- Taiwan

- /

- Construction

- /

- TWSE:2013

Hyakugo Bank And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and fluctuating economic indicators, small-cap stocks have shown resilience amid broader market volatility. With U.S. job growth cooling and manufacturing activity expanding for the first time in over two years, investors are increasingly on the lookout for undiscovered gems that can thrive in this dynamic environment. Identifying a good stock often involves finding companies with strong fundamentals that can capitalize on current market conditions, such as those with robust earnings potential or unique positioning within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

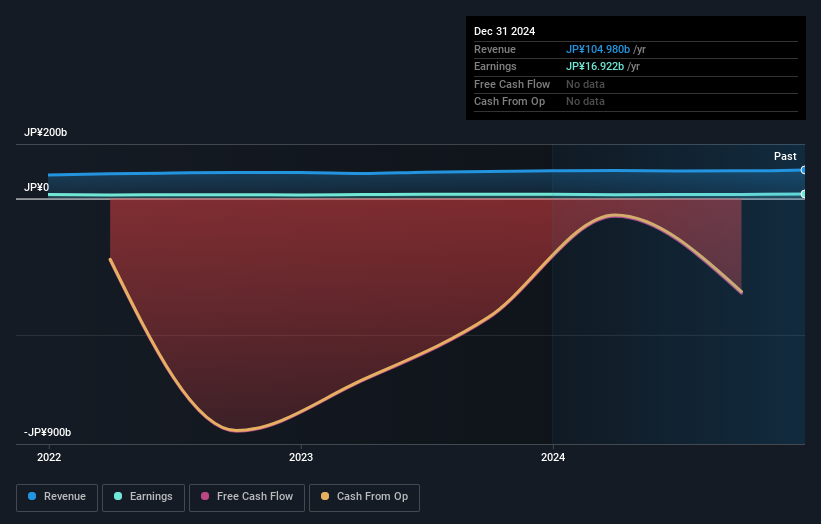

Hyakugo Bank (TSE:8368)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Hyakugo Bank, Ltd. offers a range of financial services to individual and corporate customers in Japan, with a market cap of ¥170.91 billion.

Operations: Hyakugo Bank generates revenue primarily through interest income from loans and securities, as well as fees and commissions from its financial services. The bank's cost structure includes interest expenses on deposits and borrowings, alongside operational costs. Notably, the net profit margin has shown variability over recent periods.

Hyakugo Bank, with assets totaling ¥7.71 trillion and equity of ¥472.8 billion, is a financial entity that seems to be trading at 20.9% below its estimated fair value, suggesting potential undervaluation. Its funding structure appears robust as 87% of liabilities come from low-risk sources like customer deposits. However, the bank has an insufficient allowance for bad loans at 1.4% of total loans, which may pose a risk if economic conditions worsen. Despite this challenge, Hyakugo's earnings have grown by approximately 7% annually over the past five years, indicating resilience in its operations amidst industry competition.

- Click here to discover the nuances of Hyakugo Bank with our detailed analytical health report.

Examine Hyakugo Bank's past performance report to understand how it has performed in the past.

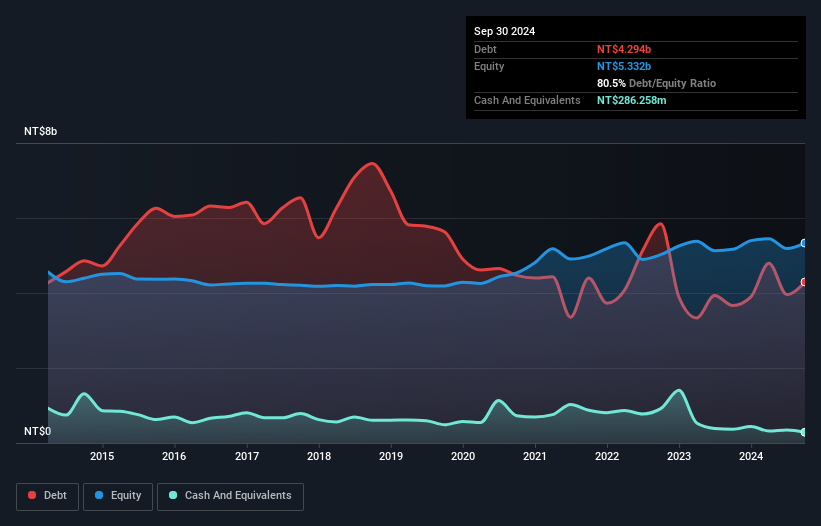

China Steel Structure (TWSE:2013)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Steel Structure Co., Ltd. is an investment holding company that produces and sells steel structures in Taiwan, Asia, and internationally, with a market capitalization of NT$10.92 billion.

Operations: China Steel Structure generates revenue primarily from its core operations, with NT$12.22 billion attributed to China Steel Structure Co., Ltd. and NT$6.92 billion from Liangang Construction Engineering Company. The company experienced a notable adjustment and write-off of NT$279.85 million, impacting overall financial performance.

China Steel Structure appears to be making strides, with its earnings growth of 24% outpacing the construction industry's 9.3%. This performance is complemented by a price-to-earnings ratio of 18.7x, which is more attractive than the Taiwan market average of 21.3x. However, the company faces challenges with a high net debt to equity ratio at 75%. Despite this, interest payments are well covered by EBIT at a coverage ratio of 7.5x. Over five years, it has successfully reduced its debt from an initial level of 134.5% to a more manageable figure at present levels around 80%.

- Click here and access our complete health analysis report to understand the dynamics of China Steel Structure.

Assess China Steel Structure's past performance with our detailed historical performance reports.

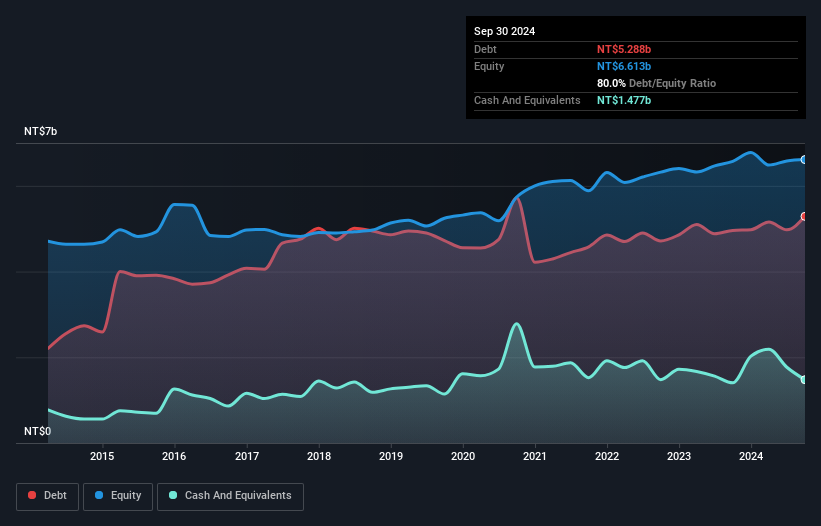

CHC Healthcare Group (TWSE:4164)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CHC Healthcare Group, along with its subsidiaries, is involved in the trading of pharmaceutical products and health food across Taiwan, China, and international markets, with a market capitalization of approximately NT$9.39 billion.

Operations: CHC Healthcare Group generates revenue primarily from the wholesale of medical equipment, amounting to NT$4.03 billion.

CHC Healthcare Group, a small player in the healthcare sector, is making waves with its high-quality earnings and impressive growth. Over the past year, its earnings grew by 7.4%, outpacing the industry average of 7.2%. The company has effectively reduced its debt to equity ratio from 90.1% to 80% over five years, though a net debt to equity ratio of 57.6% suggests room for improvement in managing leverage. With EBIT covering interest payments at a robust 7.7 times, CHC's financial health seems solid despite some challenges in operating cash flow coverage of debt obligations.

- Get an in-depth perspective on CHC Healthcare Group's performance by reading our health report here.

Evaluate CHC Healthcare Group's historical performance by accessing our past performance report.

Summing It All Up

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4698 more companies for you to explore.Click here to unveil our expertly curated list of 4701 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2013

China Steel Structure

China Steel Structure Co., Ltd. engaged in the designing, processing, manufacturing, assembly and sales of various types of steel and steel structures in Taiwan, Asia, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives