Is Honda Still Attractively Priced After Its EV and Hybrid Strategy Acceleration?

Reviewed by Bailey Pemberton

- If you are wondering whether Honda Motor is still a value play after such a long run for auto stocks, or if the easy money has already been made, you are not alone.

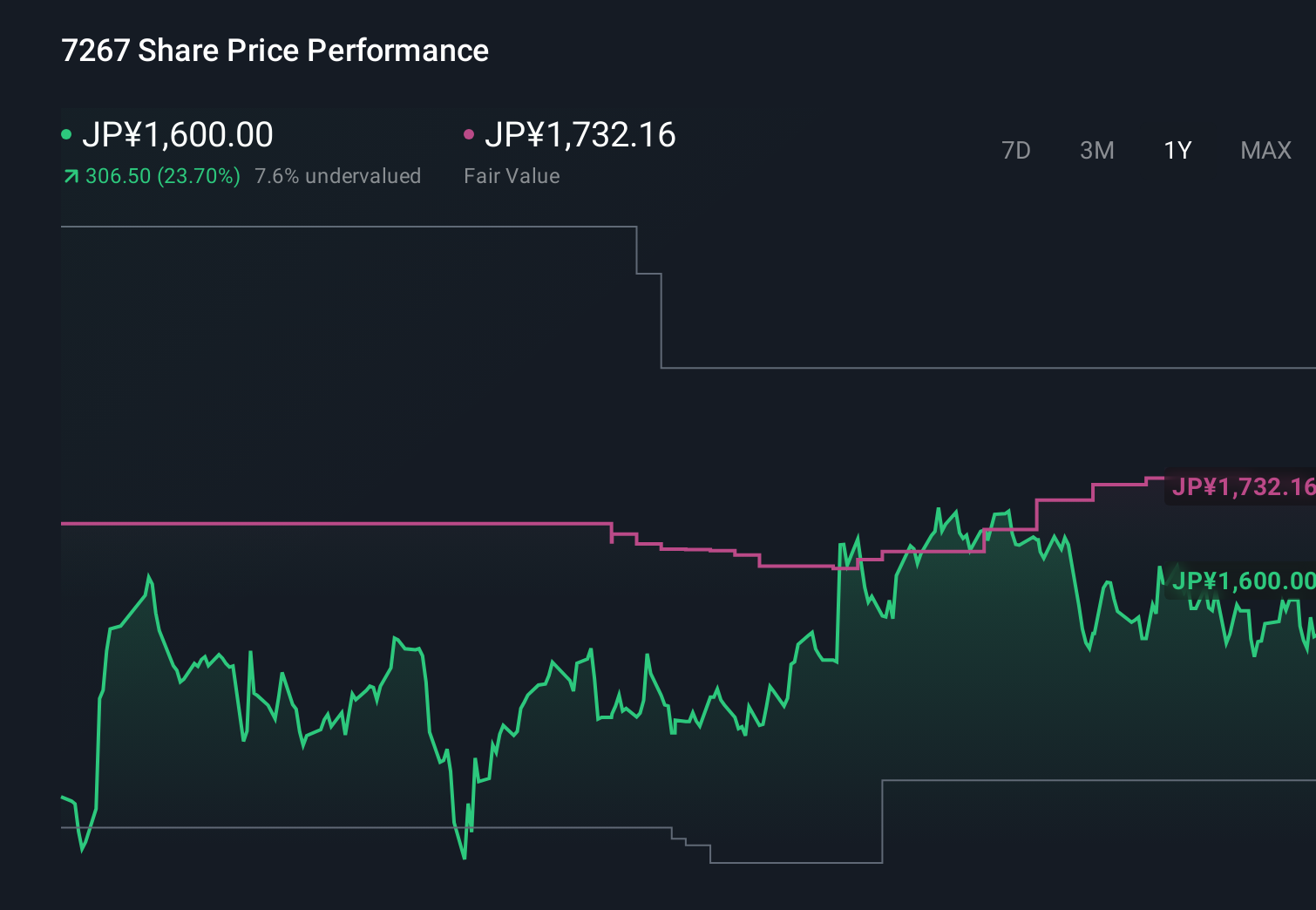

- The stock is up 21.4% over the last year and 56.5% over three years, even though it has slipped 3.8% over the past month and is down 3.4% year to date.

- Recently, Honda has been in the spotlight for ramping up its electric and hybrid vehicle strategy, including new model rollouts and expanded partnerships in battery technology. At the same time, headlines around shifting global auto demand and tighter emissions rules have sharpened investor focus on which legacy automakers can actually navigate the transition profitably.

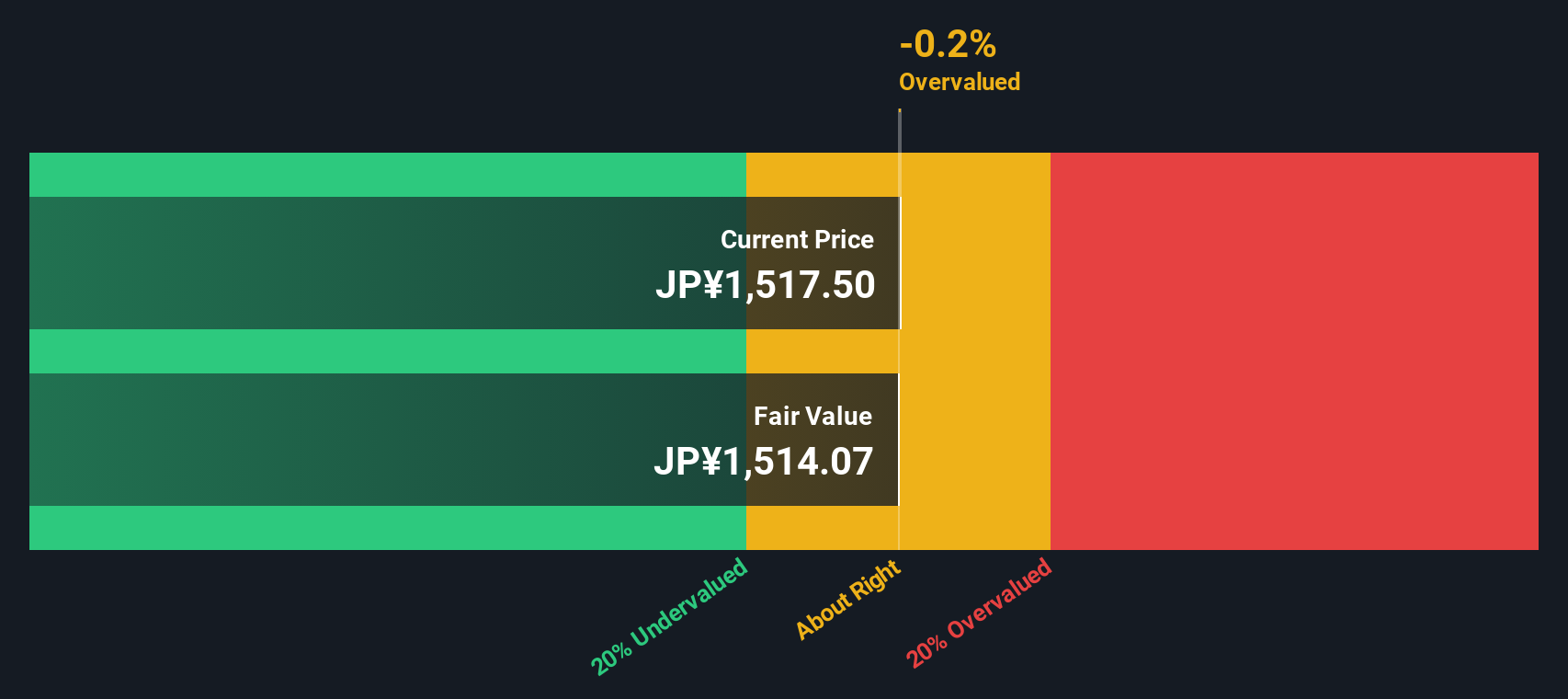

- Despite those cross-currents, Honda currently scores a 5/6 valuation check, suggesting the market may still be underestimating it. In this article, we will unpack what that means using several valuation approaches, then finish with a more holistic way to judge whether the stock is truly cheap or just looks that way on paper.

Approach 1: Honda Motor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back into today’s yen.

For Honda Motor, the latest twelve month free cash flow is slightly negative at about ¥154.3 billion, reflecting heavy investment and cyclical pressures. Analysts expect this to recover and grow, with free cash flow projected to reach roughly ¥0.89 trillion by 2030, based on a two stage Free Cash Flow to Equity model. Near term projections draw on analyst estimates, while later years are extrapolated by Simply Wall St to reflect slowing but still positive growth as the business matures.

Aggregating and discounting these future cash flows gives an estimated intrinsic value of about ¥2,198 per share. This implies Honda is trading at a 30.6% discount to its DCF fair value, signalling that the market may be underpricing its cash generation potential as it transitions toward electric and hybrid vehicles.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Honda Motor is undervalued by 30.6%. Track this in your watchlist or portfolio, or discover 900 more undervalued stocks based on cash flows.

Approach 2: Honda Motor Price vs Earnings

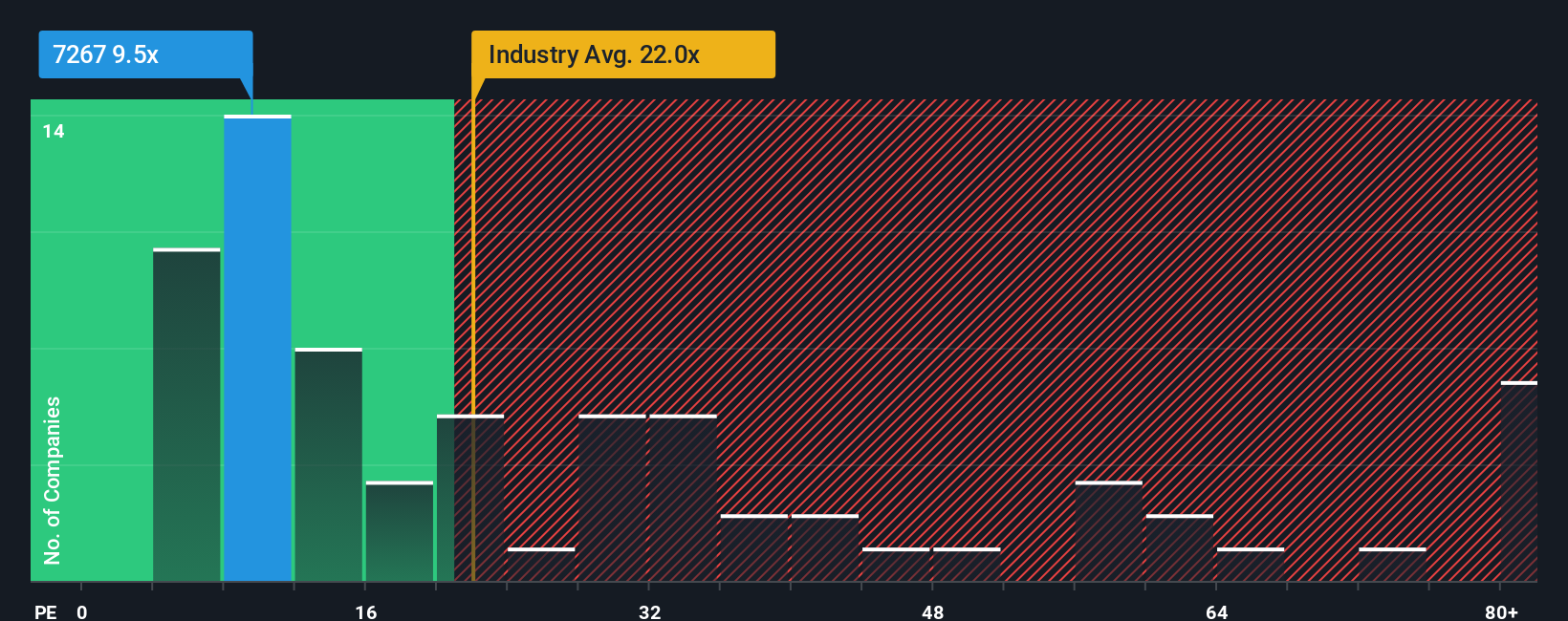

For profitable companies like Honda Motor, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay today for each unit of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or more uncertainty usually lead to a lower, or discounted, multiple.

Honda currently trades on a PE of about 9.1x, which is below both the Auto industry average of roughly 18.7x and the peer group average of around 10.2x. On the surface, that makes the stock look inexpensive relative to other automakers.

Simply Wall St goes a step further by estimating a Fair Ratio, which is the PE multiple Honda would typically warrant given its earnings growth profile, margins, industry positioning, market value and specific risk factors. This Fair Ratio for Honda is 16.8x, well above the current 9.1x, suggesting the shares are not just cheap versus peers, they also trade at a meaningful discount to what its fundamentals would normally command.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Honda Motor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories you create about a company that connect your view of its future revenue, earnings and margins to a concrete financial forecast and, ultimately, to a fair value estimate. On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible by guiding you to spell out why you think Honda Motor will win or struggle, turn that story into numbers, and then compare the resulting Fair Value with today’s share price to see whether your Narrative suggests a buy, hold, or sell. Because Narratives update dynamically when fresh information like news, earnings, or guidance changes come in, your view of Honda does not stay static; it evolves with the facts. For example, one Honda Narrative might assume earnings grow toward the more bullish forecast near ¥1,123.8 billion and justify a fair value closer to ¥1,900 per share, while a more cautious Narrative leans on the bearish ¥649.0 billion outlook and a fair value near ¥1,400, illustrating how different perspectives can coexist and be compared in one place.

Do you think there's more to the story for Honda Motor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honda Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7267

Honda Motor

Develops, manufactures, and distributes motorcycles, automobiles, and power products in Japan, North America, Europe, Asia, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026