Toyota (TSE:7203) Valuation: Fresh US Sales Growth and EV Push Highlight New Opportunities

Reviewed by Kshitija Bhandaru

Toyota Motor (TSE:7203) is drawing fresh attention after reporting strong US sales growth in August and September 2025. Demand for pickup trucks and cars has been especially solid, and electrified vehicles now represent almost half of the company’s US volume. Investors are watching Toyota’s momentum in both conventional and electrified vehicle segments as the company also expands its EV charging infrastructure in Japan.

See our latest analysis for Toyota Motor.

Alongside the surge in US sales and Toyota’s rapid roll-out of high-speed EV chargers in Japan, the stock’s long-term performance continues to signal strength. Toyota delivered a 13.5% total shareholder return over the past year, with momentum building off several upbeat developments and strategic investments in new mobility and tech initiatives.

If Toyota's recent run has you thinking about the wider auto industry, now’s a good moment to discover See the full list for free.

Despite all the optimism and a recent string of breakthroughs, is Toyota's share price still undervalued, or has the market already factored in its future growth? Could there be a buying opportunity, or are expectations running high?

Most Popular Narrative: 10.1% Undervalued

With shares last closing at ¥2,839.5 and the narrative fair value set at ¥3,157, market sentiment lags behind analysts' more optimistic views based on future profitability levers. Here’s a crucial insight fueling this perspective.

Toyota's investment in internal battery production, including various types of batteries for electric and hybrid vehicles, could bolster long-term revenue and margins. By optimizing battery production and technology, Toyota positions itself competitively in the growing electrified vehicle market.

Ever wondered what’s driving this valuation gap? Strong revenue expansion ambitions and bold margin projections play a central role, but the real intrigue lies in the financial targets and assumptions behind them. Unpack the full story to see why this optimism persists and what analysts think must go right to beat the market's expectations.

Result: Fair Value of ¥3,157 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as renewed production halts or sharp currency fluctuations could quickly shift market optimism and put Toyota's recent gains at risk.

Find out about the key risks to this Toyota Motor narrative.

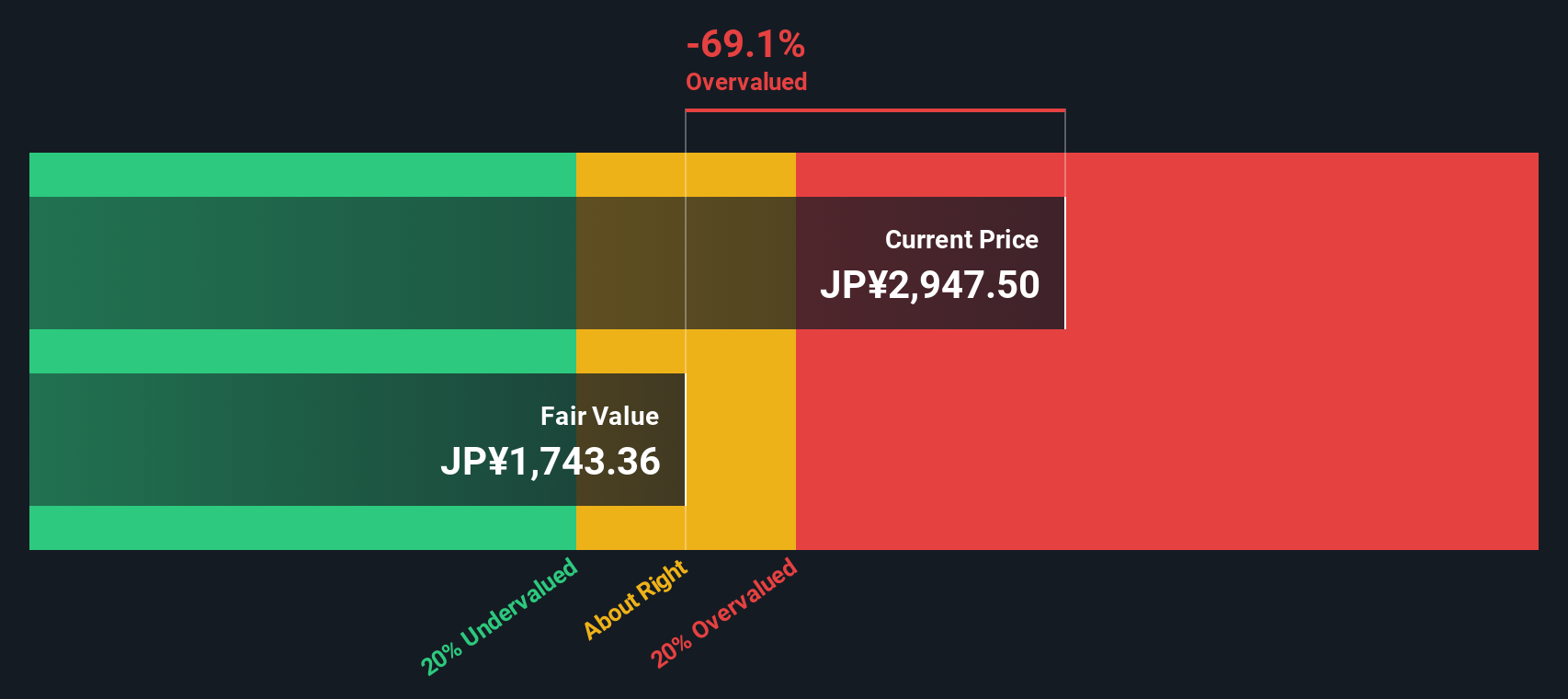

Another View: DCF Model Poses a Challenge

While analyst consensus suggests Toyota is undervalued, the SWS DCF model offers a contrasting perspective. It currently values the company well below market price, which indicates that analysts may be too optimistic about future profits and cash flows. Could this mean downside risk is being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyota Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyota Motor Narrative

If you want to dig deeper or see the numbers differently, you can pull together your own perspective in just a few minutes. Do it your way

A great starting point for your Toyota Motor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always scan beyond the obvious. Don’t let new opportunities slip by. See what’s shaking up the market and keep your watchlist ahead of the curve.

- Capitalize on high-yield opportunities by tapping into these 19 dividend stocks with yields > 3% that consistently deliver strong returns and impressive payout ratios.

- Spot breakthrough innovators early when you check out these 24 AI penny stocks, featuring companies powering the AI boom and transforming entire industries.

- Hunt for hidden value by reviewing these 900 undervalued stocks based on cash flows, where you can find under-the-radar stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7203

Toyota Motor

Designs, manufactures, assembles, and sells passenger vehicles, minivans and commercial vehicles, and related parts and accessories in Japan, North America, Europe, Asia, Central and South America, Oceania, Africa, and the Middle East.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives