Yamaha Motor (TSE:7272) Expands Electric Offerings with Torqeedo Outboards, Enhancing Growth Potential

Reviewed by Simply Wall St

Yamaha Motor (TSE:7272) is set to strengthen its market position with the recent acquisition of Torqeedo, a leader in electric marine propulsion. This strategic move enhances Yamaha's commitment to carbon neutrality and diversifies its product offerings with the introduction of Torqeedo's electric outboards at Yamaha dealerships. The company report will explore Yamaha's financial outlook, internal challenges, future prospects, and regulatory considerations impacting its growth trajectory.

Take a closer look at Yamaha Motor's potential here.

Unique Capabilities Enhancing Yamaha Motor's Market Position

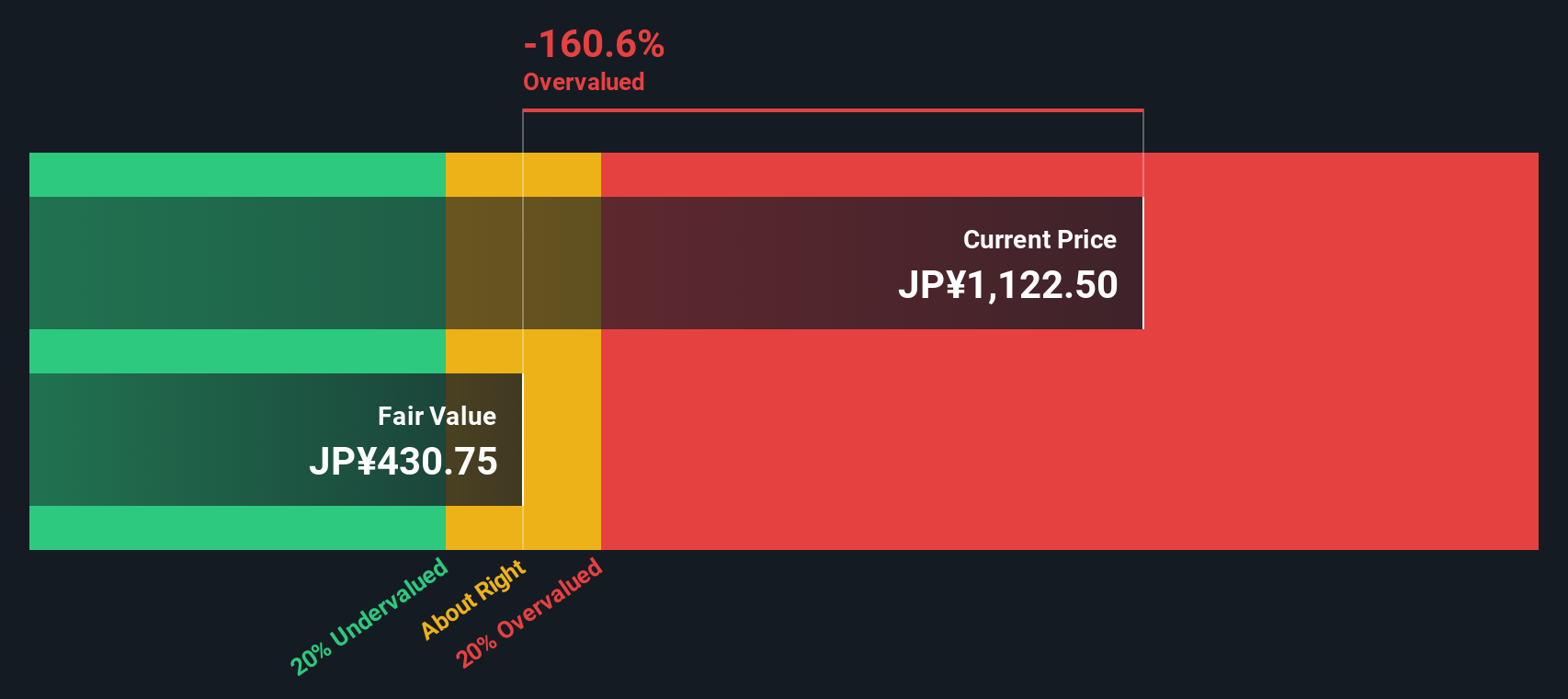

Yamaha Motor is poised for growth, with earnings projected to rise by 11.7% annually, and revenue expected to grow at 4.4% per year, surpassing the JP market's 4.2% growth rate. This financial outlook is supported by a solid payout ratio of 32.1%, ensuring dividends are well-covered by earnings. The company's profitability is further highlighted by its ability to maintain a stable cash runway, with no significant shareholder dilution in the past year. Additionally, Yamaha is trading at 34% below its SWS fair value estimate, indicating a strong market position relative to the Asian Auto industry.

Internal Limitations Hindering Yamaha Motor's Growth

Challenges remain, as evidenced by a 7.3% decline in earnings growth over the past year, complicating performance comparisons. The company's return on equity stands at 14.1%, which is below industry standards, and net profit margins have decreased from 7.9% to 5.9%. Furthermore, a high net debt to equity ratio of 40.9% raises concerns about financial leverage. Dividend payments have also been inconsistent over the past decade, potentially affecting investor confidence.

Future Prospects for Yamaha Motor in the Market

Yamaha's acquisition of Torqeedo in early 2024 marks a strategic expansion into electric marine propulsion, enhancing its multi-technology approach to carbon neutrality. The introduction of Torqeedo's electric outboards at Yamaha dealerships, including models for kayaks and boats, underscores this commitment. This move not only diversifies Yamaha's product offerings but also positions it to capitalize on favorable market conditions in the Asian Auto industry, potentially driving significant earnings growth.

Regulatory Challenges Facing Yamaha Motor

Economic uncertainties and regulatory changes present potential risks to Yamaha's growth trajectory. The company is actively monitoring these factors to ensure compliance and mitigate any impact on operations. Additionally, supply chain disruptions remain a concern, with efforts underway to address these vulnerabilities and maintain product availability. These external challenges necessitate careful strategic planning to sustain Yamaha's competitive edge.

To learn about how Yamaha Motor's valuation metrics are shaping its market position, check out our detailed analysis of Yamaha Motor's Valuation.Conclusion

Yamaha Motor is strategically positioned for growth, with anticipated earnings and revenue increases that outpace the JP market, supported by a solid dividend coverage and a stable cash runway. Internal challenges such as declining earnings growth and a high net debt to equity ratio persist, but Yamaha's strategic acquisition of Torqeedo signifies a commitment to diversifying its product offerings and embracing carbon neutrality, which could drive future earnings. The company's current trading status, 34% below its SWS fair value estimate, suggests it holds strong potential within the Asian Auto industry, despite being seen as expensive compared to peers. However, Yamaha must navigate economic uncertainties and regulatory changes with careful planning to maintain its competitive edge and capitalize on its market position.

Seize The Opportunity

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:7272

Yamaha Motor

Engages in the land mobility, marine products, robotics, financial services, and others businesses in Japan, North America, Europe, Asia, and internationally.

Good value with adequate balance sheet and pays a dividend.