Subaru (TSE:7270) – Assessing Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Subaru (TSE:7270) shares slipped today, giving back some recent gains as investors continued to digest market dynamics around the automaker. The stock’s performance has attracted attention amid its strong returns over the past year.

See our latest analysis for Subaru.

While Subaru’s latest share price slipped back to ¥3,354, momentum remains impressive. A 21.9% year-to-date share price return highlights strong interest from investors. Over the longer term, total shareholder return has been robust, up 39.4% over the past year as the company steadily delivers value.

If you’re curious about where the broader auto sector is headed next, this is a great opportunity to browse See the full list for free.

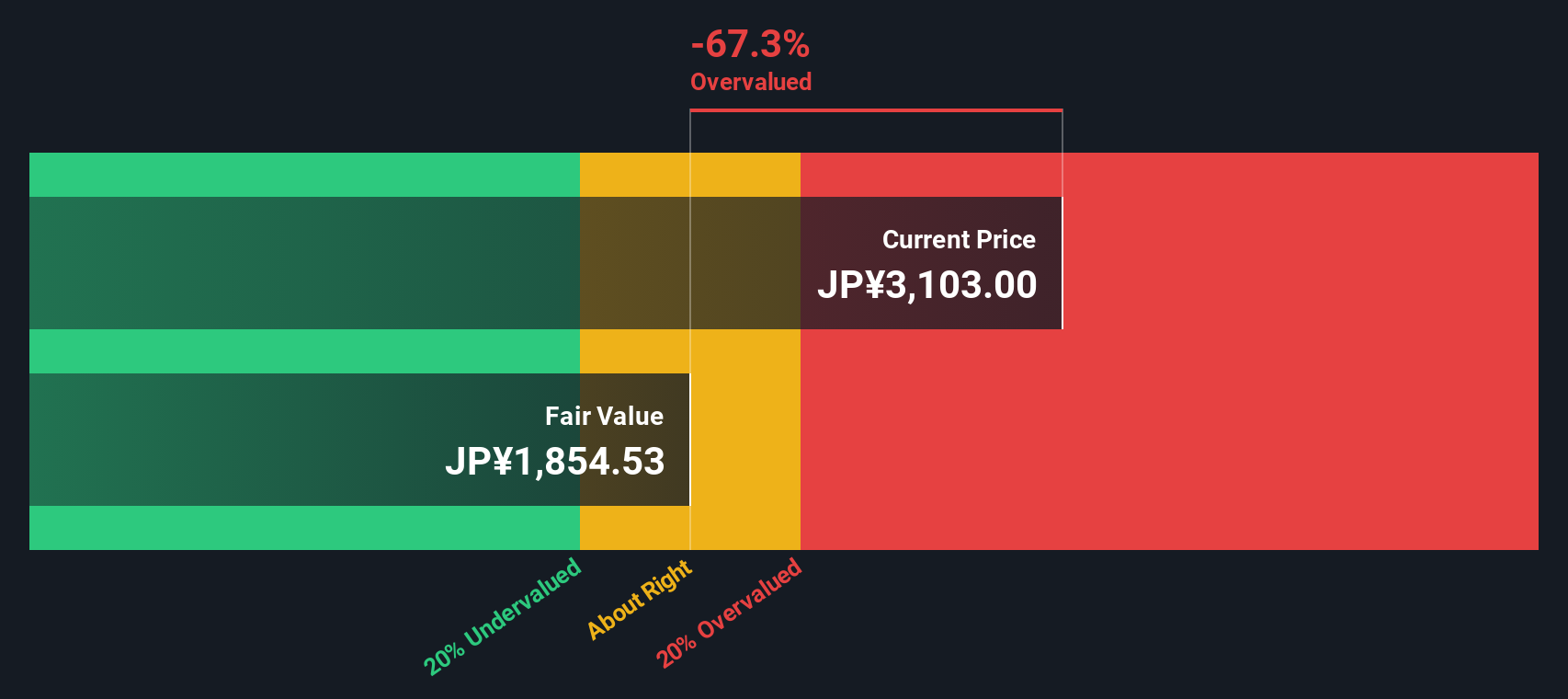

But with recent investor enthusiasm and solid long-term gains, is Subaru’s stock still undervalued at current levels, or are investors already factoring in all of the company’s future growth potential, leaving limited room for upside?

Price-to-Earnings of 9.1x: Is it justified?

Subaru’s Price-to-Earnings (P/E) ratio sits at 9.1x, noticeably lower than the figure seen across peers and the broader market at the recent close of ¥3,354. This signals that the market currently values Subaru’s earnings less generously than its competitors.

The P/E ratio measures how much investors are paying for each yen of Subaru’s earnings. For automakers, this multiple helps gauge investor sentiment, whether they anticipate earnings growing or stalling in the near future. Given Subaru’s position and recent returns, it suggests that the market might be skeptical about the company’s growth trajectory or is underestimating its earnings power.

Compared to other companies in the Japanese auto sector, Subaru’s P/E of 9.1x stands out as attractive. The sector’s average is 18.5x and peers average 13.4x, shining a light on Subaru’s relative affordability. According to regression-based analysis, the fair P/E ratio could be closer to 14.4x, indicating room for a market re-rating if confidence in Subaru’s long-term prospects improves.

Explore the SWS fair ratio for Subaru

Result: Price-to-Earnings of 9.1x (UNDERVALUED)

However, potential risks such as sluggish revenue and net income growth could limit further upside for Subaru shares if these trends continue.

Find out about the key risks to this Subaru narrative.

Another View: What Does the DCF Model Suggest?

While Subaru appears undervalued by standard valuation ratios, our DCF model provides a different perspective. It calculates a fair value of ¥2,332.5, which is well below the current price. This indicates that Subaru might actually be overvalued when considering projected future cash flows. This raises the question of whether investors are placing too much confidence in ongoing performance.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Subaru for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 929 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Subaru Narrative

If you see Subaru’s story unfolding differently, or want to dig deeper into the numbers, you can easily build your own perspective in just minutes. Do it your way

A great starting point for your Subaru research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your next advantage with stocks catching attention beyond just the auto sector. Don’t let fresh opportunities pass you by and invest smarter right now.

- Spot reliable income by checking out these 14 dividend stocks with yields > 3% that consistently deliver attractive yields above 3% for your portfolio.

- Target tomorrow’s leaders with momentum by starting with these 25 AI penny stocks already pushing the boundaries in artificial intelligence and innovation.

- Grow your capital with companies trading below intrinsic value by reviewing these 929 undervalued stocks based on cash flows packed with strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7270

Subaru

Manufactures and sells automobiles and aerospace products in Japan, Rest of Asia, North America, Europe, and Internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026