As global markets continue to reach new heights, with U.S. small-cap stocks joining their larger peers in record territory, investors are navigating a landscape shaped by geopolitical developments and domestic policy shifts. In this dynamic environment, identifying undiscovered gems requires a keen understanding of market trends and the ability to spot companies poised for growth amidst broader economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Liuzhou Liangmianzhen (SHSE:600249)

Simply Wall St Value Rating: ★★★★★☆

Overview: Liuzhou Liangmianzhen Co., Ltd. engages in the production and sale of oral care, personal care products, hotel daily necessities, and pharmaceutical products both in China and internationally, with a market capitalization of CN¥3.33 billion.

Operations: Liuzhou Liangmianzhen's revenue streams are primarily derived from oral care, personal care products, hotel daily necessities, and pharmaceutical products. The company operates both domestically in China and internationally. Financial performance indicators such as gross profit margin or net profit margin are not provided for analysis in the available data.

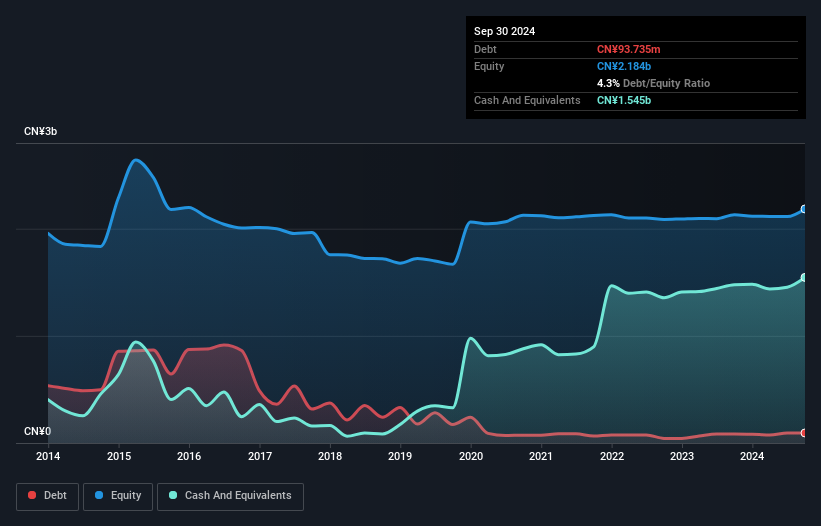

Liuzhou Liangmianzhen, a smaller player in the personal products sector, has been making waves with its impressive earnings growth of 55.4% over the past year, outpacing the industry average. The company reported net income of CN¥84.02 million for nine months ending September 2024, up from CN¥38.81 million the previous year. This boost seems partly driven by a one-off gain of CN¥61.7 million, which impacted recent financial results positively. Additionally, its debt-to-equity ratio improved to 4.3% from 10.4% over five years, and it holds more cash than total debt—indicating strong financial health and potential for future stability.

- Click to explore a detailed breakdown of our findings in Liuzhou Liangmianzhen's health report.

Assess Liuzhou Liangmianzhen's past performance with our detailed historical performance reports.

Guilin Layn Natural Ingredients (SZSE:002166)

Simply Wall St Value Rating: ★★★★★★

Overview: Guilin Layn Natural Ingredients Corp. is a company that produces plant-based sweeteners and natural flavors, operating both in China and internationally, with a market cap of CN¥6.23 billion.

Operations: The company generates revenue primarily from the sale of plant-based sweeteners and natural flavors. It has a market cap of CN¥6.23 billion, indicating its size within the industry.

