Undiscovered Gems Three Promising Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming their value counterparts. However, small-cap stocks have lagged behind the broader market indices, presenting potential opportunities for investors seeking undiscovered gems in this segment. In such an environment, identifying promising stocks often involves looking for companies with strong fundamentals and resilience that can thrive despite economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Zengame Technology Holding (SEHK:2660)

Simply Wall St Value Rating: ★★★★★★

Overview: Zengame Technology Holding Limited is an investment holding company that focuses on developing and operating mobile games primarily in the People’s Republic of China, with a market capitalization of approximately HK$2.15 billion.

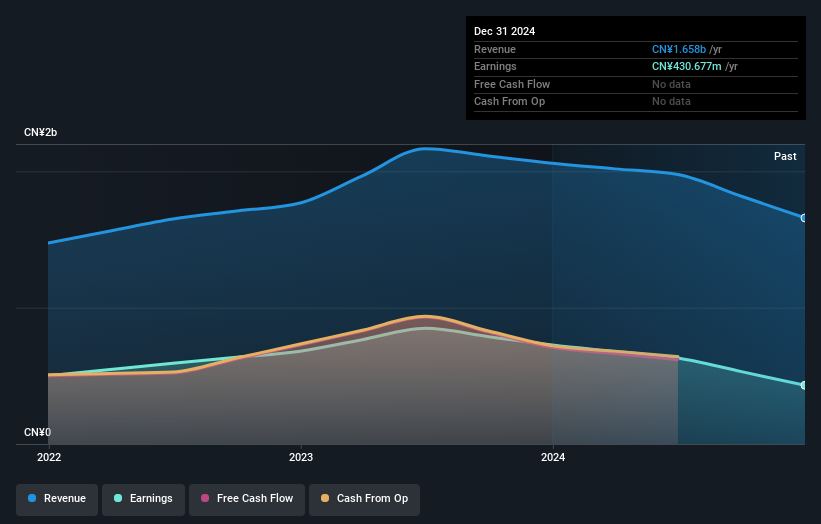

Operations: The primary revenue stream for Zengame Technology Holding comes from developing and operating mobile games, generating CN¥1.98 billion. The company's net profit margin reflects its financial performance efficiency in this sector.

Zengame Technology Holding, a smaller player in the gaming industry, is navigating a challenging landscape. Recently, they projected a 35% to 45% drop in net profit for 2024 due to revenue declines of up to 25%, impacted by weaker sales and market conditions. The gross profit margin also took a hit, falling between 5% and 10%. Despite these hurdles, Zengame remains debt-free with positive free cash flow and trades at about half its estimated fair value. Leadership changes include Ms. Chan Ching Nga's appointment as company secretary, bringing over two decades of experience in corporate governance.

Noritsu Koki (TSE:7744)

Simply Wall St Value Rating: ★★★★★★

Overview: Noritsu Koki Co., Ltd. is a company that manufactures and sells audio equipment and peripheral products across various regions including Japan, China, the United States, Europe, Central and South America, the Middle East, Africa, and internationally with a market cap of ¥168.86 billion.

Operations: Noritsu Koki generates revenue primarily through the sale of audio equipment and peripheral products across multiple international markets. The company's net profit margin has shown notable fluctuations, reflecting changes in operational efficiency and market conditions.

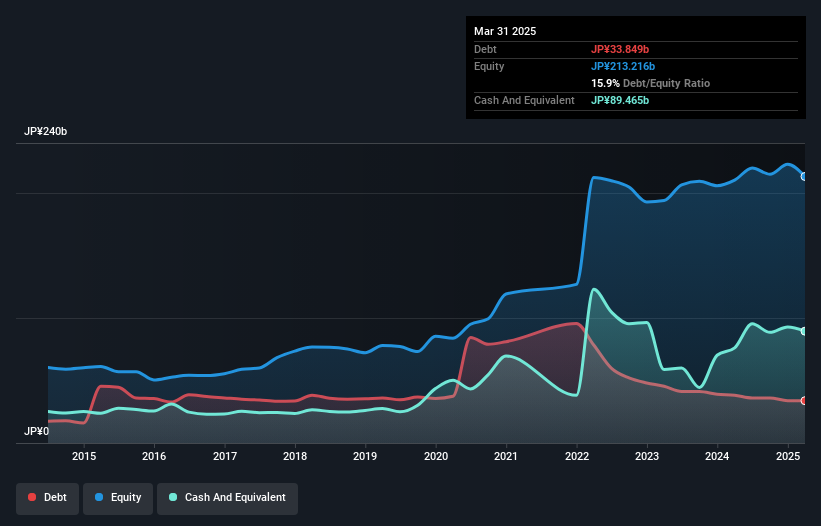

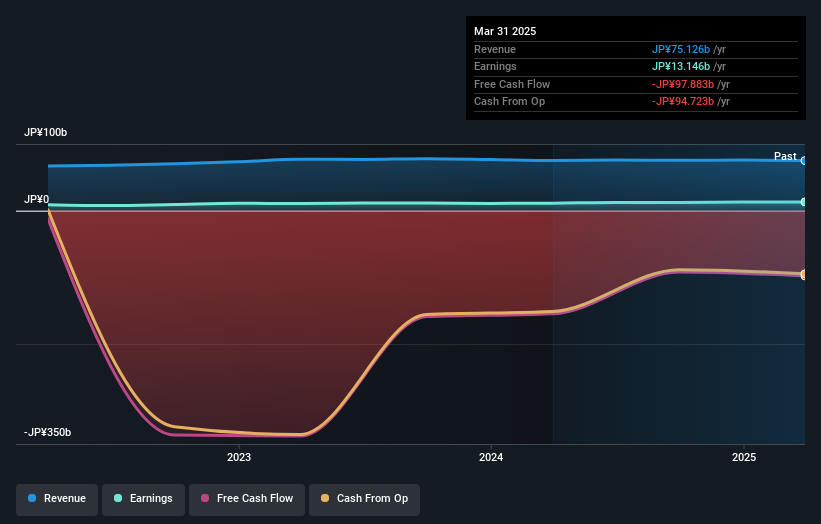

Noritsu Koki, a smaller player in the Industrials sector, has been making waves with its impressive 39.5% earnings growth over the past year, outpacing the industry's 17.3%. The company is trading at a significant discount of 55.2% below estimated fair value, suggesting potential upside for investors. With high-quality past earnings and a reduced debt-to-equity ratio from 41.7% to 15.2% over five years, Noritsu Koki's financial health appears robust. Additionally, it holds more cash than total debt and comfortably covers interest payments with profits, indicating sound fiscal management and potential for continued growth.

- Get an in-depth perspective on Noritsu Koki's performance by reading our health report here.

Examine Noritsu Koki's past performance report to understand how it has performed in the past.

Musashino Bank (TSE:8336)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Musashino Bank, Ltd. operates as a financial institution offering a range of banking products and services in Japan, with a market capitalization of ¥105.36 billion.

Operations: Musashino Bank generates revenue primarily from its banking segment, which contributes ¥65.01 billion, and its leasing business, adding ¥10.93 billion. The credit guarantee business further supplements the revenue with ¥1.53 billion.

Musashino Bank, with assets totaling ¥5,443.6B and equity of ¥273.1B, stands out for its solid foundation primarily backed by low-risk customer deposits comprising 97% of liabilities. It boasts high-quality earnings and a reasonable bad loan level at 1.6%, though the allowance for these loans is low at 23%. With total deposits reaching ¥5,040.0B and loans amounting to ¥4,045.9B, the bank trades at a significant discount of 36% below estimated fair value despite not matching industry growth rates last year (19%). Its net interest margin sits modestly at 0.9%.

Turning Ideas Into Actions

- Explore the 4710 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Musashino Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8336

Musashino Bank

Provides banking products and financial services in Japan.

Established dividend payer and good value.

Market Insights

Community Narratives