- Japan

- /

- Auto Components

- /

- TSE:7220

Why Musashi Seimitsu Industry (TSE:7220) Is Up 5.8% After Emerging Market Motorcycle Sales Surge Spurs Supplier Growth

Reviewed by Sasha Jovanovic

- Sales of motorcycles in emerging markets such as India, ASEAN countries, and Brazil have been performing strongly, with Japanese manufacturers accelerating local production to meet increasing demand.

- This surge in regional motorcycle sales is creating greater business opportunities for component suppliers like Musashi Seimitsu Industry, as global motorcycle demand is expected to steadily rise through 2030.

- We'll explore how Musashi Seimitsu Industry's exposure to expanding local production in emerging markets shapes its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Musashi Seimitsu Industry's Investment Narrative?

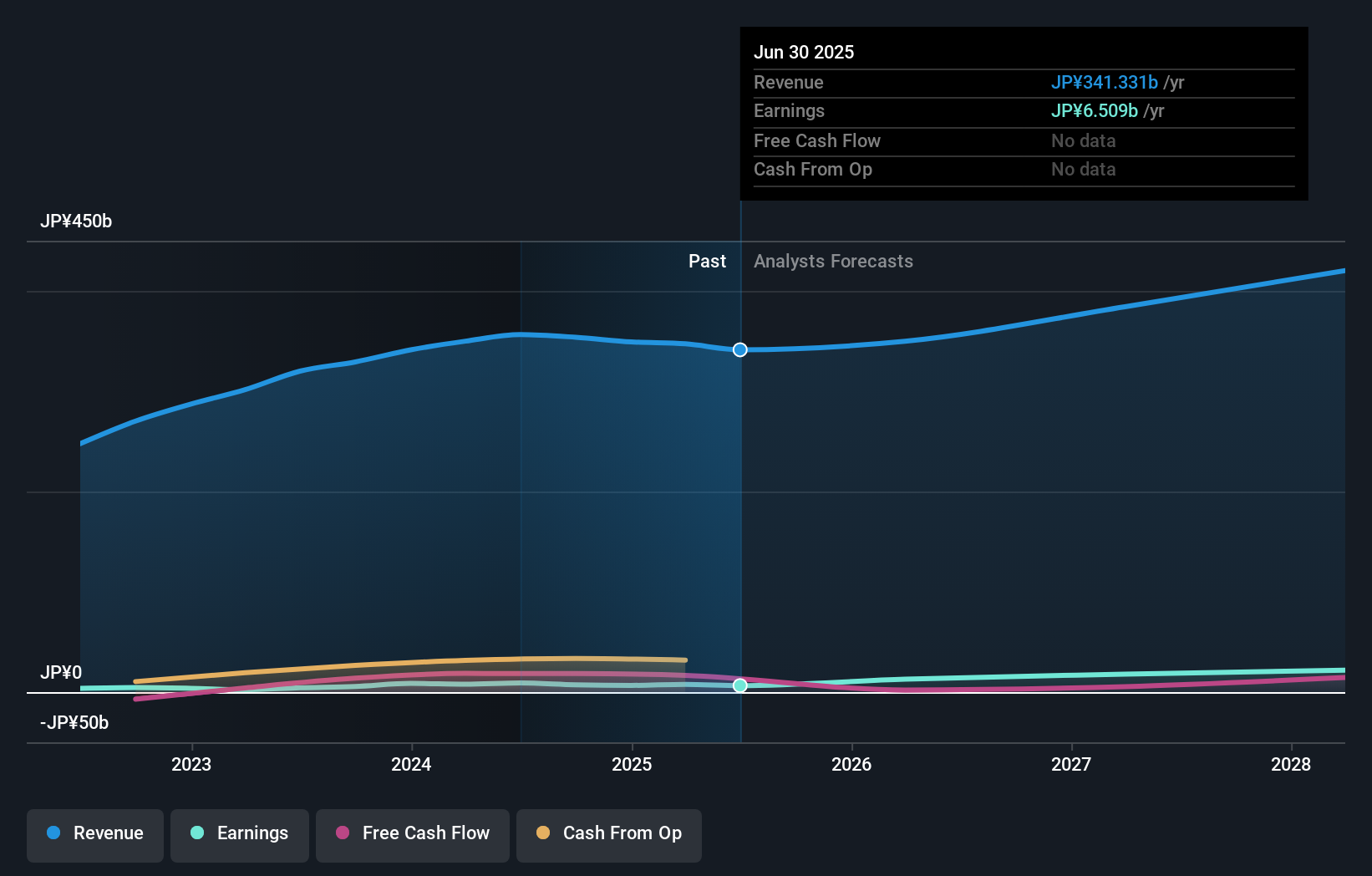

To see Musashi Seimitsu Industry as an attractive opportunity, you need to believe that robust motorcycle demand in emerging markets such as India, ASEAN, and Brazil will continue translating into tangible benefits for core suppliers. The recent surge in local production by Japanese manufacturers could serve as a short-term catalyst, adding momentum to already positive trends in revenue growth and earnings forecasts. This uptick in demand has the potential to help offset some of the company’s most pressing risks, such as high debt levels and profit margin pressure, both flagged in prior analysis. However, volatility in the stock price and a relatively high price-to-earnings ratio remain front of mind for near-term sentiment. The latest news further supports revenue momentum, but investors need to watch just how much of this incremental demand actually trickles down to suppliers like Musashi Seimitsu, especially as cost pressures and industry competition remain significant wildcards.

But, with cost pressures still a concern, can these gains actually reach the bottom line? Musashi Seimitsu Industry's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Musashi Seimitsu Industry - why the stock might be worth over 4x more than the current price!

Build Your Own Musashi Seimitsu Industry Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Musashi Seimitsu Industry research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Musashi Seimitsu Industry research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Musashi Seimitsu Industry's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7220

Musashi Seimitsu Industry

Manufactures and sells automotive parts in Japan, the United States, Asia, China, and Europe.

Excellent balance sheet and good value.

Market Insights

Community Narratives