- Japan

- /

- Auto Components

- /

- TSE:7287

Even With A 33% Surge, Cautious Investors Are Not Rewarding Nippon Seiki Co., Ltd.'s (TSE:7287) Performance Completely

Nippon Seiki Co., Ltd. (TSE:7287) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 2.5% isn't as attractive.

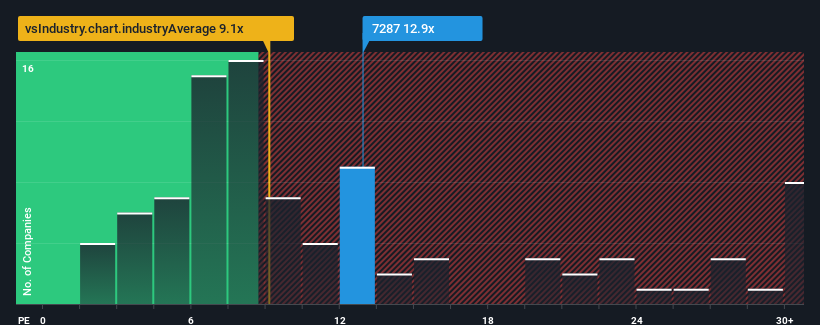

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Nippon Seiki's P/E ratio of 12.9x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Our free stock report includes 2 warning signs investors should be aware of before investing in Nippon Seiki. Read for free now.Recent times have been advantageous for Nippon Seiki as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Nippon Seiki

How Is Nippon Seiki's Growth Trending?

In order to justify its P/E ratio, Nippon Seiki would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 48% as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 9.3%, which is noticeably less attractive.

In light of this, it's curious that Nippon Seiki's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Nippon Seiki appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Nippon Seiki currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Nippon Seiki you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nippon Seiki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7287

Nippon Seiki

Engages in the manufacture and sale of instruments for automobiles, motorcycles, agricultural and construction machines, and marine instruments in Japan, the Americas, Europe, and rest of Asia.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026