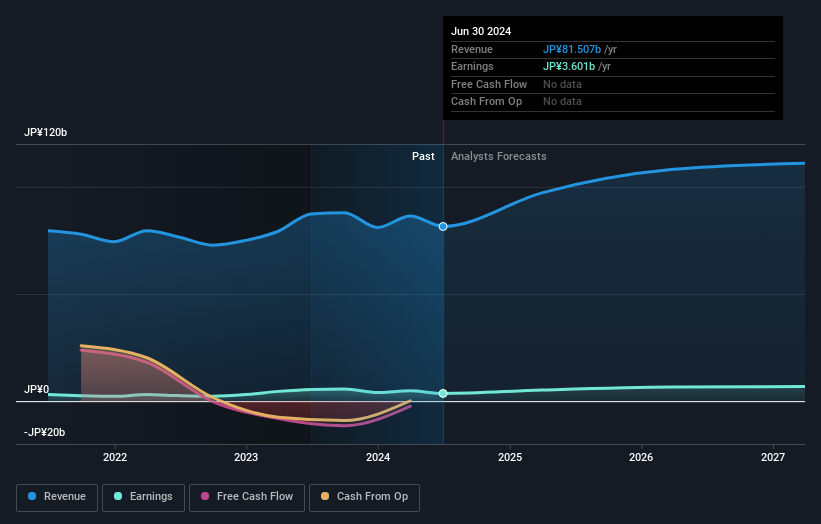

CYBERDYNE (TSE:7779)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CYBERDYNE Inc. researches, develops, produces, sells, leases, and maintains robotic equipment and systems for medical and welfare sectors across various regions including Japan, the United States, Europe, the Middle East, Africa, and Asia Pacific countries with a market cap of ¥43.28 billion.

Operations: The company generates revenue through the research, development, production, sales, leasing, and maintenance of robotic equipment and systems for medical and welfare sectors across Japan, the United States, Europe, the Middle East, Africa, and Asia Pacific regions.

Insider Ownership: 39%

Revenue Growth Forecast: 17.3% p.a.

CYBERDYNE is forecast to become profitable within the next three years, with earnings expected to grow 62.16% annually. Revenue growth is projected at 17.3% per year, outpacing the Japanese market average of 4.3%. However, its Return on Equity is forecast to be low at 2.2%. The company announced it will report Q1 2025 results on August 14, 2024, indicating transparency and potential for future updates on performance metrics.

- Delve into the full analysis future growth report here for a deeper understanding of CYBERDYNE.

- Our valuation report here indicates CYBERDYNE may be overvalued.

Summing It All Up

- Investigate our full lineup of 104 Fast Growing Japanese Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7779

CYBERDYNE

Researches, develops, produces, sell, leases, and maintains robotic equipment and systems for medical and welfare in Japan, the United States, Europe, the Middle East, Africa, and the Asia Pacific countries.

Reasonable growth potential with adequate balance sheet.