Isuzu Motors (TSE:7202) Valuation in Focus After South Carolina Plant Groundbreaking and US Growth Push

Reviewed by Kshitija Bhandaru

Isuzu Motors (TSE:7202) just broke ground on a new production facility in South Carolina. This step highlights its focus on growing its North American truck business and expanding local manufacturing capabilities.

See our latest analysis for Isuzu Motors.

While enthusiasm around Isuzu Motors’ US plant announcement and recent share buyback has yet to translate into momentum, the stock’s three-year total shareholder return of roughly 27% points to steady long-term value-building, even as this year’s returns have been muted.

Curious where else automotive innovation is gaining traction? Explore the broader market of manufacturers with our auto industry screener. See the full list for free.

With shares still trading roughly 17% below analyst targets despite solid growth and a completed buyback, investors are left to wonder: Is Isuzu Motors undervalued, or has the market already factored in its future gains?

Most Popular Narrative: 14.1% Undervalued

Isuzu Motors’ narrative-implied fair value stands noticeably higher than its last close, suggesting the market may be overlooking embedded growth and profitability levers. This sets up a fascinating divide between consensus forecasts and recent trading levels.

Isuzu's strategy to leverage its midterm management plan, ISUZU Transformation IX, and focus on becoming a commercial mobility solutions company by 2030 could lead to innovative products and services, potentially improving net margins through a diversified product lineup.

Want to know what bold growth targets and future profit margins are at the heart of this valuation? The narrative centers on surprising financial projections and ambitious margin expansion. Don’t miss out on the exact drivers behind this compelling fair value estimate.

Result: Fair Value of ¥2,164 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising material costs or further yen appreciation could threaten Isuzu Motors’ profit margins. This could put these bullish growth projections at risk.

Find out about the key risks to this Isuzu Motors narrative.

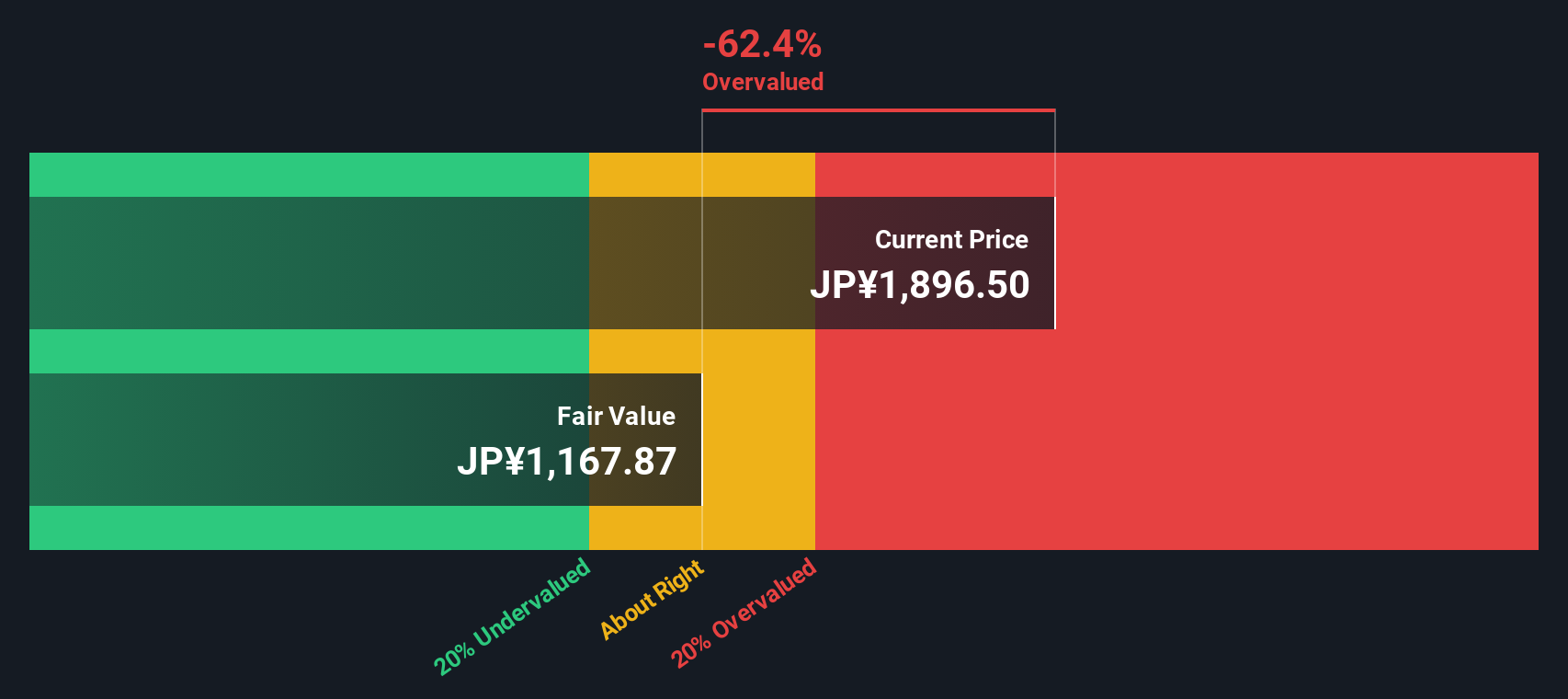

Another View: What Does the SWS DCF Model Say?

While analysts see Isuzu Motors as undervalued based on forecast earnings and growth, our DCF model paints a more cautious picture. According to this cash flow-based approach, the current share price actually sits above the DCF estimate of fair value. This suggests less upside than the consensus narrative implies. Could the market be right, or are risks being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Isuzu Motors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Isuzu Motors Narrative

If you think there’s more to the story or want to dig into the numbers on your own terms, you can build your own narrative in just a matter of minutes. Do it your way.

A great starting point for your Isuzu Motors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock higher potential for your portfolio by taking a fresh look at standout opportunities beyond the automotive sector. See what else you could be capitalizing on right now.

- Capture rapid growth stories in emerging tech by scanning through these 24 AI penny stocks, which are shaping tomorrow’s industries with artificial intelligence innovations.

- Lock in steady income and inflation protection by browsing these 19 dividend stocks with yields > 3% with strong yields and reliable payout records.

- Spot undervalued opportunities first and position yourself ahead of the crowd with these 901 undervalued stocks based on cash flows, which are based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7202

Isuzu Motors

Manufactures and sells commercial vehicles, light commercial vehicles, and diesel engines and components worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives