Mazda Motor (TSE:7261) Valuation Check After Perrone Robotics’ Autonomous Driving Patent Lawsuit

Reviewed by Simply Wall St

Perrone Robotics’ fresh patent lawsuits against seven automakers put Mazda Motor (TSE:7261) under a legal microscope and prompt investors to reassess the long term risk around its autonomous driving software stack.

See our latest analysis for Mazda Motor.

Despite the legal overhang, Mazda’s share price has quietly ground higher, with a year to date share price return of 6.3 percent and a 1 year total shareholder return of 24.1 percent, suggesting underlying confidence rather than panic.

If this lawsuit has you rethinking the whole sector, it might be a good moment to scan other auto manufacturers and see which names look better positioned on growth and risk.

Yet with Mazda trading slightly below some intrinsic value estimates but already beyond consensus targets, investors now face a tougher question: is this still a mispriced opportunity, or has the market already discounted future growth?

Price to Earnings of 21.7x: Is it justified?

Mazda trades on a price to earnings ratio of 21.7x at ¥1151.5, a level that screens rich against peers even though it sits modestly below some intrinsic estimates.

The price to earnings ratio compares the company’s current share price to its per share earnings, effectively revealing how much investors are willing to pay for each unit of profit. For a cyclical, capital intensive automaker, this multiple often reflects how confident the market is that current earnings can grow or at least prove durable through the cycle.

In Mazda’s case, our SWS fair ratio work suggests a fair price to earnings multiple closer to 22x. This means today’s 21.7x sits near that implied equilibrium level. Still, the same multiple looks stretched when stacked against the Asian Auto industry at 19.3x and a much lower peer average of 12.3x, signalling that the market is assigning Mazda a premium earnings profile relative to regional rivals.

Explore the SWS fair ratio for Mazda Motor

Result: Price to Earnings of 21.7x (OVERVALUED)

However, investors must still weigh lawsuit uncertainty and any slowdown in revenue growth, either of which could quickly erode Mazda’s current valuation premium.

Find out about the key risks to this Mazda Motor narrative.

Another View: Our DCF Fair Value Check

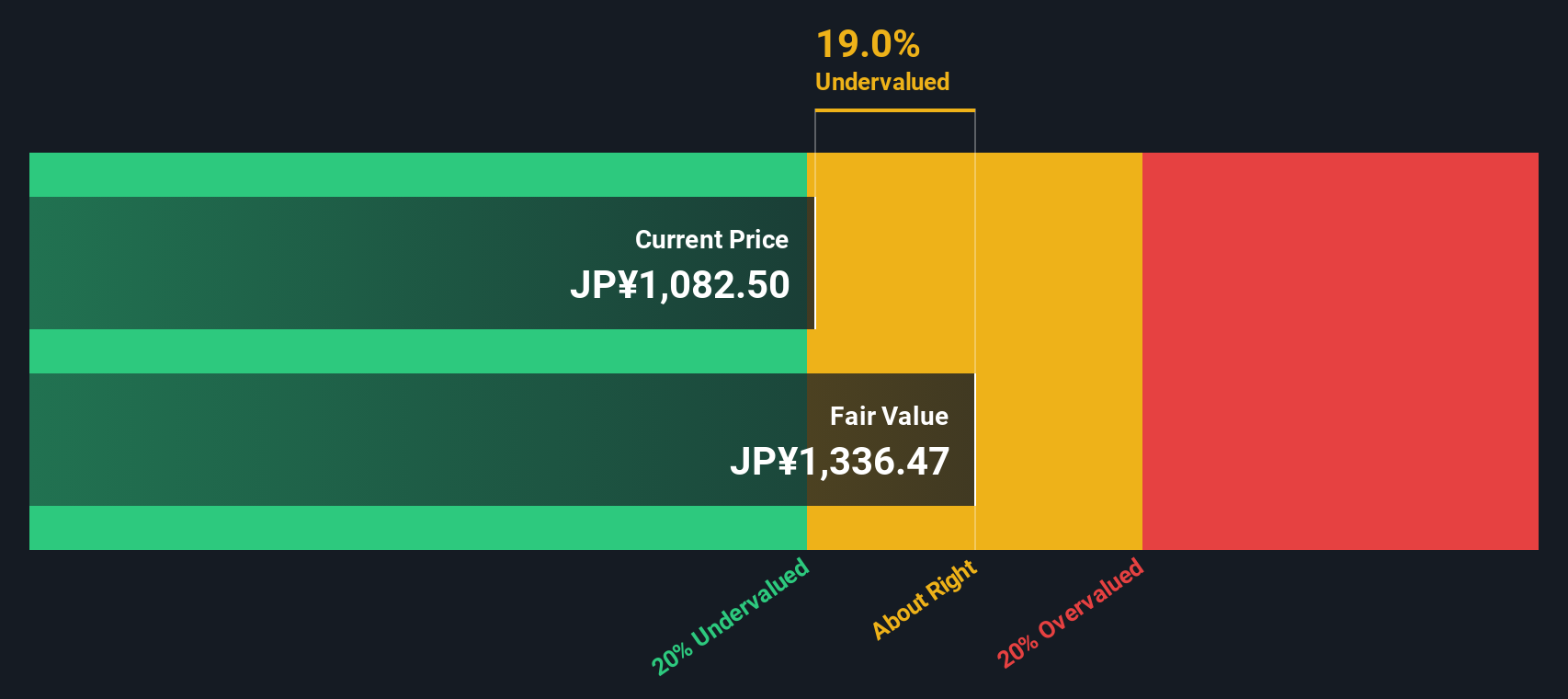

While earnings multiples make Mazda look expensive next to peers, our DCF model tells a softer story. It suggests fair value of ¥1209.5 versus today’s ¥1151.5, a discount of about 4.8 percent. Is the market underestimating future cash flows or just baking in lawsuit risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mazda Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 893 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mazda Motor Narrative

If you see the numbers differently, or simply prefer your own due diligence, you can shape a personalized view in minutes with Do it your way.

A great starting point for your Mazda Motor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by scanning fresh opportunities on Simply Wall Street’s powerful screener so that tomorrow’s potential opportunities do not slip past you.

- Identify potential mispricings by scanning these 893 undervalued stocks based on cash flows that strong cash flow analysis suggests the market may be overlooking.

- Explore cutting edge innovation by targeting these 27 AI penny stocks that may benefit from growing demand for intelligent software and automation.

- Strengthen your income focus by reviewing these 15 dividend stocks with yields > 3% that can support your portfolio’s cash generation through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7261

Mazda Motor

Engages in the manufacture and sale of passenger cars and commercial vehicles in Japan, North America, Europe, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026