- Japan

- /

- Auto Components

- /

- TSE:7276

Koito Manufacturing (TSE:7276) Net Margin Surge Driven by ¥16.2B One-Off Gain Spurs Sustainability Debate

Reviewed by Simply Wall St

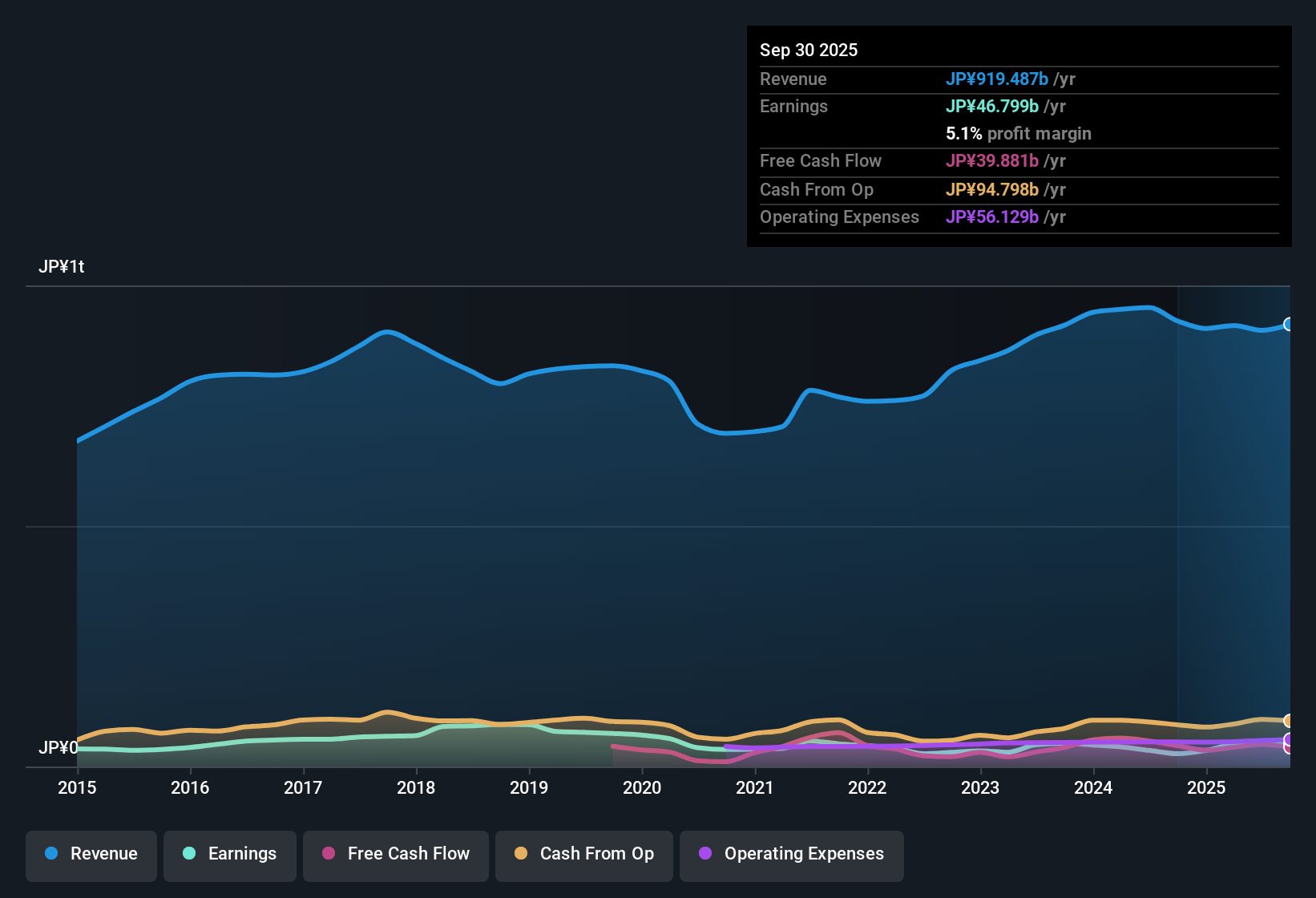

Koito Manufacturing (TSE:7276) delivered a net profit margin of 5.4%, up from 3.5% last year, and grew earnings by 46.1% year over year. This far outpaces its five-year average of 0.4% per year, driven in part by a one-off gain of ¥16.2 billion. Despite this surge, revenue is forecast to rise at just 3% per year compared to the broader Japanese market's 4.5% annual pace, with shares currently trading at ¥2,337, above an estimated fair value of ¥1,594.9. Investors are weighing the improved earnings momentum and modest growth outlook against a relatively rich valuation and several minor risks flagged in recent results.

See our full analysis for Koito Manufacturing.The next step is to see how these headline results compare to the widely discussed narratives around Koito Manufacturing, and where the numbers might tell a different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Adds Punch to Profit Margins

- The latest net margin of 5.4% was boosted by a one-off gain of ¥16.2 billion, giving Koito a dramatic edge over its five-year average earnings growth of just 0.4% per year.

- Investors looking for structural upside are paying close attention to this margin spike. The prevailing market view sees Koito’s reputation for partnering with leading electric vehicle makers as a strength, but also highlights the risk that future margins could slip without more frequent gains of this scale.

- The standout profit surge heavily supports optimism around Koito’s technology leadership and sector relationships.

- It is notable that such extraordinary margin expansion is anchored to a one-time event, so questions remain about how sustainable this performance really is as EV and headlight innovation drive demand, but competition pressures persist.

Peer Valuation Stirs Debate

- Koito’s price-to-earnings ratio stands at 13.2x, notably higher than the industry average of 11.6x but still well below the peer average of 23.6x; its share price of ¥2,337 also trades significantly above the DCF fair value of ¥1,594.90.

- While the prevailing market view highlights Koito’s attractive discount compared to high-profile peers, it also underlines the tension that the company’s premium over the industry average and the DCF estimate may limit near-term re-rating potential.

- This valuation gap strengthens the case for investors prioritizing future growth tied to Koito’s position in electrification and advanced lighting.

- At the same time, bears may argue the premium could be hard to defend unless revenue growth outpaces the forecast 3% rate, which lags the broader Japanese market.

Profit and Revenue Outpacing the Market

- Earnings are projected to grow 10.7% per year, ahead of the market’s 7.9% forecast, and both profit and revenue have continued their upward trend despite sector competition and input cost pressures.

- The prevailing market view notes the outperformance versus the broader market boosts Koito’s appeal to investors seeking reliable suppliers to automakers. However, the stock’s relatively rich valuation means ongoing growth and partnership wins must deliver to keep sentiment positive.

- Analysts tracking the sector highlight the dual effect: Koito’s strong ties to EV supply chains set a supportive backdrop for future growth.

- On the other hand, slower revenue growth projections versus the total Japanese market put more weight on profit durability and tech innovation.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Koito Manufacturing's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Koito’s revenue growth trails the broader Japanese market, and its valuation premium looks difficult to justify without more consistent expansion ahead.

If you want to focus on companies delivering steadier progress, start with stable growth stocks screener (2122 results). They have proven their ability to expand earnings and sales, cycle after cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Koito Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7276

Koito Manufacturing

Engages in the manufacture and sale of automotive lighting devices, aircraft parts, railway vehicle parts, electrical equipment, and other related products in Japan.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026