Suzuki (TSE:7269) Valuation in Focus After Cerence AI Partnership for e VITARA Launch

Reviewed by Kshitija Bhandaru

Suzuki Motor (TSE:7269) just announced a partnership with Cerence AI to bring a conversational in-car assistant to its first battery electric vehicle, the e VITARA. This move positions Suzuki at the forefront of the EV market as it focuses on integrated technology and electrification.

See our latest analysis for Suzuki Motor.

While Suzuki’s EV tech partnership made the headlines, its shares have been holding steady, catching investors’ eyes after a period of relative calm. Although recent share price moves have been muted, long-term shareholders have seen nearly 97% total shareholder return over five years, with Suzuki trading at a noticeable discount to its sector peers.

If Suzuki’s latest tech-driven strategy piqued your interest, you might also want to check out other leading automakers. See the full list with See the full list for free..

With Suzuki shares trading below analyst price targets and the company advancing its tech capabilities despite recent sales declines, it raises the question: is there still untapped upside here, or has the market already factored in the path for future growth?

Price-to-Earnings of 10.5x: Is it justified?

With Suzuki Motor trading at a price-to-earnings (P/E) ratio of 10.5x, the stock currently sits below the peer average and industry levels. This hints at undervaluation relative to its fundamentals. The most recent share price of ¥2,189 further supports the perspective that Suzuki may be priced attractively when compared to sector norms.

The P/E ratio measures how much investors are willing to pay per yen of earnings, making it a key indicator for established automakers like Suzuki. A lower multiple can signal skepticism about future growth, but can also indicate a value opportunity if earnings are robust.

Suzuki’s P/E not only trails the Asian Auto industry average of 21.7x, but it also sits beneath both the peer average of 14.1x and its estimated fair P/E ratio of 13.9x. This notable discount suggests the market may be underappreciating Suzuki's recent earnings momentum and profit quality, as evidenced by consistent outperformance versus industry and market returns.

Explore the SWS fair ratio for Suzuki Motor

Result: Price-to-Earnings of 10.5x (UNDERVALUED)

However, ongoing sales declines and uncertainties around execution of Suzuki’s tech strategy could temper enthusiasm for continued outperformance in the near term.

Find out about the key risks to this Suzuki Motor narrative.

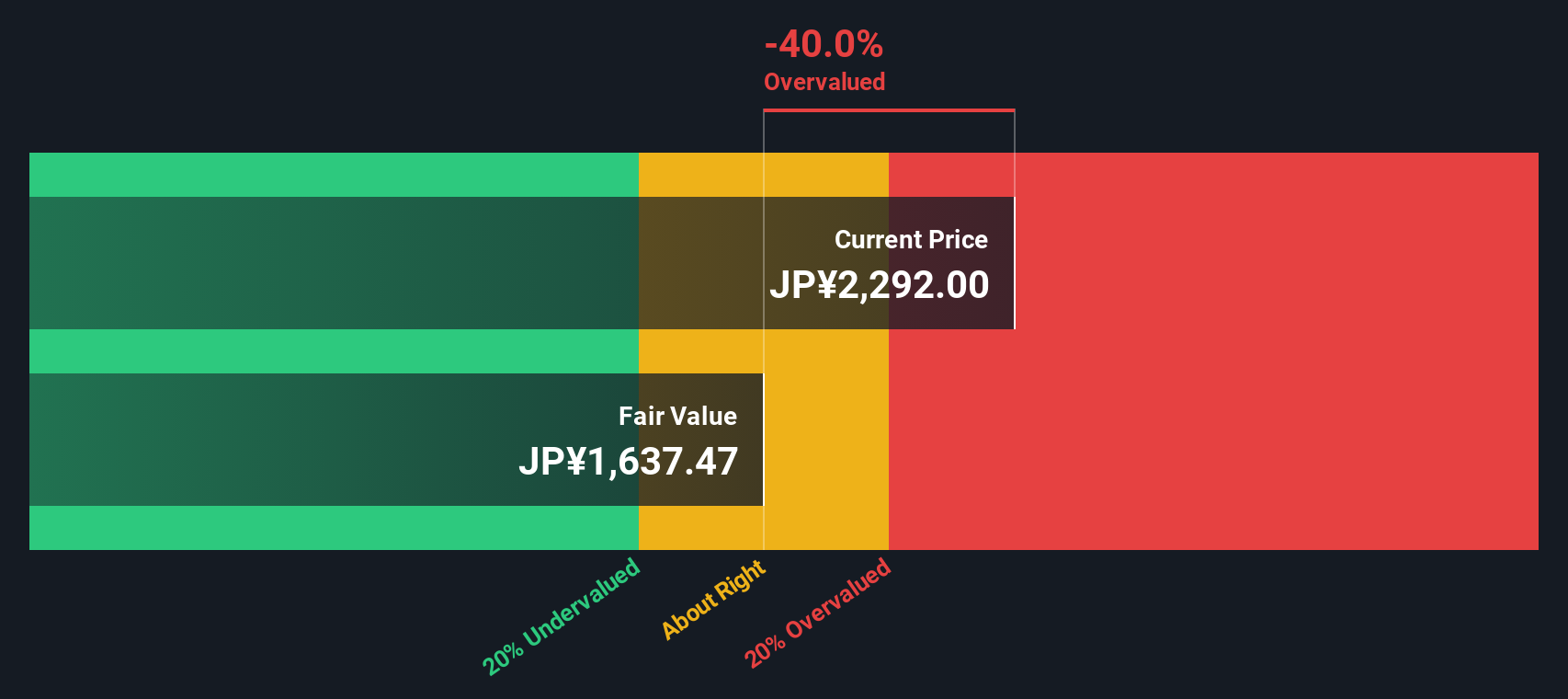

Another View: What Does Our DCF Model Say?

While Suzuki Motor looks undervalued on earnings comparisons, the SWS DCF model provides a different angle. According to our DCF estimate, the shares are actually trading above their fair value. This suggests that relying solely on multiples may not provide the complete picture. Could longer-term cash flow trends limit near-term upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Suzuki Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Suzuki Motor Narrative

If you see the story differently or prefer to dig into the data yourself, you can easily craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Suzuki Motor.

Looking for more investment ideas?

Make your next smart move by seeking out market-beating opportunities before others catch on. The Simply Wall Street Screener can help you stay ahead of the curve by zeroing in on the stocks that fit your personal criteria.

- Boost your income by targeting generous yields. Unlock hidden market potential with these 19 dividend stocks with yields > 3% now yielding over 3% and see which companies are rewarding their shareholders.

- Ride the AI innovation wave by browsing these 24 AI penny stocks, where tech disruptors are applying artificial intelligence in ways that could reshape entire industries.

- Catch undervalued plays with strong fundamentals and get an edge by reviewing these 896 undervalued stocks based on cash flows based on discounted cash flow insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7269

Suzuki Motor

Engages in the manufacture and sale of automobiles, motorcycles, outboard motors, electric wheelchairs, and other products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives