Iyogin Holdings,Inc.'s (TSE:5830) investors are due to receive a payment of ¥20.00 per share on 9th of December. The payment will take the dividend yield to 2.8%, which is in line with the average for the industry.

View our latest analysis for Iyogin HoldingsInc

Iyogin HoldingsInc's Payment Expected To Have Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable.

Iyogin HoldingsInc has a long history of paying out dividends, with its current track record at a minimum of 10 years. While past data isn't a guarantee for the future, Iyogin HoldingsInc's latest earnings report puts its payout ratio at 19%, showing that the company can pay out its dividends comfortably.

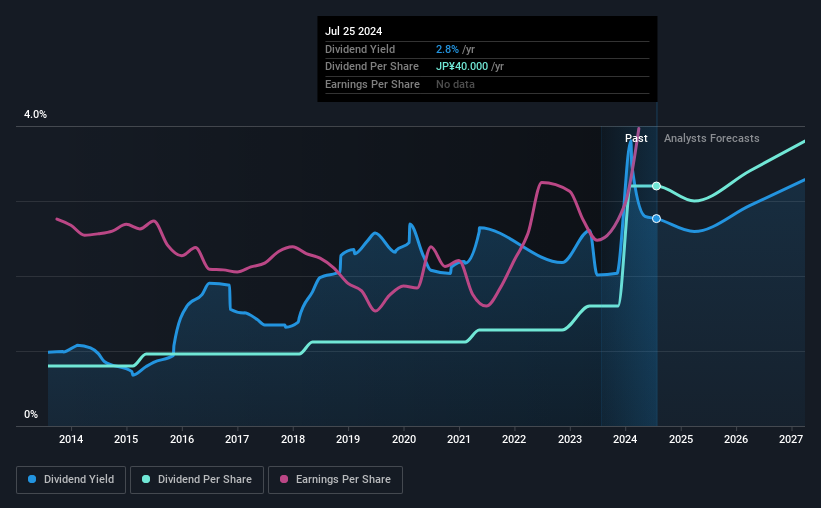

Looking forward, earnings per share is forecast to rise by 3.9% over the next year. Assuming the dividend continues along recent trends, we think the future payout ratio could be 31% by next year, which is in a pretty sustainable range.

Iyogin HoldingsInc Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of ¥10.00 in 2014 to the most recent total annual payment of ¥40.00. This implies that the company grew its distributions at a yearly rate of about 15% over that duration. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. Iyogin HoldingsInc has seen EPS rising for the last five years, at 18% per annum. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

Iyogin HoldingsInc Looks Like A Great Dividend Stock

Overall, a dividend increase is always good, and we think that Iyogin HoldingsInc is a strong income stock thanks to its track record and growing earnings. Earnings are easily covering distributions, and the company is generating plenty of cash. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Iyogin HoldingsInc stock. Is Iyogin HoldingsInc not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5830

Solid track record with excellent balance sheet and pays a dividend.