As global markets continue to reach record highs, buoyed by gains in major indices like the Dow Jones Industrial Average and S&P 500, investors are keenly observing the interplay of domestic policy and geopolitical factors that are shaping economic sentiment. Amidst this backdrop, dividend stocks present an appealing option for those seeking stability and income, especially as they can offer a reliable stream of returns even when market volatility is influenced by events such as tariff announcements or inflationary pressures.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.20% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.34% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.91% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Dubai Insurance Company (P.S.C.) (DFM:DIN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dubai Insurance Company (P.S.C.) offers a range of insurance products for individuals and corporates in the United Arab Emirates, with a market cap of AED1.27 billion.

Operations: The company's revenue segments include Life and Medical insurance, generating AED542.59 million, and Motor and General insurance, contributing AED630.70 million.

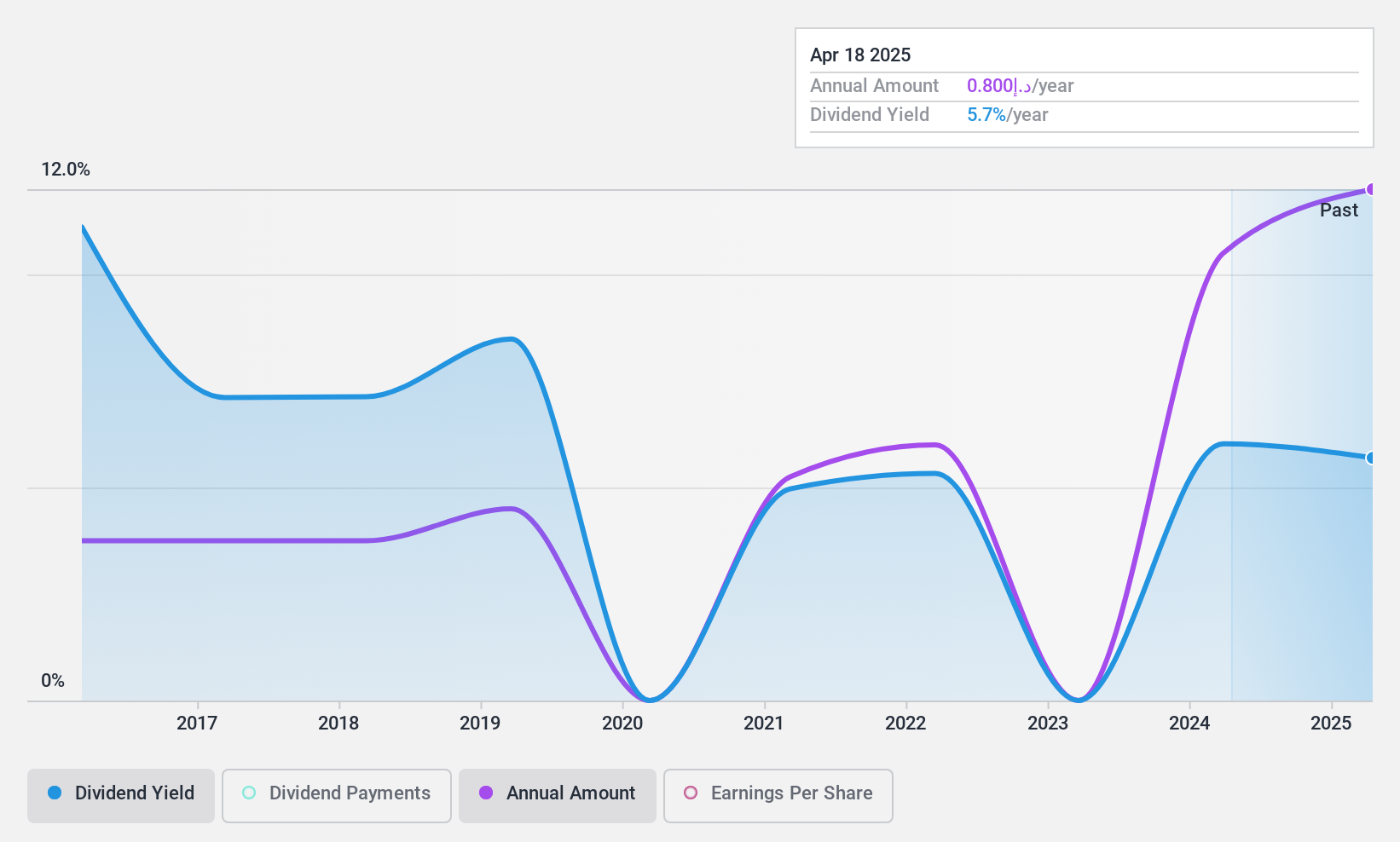

Dividend Yield: 5.5%

Dubai Insurance Company (P.S.C.) offers a reliable dividend with a payout ratio of 53.6%, indicating dividends are well-covered by earnings. Although the cash payout ratio is higher at 80.1%, it remains sustainable. The company has consistently grown its dividends over the past decade, despite recent declines in net income and profit margins. With a stable share price and an attractive P/E ratio of 9.7x, DIN presents a balanced option for dividend investors, although its yield is below top-tier levels in the AE market.

- Unlock comprehensive insights into our analysis of Dubai Insurance Company (P.S.C.) stock in this dividend report.

- Our valuation report here indicates Dubai Insurance Company (P.S.C.) may be overvalued.

Musashino Bank (TSE:8336)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Musashino Bank, Ltd., along with its subsidiaries, offers banking products and financial services in Japan and has a market cap of ¥98.48 billion.

Operations: Musashino Bank generates revenue through its banking products and financial services in Japan.

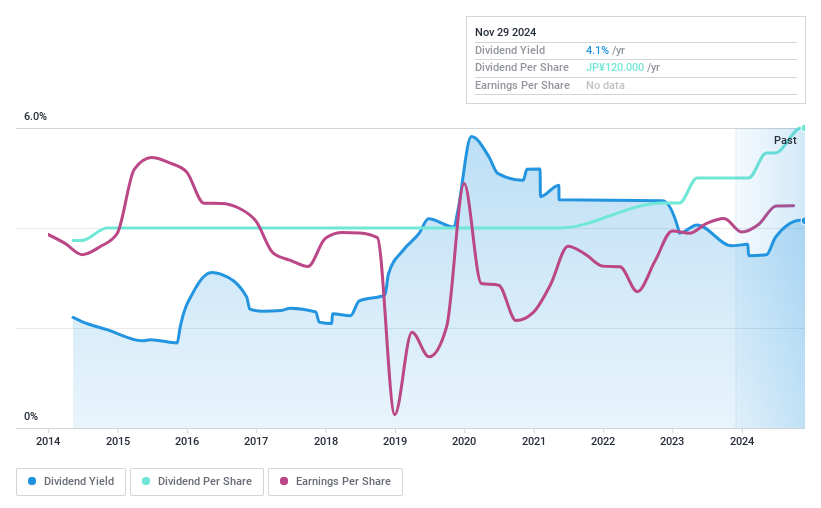

Dividend Yield: 3.9%

Musashino Bank offers a high dividend yield of 3.92%, ranking in the top 25% of JP market payers, with stable and growing dividends over the past decade. The low payout ratio of 14.8% ensures dividends are well-covered by earnings, although there's insufficient data on future sustainability. Trading significantly below estimated fair value enhances its appeal, but a low allowance for bad loans at 23% may be a concern for risk-averse investors.

- Click to explore a detailed breakdown of our findings in Musashino Bank's dividend report.

- Our comprehensive valuation report raises the possibility that Musashino Bank is priced lower than what may be justified by its financials.

77 Bank (TSE:8341)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The 77 Bank, Ltd., along with its subsidiaries, offers a range of banking products and services to both corporate and individual clients in Japan, with a market capitalization of approximately ¥335.73 billion.

Operations: The 77 Bank, Ltd. generates revenue primarily from its Banking Business segment, which amounts to ¥154.27 billion.

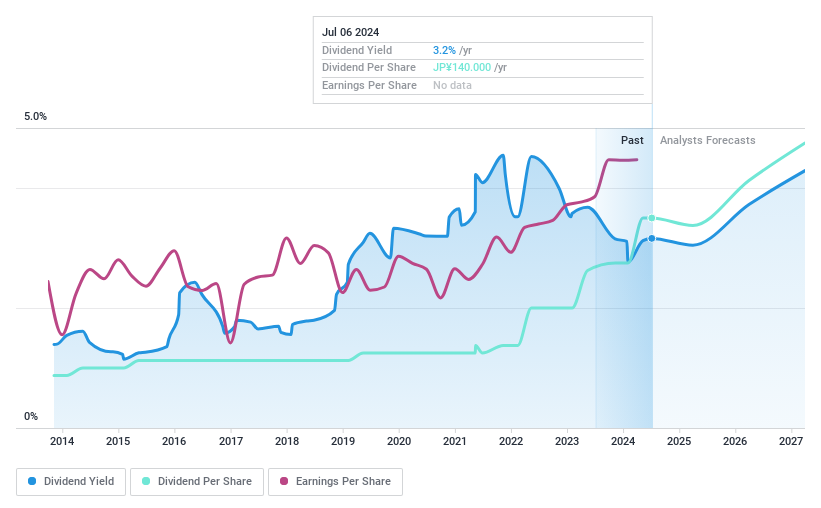

Dividend Yield: 3.4%

77 Bank offers a reliable dividend yield of 3.36%, though it falls short of the top 25% in the JP market. Its dividends have been stable and growing over the past decade, supported by a low payout ratio of 15.7%. Trading at 36.9% below estimated fair value adds appeal; however, a high level of bad loans at 2% and a low allowance for these loans at 50% could pose risks for cautious investors.

- Dive into the specifics of 77 Bank here with our thorough dividend report.

- Upon reviewing our latest valuation report, 77 Bank's share price might be too pessimistic.

Next Steps

- Click here to access our complete index of 1964 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8341

77 Bank

Provides banking products and services to corporate and individual customers in Japan.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives