Does Mazda Still Offer Value After Its 104% Five Year Share Price Surge?

Reviewed by Bailey Pemberton

- If you have been wondering whether Mazda Motor’s share price still offers value after its big run, you are not alone. This breakdown is designed to answer exactly that.

- The stock is up 19.4% over the last year and 104.3% over five years, even though it has been a bit choppy more recently with a 4.1% gain over 30 days and a modest 3.0% return year to date.

- That climb has been supported by steady progress on Mazda’s electrification roadmap and deepening alliances with larger partners. Together, these have reshaped expectations about its long term competitiveness. At the same time, shifting sentiment around global auto demand and higher interest rates has kept risk perceptions very much in play.

- Even after these moves, Mazda Motor only scores 2/6 on our valuation checks, suggesting pockets of undervaluation but also areas where the price already bakes in good news. Next we will unpack what different valuation methods say about the stock, before finishing with a more holistic way to think about fair value.

Mazda Motor scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mazda Motor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting them back into today’s yen. In Mazda Motor’s case, we use a 2 Stage Free Cash Flow to Equity approach that combines analyst forecasts with longer term extrapolations.

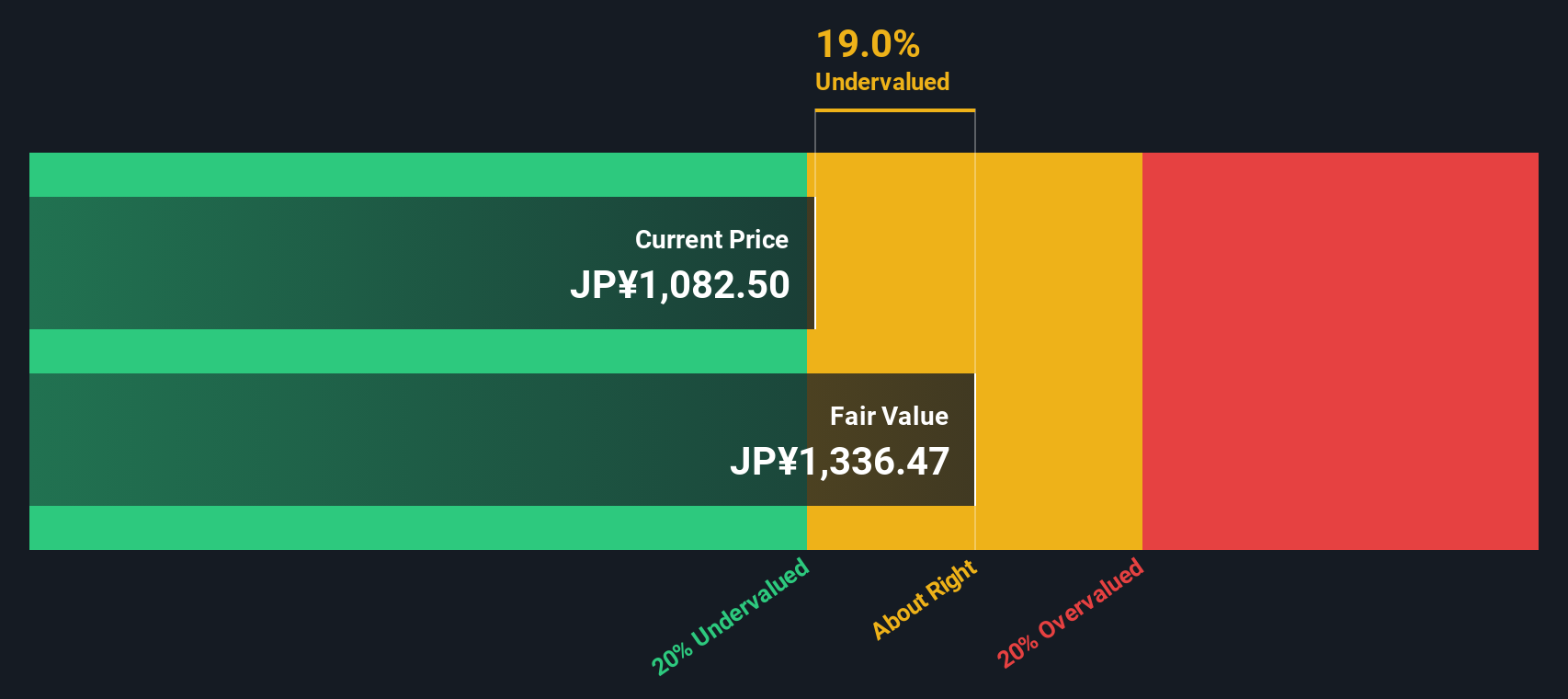

Right now, Mazda’s last twelve month free cash flow is about ¥61.7 billion outflow, so the starting point is weak. Analysts and extrapolations, however, point to a recovery, with free cash flow expected to reach roughly ¥128.4 billion in 2035. These cash flows, mostly in the tens of billions of yen each year, are discounted back to arrive at an estimated intrinsic value of about ¥1,210 per share.

Compared with the current share price, this implies Mazda Motor trades at roughly a 7.8% discount to its DCF based fair value. That gap is modest, suggesting the market already prices in much of the expected improvement in cash generation.

Result: ABOUT RIGHT

Mazda Motor is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Mazda Motor Price vs Earnings

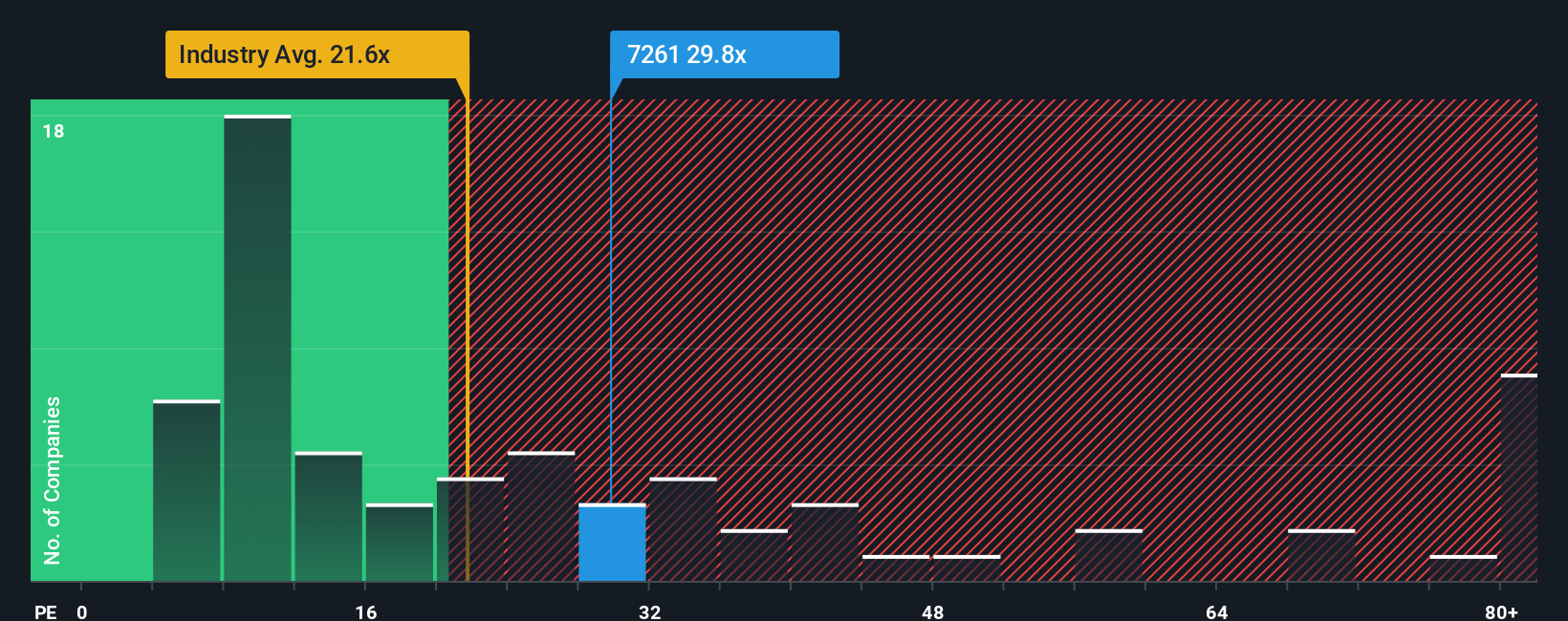

For profitable companies like Mazda Motor, the price to earnings (PE) ratio is a straightforward way to judge whether investors are paying a reasonable price for each yen of current earnings. In general, faster growing and lower risk businesses can justify a higher PE multiple, while slower growth or higher uncertainty should pull that multiple down.

Mazda Motor currently trades on a PE of 21.03x. That sits above both the Auto industry average of 18.42x and the broader peer average of 12.48x, which might initially suggest the stock is a bit expensive. However, these simple comparisons miss important context around Mazda’s specific growth outlook, profitability profile and risk.

To address this, Simply Wall St calculates a proprietary Fair Ratio of 21.82x for Mazda Motor. This is the PE multiple the company would typically deserve given its earnings growth prospects, margins, industry, market cap and risk characteristics. Because it is tailored to Mazda’s fundamentals, this Fair Ratio is more informative than a blunt comparison with peers or the industry as a whole. With the current PE of 21.03x sitting slightly below the Fair Ratio, the stock looks broadly in line with its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

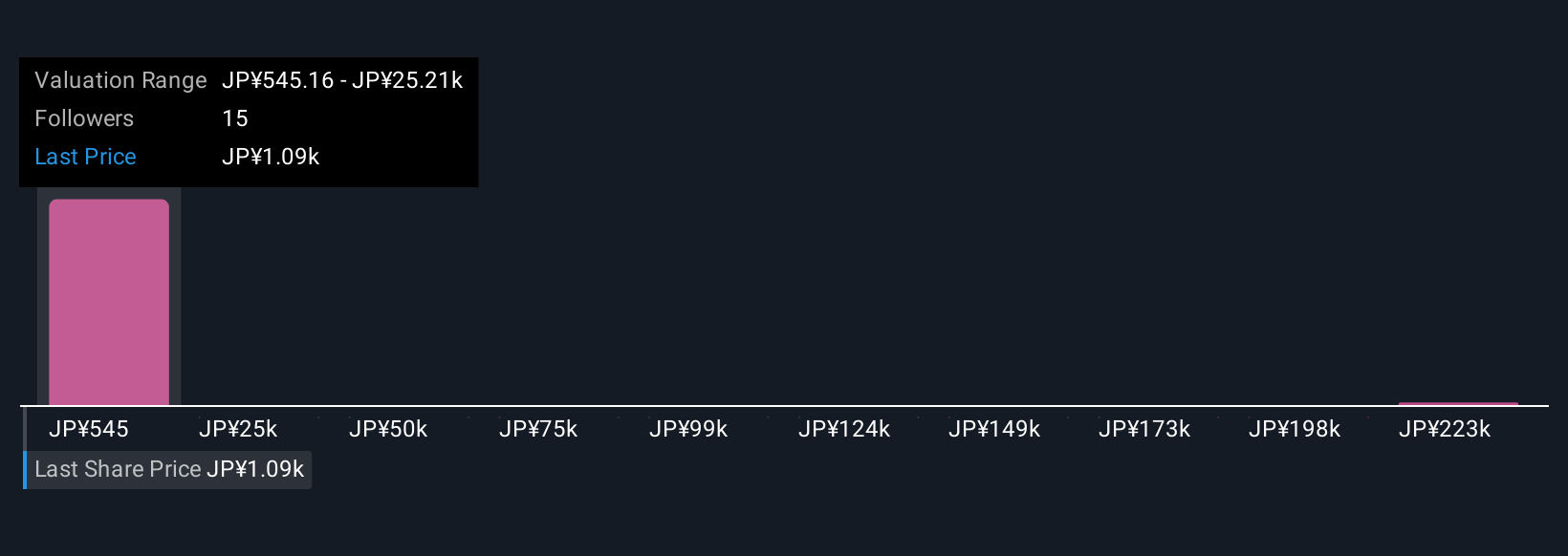

Upgrade Your Decision Making: Choose your Mazda Motor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers by linking your assumptions for Mazda Motor’s future revenue, earnings and margins to a fair value estimate. A Narrative connects three elements: what you believe about the business, how that belief translates into a financial forecast, and what fair value that forecast implies. On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy and accessible tool that helps you decide when to buy or sell by comparing your Narrative Fair Value to the current share price, and then updating those views dynamically when fresh news or earnings arrive. For example, one Mazda Motor Narrative might assume strong adoption of electrified models and assign a higher fair value, while another could expect slower EV progress and weaker margins, resulting in a much lower estimate for what the shares are worth.

Do you think there's more to the story for Mazda Motor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7261

Mazda Motor

Engages in the manufacture and sale of passenger cars and commercial vehicles in Japan, North America, Europe, and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026