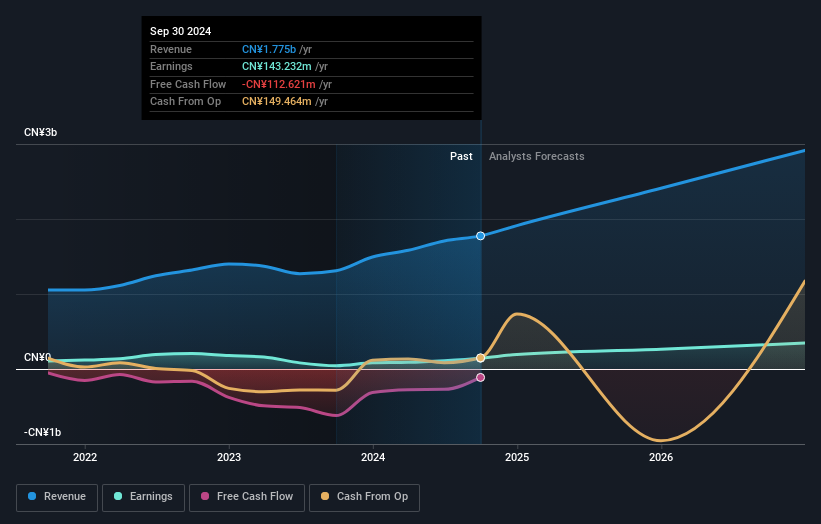

Guilin Layn Natural Ingredients, a promising player in the natural ingredients sector, has shown impressive financial performance recently. The company reported sales of CNY 1.17 billion for the first nine months of 2024, up from CNY 888.98 million last year, with net income rising to CNY 101.62 million from CNY 40.9 million. Their earnings growth of 226% over the past year outpaced the food industry's -5%. With a satisfactory net debt to equity ratio of 4.9% and EBIT covering interest payments by 5.6 times, their financial health appears robust despite non-recurring gains impacting results by CN¥31.6M.

Juroku Financial GroupInc (TSE:7380)

Simply Wall St Value Rating: ★★★★★☆

Overview: Juroku Financial Group, Inc. offers banking and leasing products and services in Japan, with a market cap of ¥158.27 billion.

Operations: The financial group generates revenue primarily from its banking and leasing segments. It operates with a market cap of ¥158.27 billion, focusing on providing financial services within Japan.

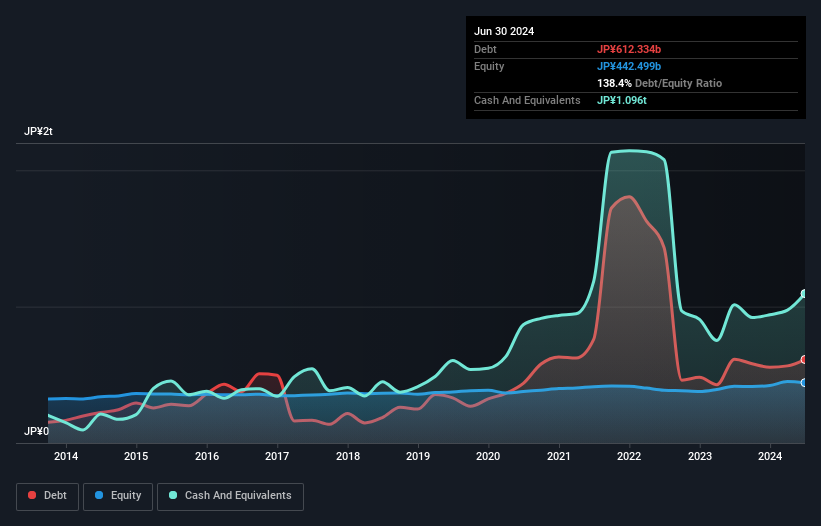

Juroku Financial Group Inc., with total assets of ¥7,568.9 billion and equity of ¥429.5 billion, presents a mixed bag for investors. Its total deposits stand at ¥6,414.6 billion against loans of ¥4,863.9 billion, reflecting a net interest margin of 0.8%. However, its allowance for bad loans is insufficient at 1.3% of total loans and only 37% coverage suggests potential vulnerabilities in loan quality management despite the low-risk nature of its funding sources which are primarily customer deposits (90%). Despite these challenges, it trades significantly below estimated fair value by around 46%, indicating potential undervaluation in the market context.

Seize The Opportunity

- Gain an insight into the universe of 4640 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7380

Juroku Financial GroupInc

Provides banking and leasing products and services in Japan.

Excellent balance sheet and good value.