The board of Yorozu Corporation (TSE:7294) has announced that it will pay a dividend on the 16th of June, with investors receiving ¥16.00 per share. However, the dividend yield of 2.8% still remains in a typical range for the industry.

View our latest analysis for Yorozu

Yorozu Might Find It Hard To Continue The Dividend

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Yorozu is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. This gives us some comfort about the level of the dividend payments.

If the trend of the last few years continues, EPS will grow by 38.5% over the next 12 months. The company seems to be going down the right path, but it will probably take a little bit longer than a year to cross over into profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

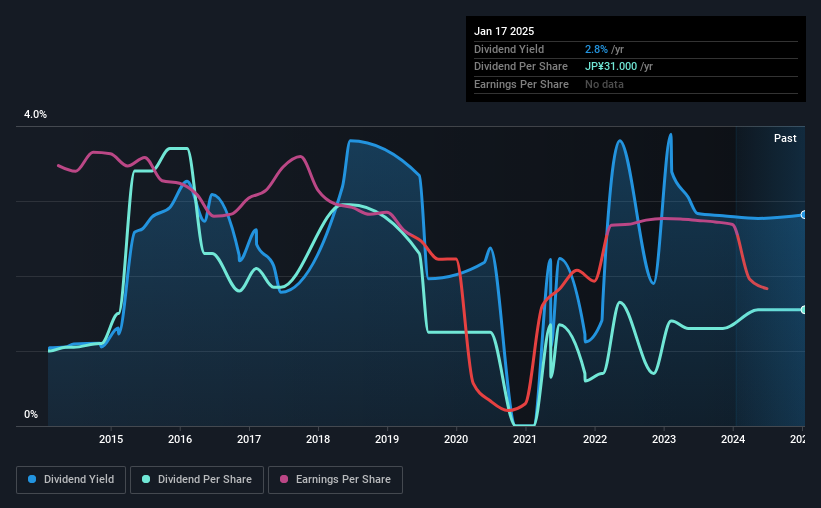

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of ¥20.00 in 2015 to the most recent total annual payment of ¥31.00. This works out to be a compound annual growth rate (CAGR) of approximately 4.5% a year over that time. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Company Could Face Some Challenges Growing The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. We are encouraged to see that Yorozu has grown earnings per share at 38% per year over the past five years. The company hasn't been turning a profit, but it running in the right direction. If profitability can be achieved soon and growth continues apace, this stock could certainly turn into a solid dividend payer.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Yorozu that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7294

Yorozu

Designs, develops, manufactures, and sells auto parts, agricultural machinery parts, and manufacturing equipment in Japan, the United States, Mexico, China, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in