As global markets navigate a mixed landscape, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching new heights while others like the Russell 2000 face declines, investors are keenly observing economic indicators such as job growth and potential interest rate cuts by the Federal Reserve. In this context of varied market performance and economic signals, dividend stocks stand out as a compelling option for those seeking steady income streams, especially when sectors like energy and utilities experience downturns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.41% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

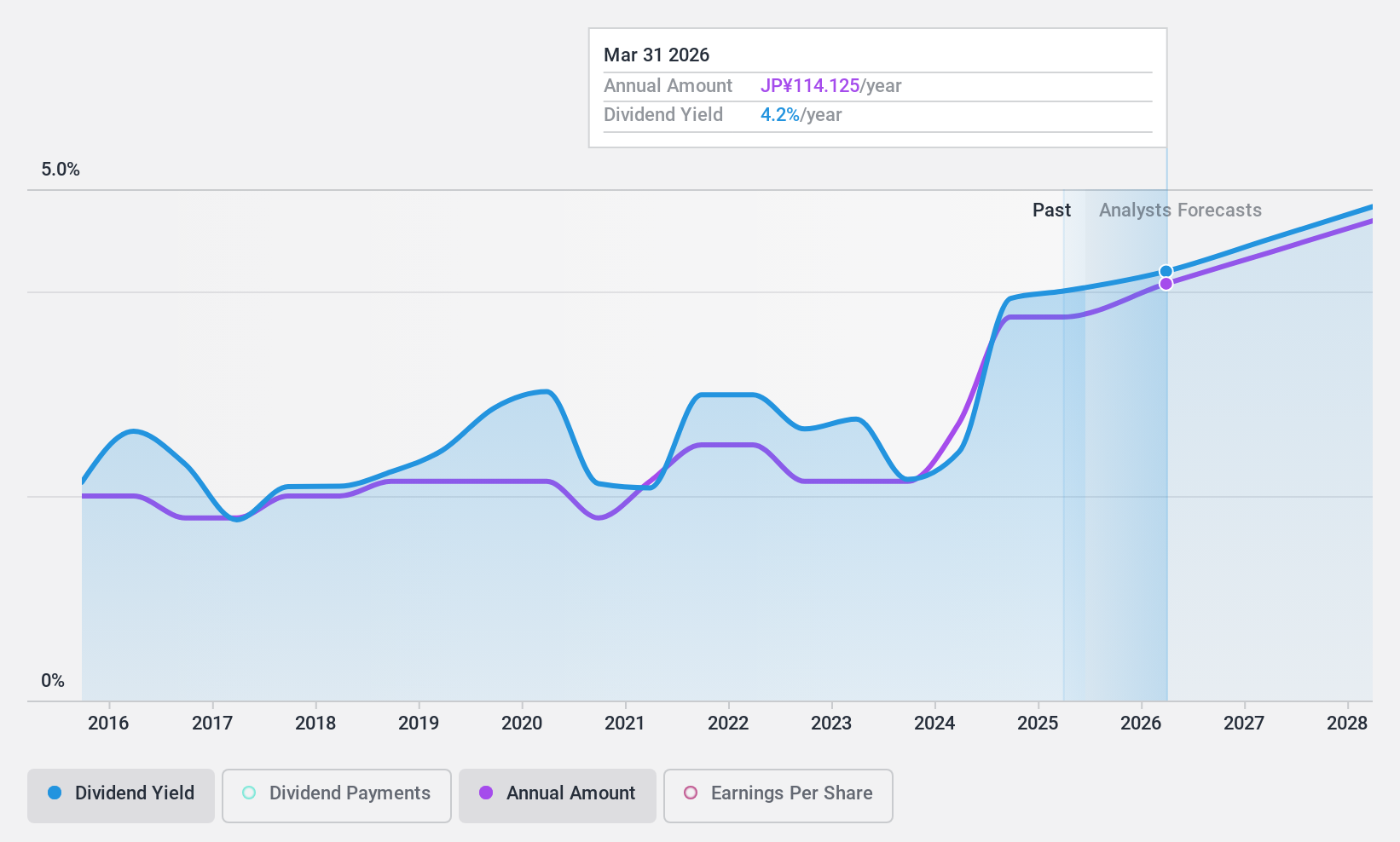

Tokai Rika (TSE:6995)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tokai Rika Co., Ltd. manufactures and sells human interface systems, security and safety systems, electronics, ornaments, and home devices across Japan, North America, Asia, and internationally with a market cap of ¥184.76 billion.

Operations: Tokai Rika Co., Ltd. generates revenue through its diverse operations, including the production and sale of human interface systems, security and safety systems, electronics, ornaments, and home devices across various regions globally.

Dividend Yield: 4.1%

Tokai Rika's dividend yield is in the top 25% of the Japanese market, with a payout ratio of 65.1% covered by earnings and a cash payout ratio of 65.6%. Despite this, its dividend history has been volatile over the past decade, showing both increases and drops exceeding 20%. While trading significantly below estimated fair value, profit margins have declined from last year. Earnings are expected to grow annually by 17.04%, potentially supporting future dividends.

- Unlock comprehensive insights into our analysis of Tokai Rika stock in this dividend report.

- In light of our recent valuation report, it seems possible that Tokai Rika is trading beyond its estimated value.

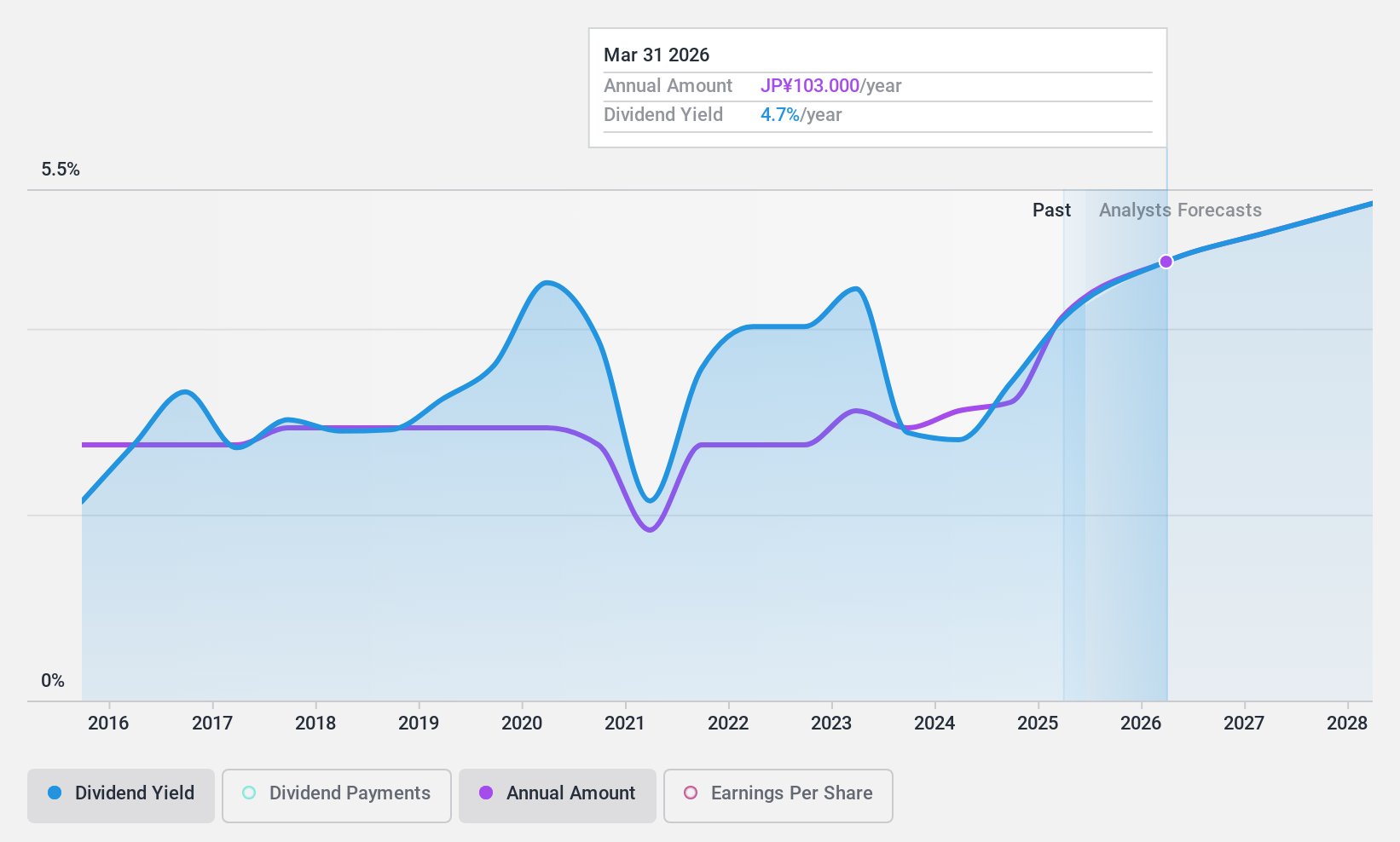

Toyoda Gosei (TSE:7282)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyoda Gosei Co., Ltd. is a manufacturer and seller of automotive parts, optoelectronic products, and general industry products with a market cap of ¥331.97 billion.

Operations: Toyoda Gosei Co., Ltd. generates revenue from various regions, including ¥209.67 billion from Asia, ¥436.56 billion from Japan, ¥406.53 billion from the Americas, and ¥35.41 billion from Europe & Africa.

Dividend Yield: 4%

Toyoda Gosei's dividend yield ranks in the top 25% of Japanese market payers, supported by a low payout ratio of 29.4% and cash payout ratio of 28%, indicating strong earnings and cash flow coverage. However, its dividend history has been volatile over the past decade, with significant fluctuations. Despite this instability, recent increases in dividends suggest potential improvement. Additionally, Toyoda Gosei trades well below fair value estimates, offering attractive relative valuation for investors seeking dividends.

- Get an in-depth perspective on Toyoda Gosei's performance by reading our dividend report here.

- The analysis detailed in our Toyoda Gosei valuation report hints at an deflated share price compared to its estimated value.

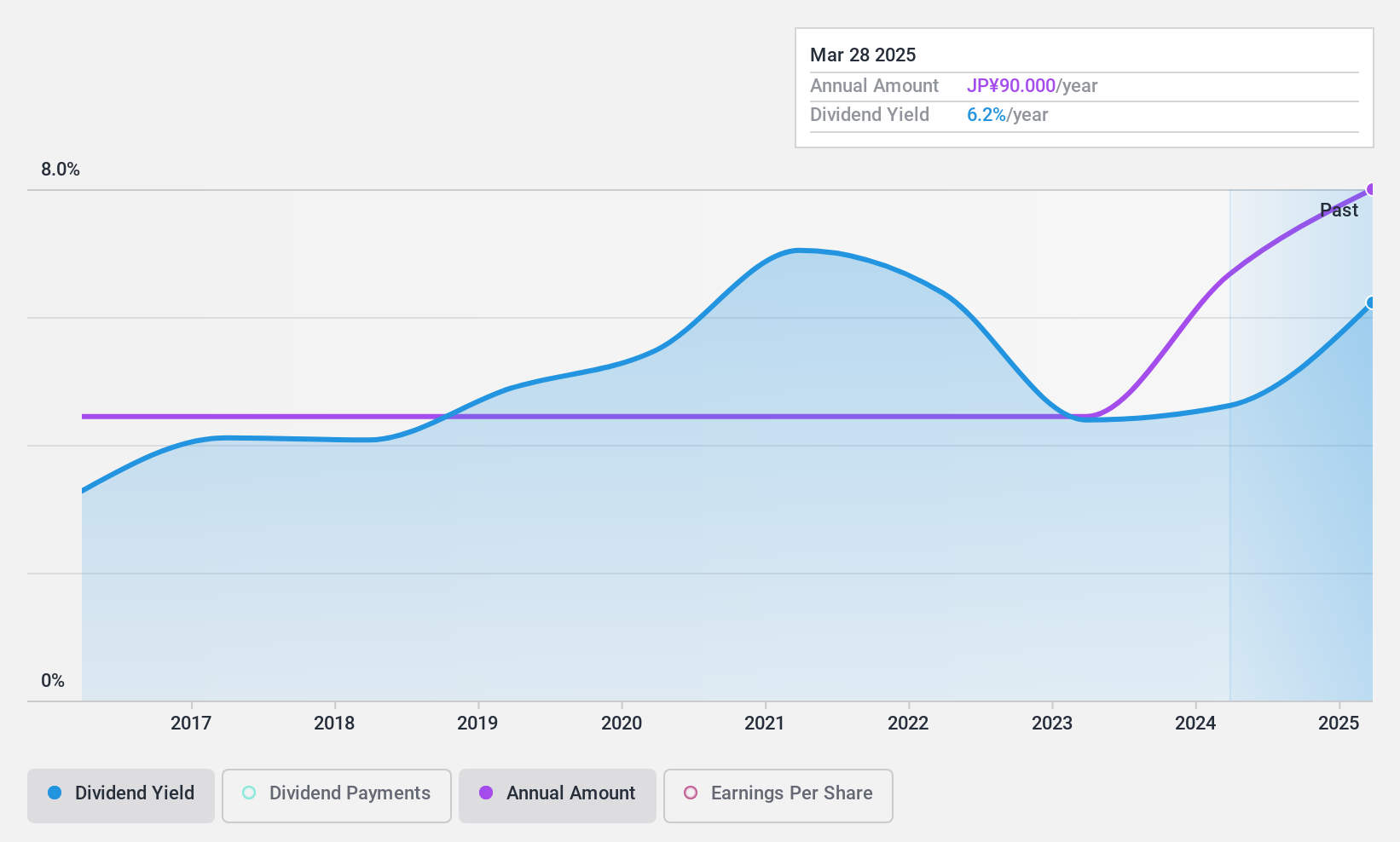

Mamiya-OP (TSE:7991)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mamiya-OP Co., Ltd. is a company that manufactures and sells electronic and sports equipment both in Japan and internationally, with a market cap of ¥17.20 billion.

Operations: Mamiya-OP Co., Ltd.'s revenue is primarily derived from its Electronic Equipment Business, which generates ¥29.67 billion, followed by the Sports Business at ¥4.96 billion and the Real Estate Business contributing ¥1.53 billion.

Dividend Yield: 4.5%

Mamiya-OP's dividend yield is among the top 25% in Japan, supported by a low payout ratio of 12.1% and cash payout ratio of 32.3%, ensuring dividends are well covered by earnings and cash flows. Despite robust coverage, the company's dividend history has been volatile over the past decade, with significant drops exceeding 20%. Nonetheless, recent earnings growth of 109.2% could provide some optimism for future stability in payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Mamiya-OP.

- Our valuation report unveils the possibility Mamiya-OP's shares may be trading at a discount.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1925 more companies for you to explore.Click here to unveil our expertly curated list of 1928 Top Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7991

Mamiya-OP

Manufactures and sells electronic and sports equipment in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.