Assessing Mebuki Financial Group (TSE:7167) Valuation Following New Share Buyback Program Announcement

Reviewed by Kshitija Bhandaru

Mebuki Financial Group (TSE:7167) just announced a new share buyback program, authorizing the repurchase of up to 9,000,000 shares, which is nearly 1% of its total capital, through late November 2025.

See our latest analysis for Mebuki Financial GroupInc.

The buyback news comes after a year of substantial momentum for Mebuki Financial GroupInc, with a 40% year-to-date share price return and a massive 57.6% total shareholder return over the past twelve months. Long-term holders have seen those rewards compounded further thanks to impressive multi-year gains, which suggests that investor confidence is rising rather than fading.

If you’re wondering what other companies are catching investors’ attention lately, this is a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

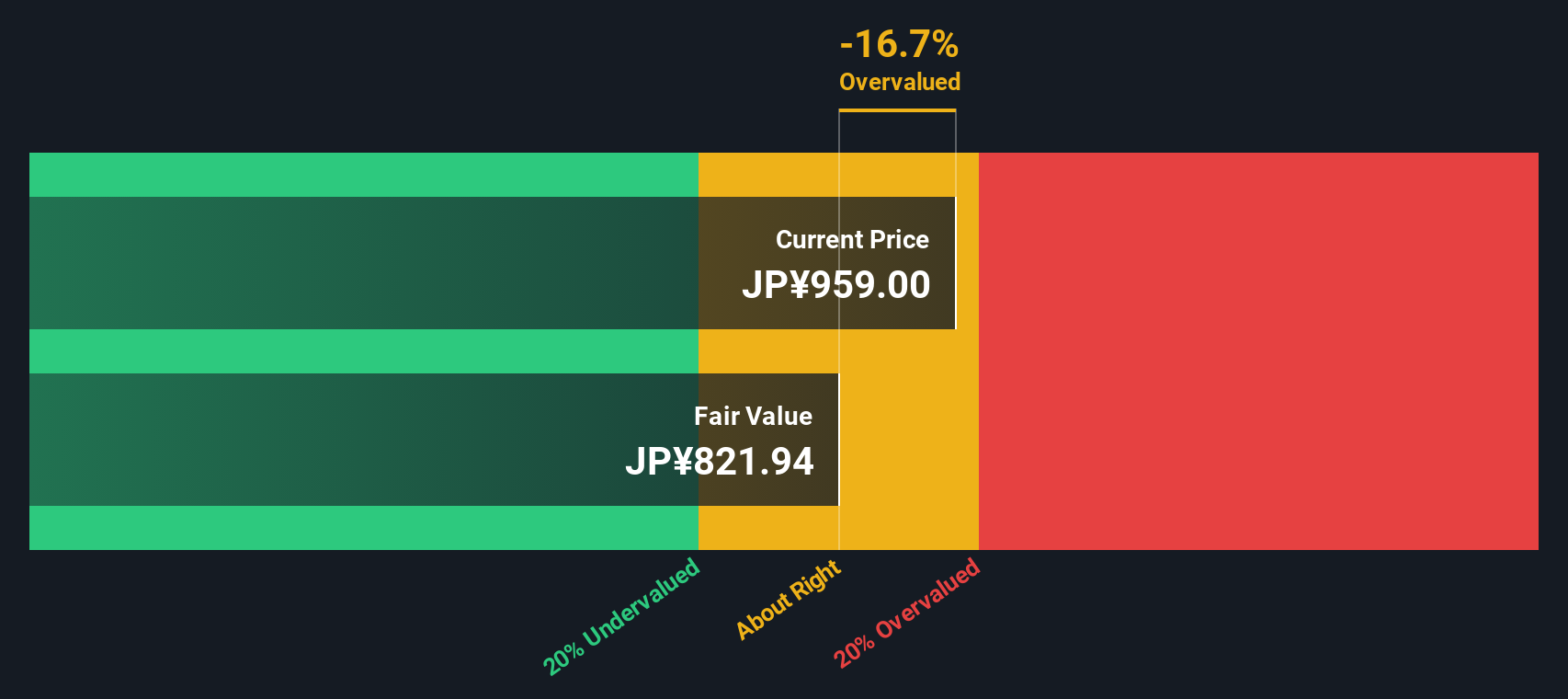

With strong recent gains and positive buyback news, investors are left to consider whether Mebuki Financial Group is still trading at a bargain or if future growth has already been fully priced in.

Price-to-Earnings of 13.6x: Is it justified?

Mebuki Financial GroupInc currently trades at a price-to-earnings (P/E) ratio of 13.6x, notably higher than the Japanese banks industry average of 10.4x. This makes the stock look expensive when compared with typical peers, especially given its recent share price rally.

The P/E ratio reflects what investors are willing to pay today for a company’s future earnings power. For a bank like Mebuki, the metric helps investors gauge whether the market is pricing in expected profit growth or rewarding the company for recent positive momentum.

Despite the high P/E compared to industry, the ratio is actually below the average P/E of its direct peers, which stands at 16.3x. Furthermore, when matched against our estimated fair P/E of 14.9x, today's multiple suggests there could still be some upside if the broader market starts to price the stock more in line with those fair-value benchmarks.

Explore the SWS fair ratio for Mebuki Financial GroupInc

Result: Price-to-Earnings of 13.6x (ABOUT RIGHT)

However, lackluster recent returns and uncertainty around sustained revenue growth could challenge the positive momentum that investors have come to expect from Mebuki Financial Group.

Find out about the key risks to this Mebuki Financial GroupInc narrative.

Another View: Discounted Cash Flow Model

While the market seems to be pricing Mebuki Financial GroupInc in line with its peers using the price-to-earnings ratio, our SWS DCF model paints a different picture. According to this method, the stock is trading about 38% below its estimated fair value. This suggests it appears undervalued on a cash flow basis.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mebuki Financial GroupInc for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mebuki Financial GroupInc Narrative

If you’d rather draw your own conclusions or enjoy digging into the numbers firsthand, it only takes a few minutes to shape your own perspective. Do it your way.

A great starting point for your Mebuki Financial GroupInc research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your investment strategy to a single opportunity. Some of the market’s most promising picks are just a click away on Simply Wall Street. Make your next move smarter and stay ahead of the curve with these handpicked ideas:

- Capitalize on rising market disruptors by scanning these 24 AI penny stocks, which are redefining industries with artificial intelligence innovation and rapid earnings growth.

- Boost your portfolio’s income potential by uncovering these 18 dividend stocks with yields > 3% that offer reliable yields above 3 percent and a history of steady payouts.

- Get ahead of market trends by tracking these 79 cryptocurrency and blockchain stocks, organizations that are pushing the boundaries of finance and technology through decentralized platforms and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7167

Mebuki Financial GroupInc

Provides banking products and financial services in Japan and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives