The Bull Case For Nissan Motor (TSE:7201) Could Change Following Electric Vehicle Microgrid Pilot Collaboration

Reviewed by Sasha Jovanovic

- Pacific Gas and Electric Company recently announced a collaboration with Nissan and Fermata Energy to demonstrate automated frequency management by integrating electric vehicles and bi-directional chargers into a multi-customer microgrid at California's Redwood Coast Airport Microgrid.

- This pilot project positions Nissan at the forefront of vehicle-to-grid integration, underscoring its ongoing commitment to innovative energy solutions beyond automotive manufacturing.

- We'll examine how Nissan's pioneering role in grid-connected electric vehicles could shape its investment narrative and long-term market relevance.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Nissan Motor Investment Narrative Recap

To see Nissan as an investment opportunity right now, you have to believe not just in the company's global EV ambitions, but also in its ability to convert pioneering technology―such as vehicle-to-grid integration―into reliable growth and profitability. While Nissan's recent microgrid collaboration with PG&E and Fermata Energy affirms its reputation for energy innovation, it is not expected to materially alter the most pressing short-term catalyst: restoring positive free cash flow and stabilizing core earnings in the face of ongoing losses and margin pressures. The primary risk remains continued liquidity strain from operating losses, especially against the backdrop of weak sales and cost volatility.

Nissan's latest earnings announcement is particularly relevant here, as it underscores the company’s ongoing struggles with declining sales (down 7.7% year on year) and a notable swing to a half-year net loss of JPY 221,921 million. These figures put the spotlight back on the urgent need for operational turnaround and cost containment, reminding investors that even leading-edge energy projects cannot offset immediate balance sheet challenges.

Yet, even as Nissan rolls out new technology partnerships, investors should not overlook the risks tied to...

Read the full narrative on Nissan Motor (it's free!)

Nissan Motor's outlook predicts ¥12,909.5 billion in revenue and ¥203.3 billion in earnings by 2028. This is based on analysts estimating 1.5% annual revenue growth and a ¥1,018.5 billion increase in earnings from the current ¥-815.2 billion.

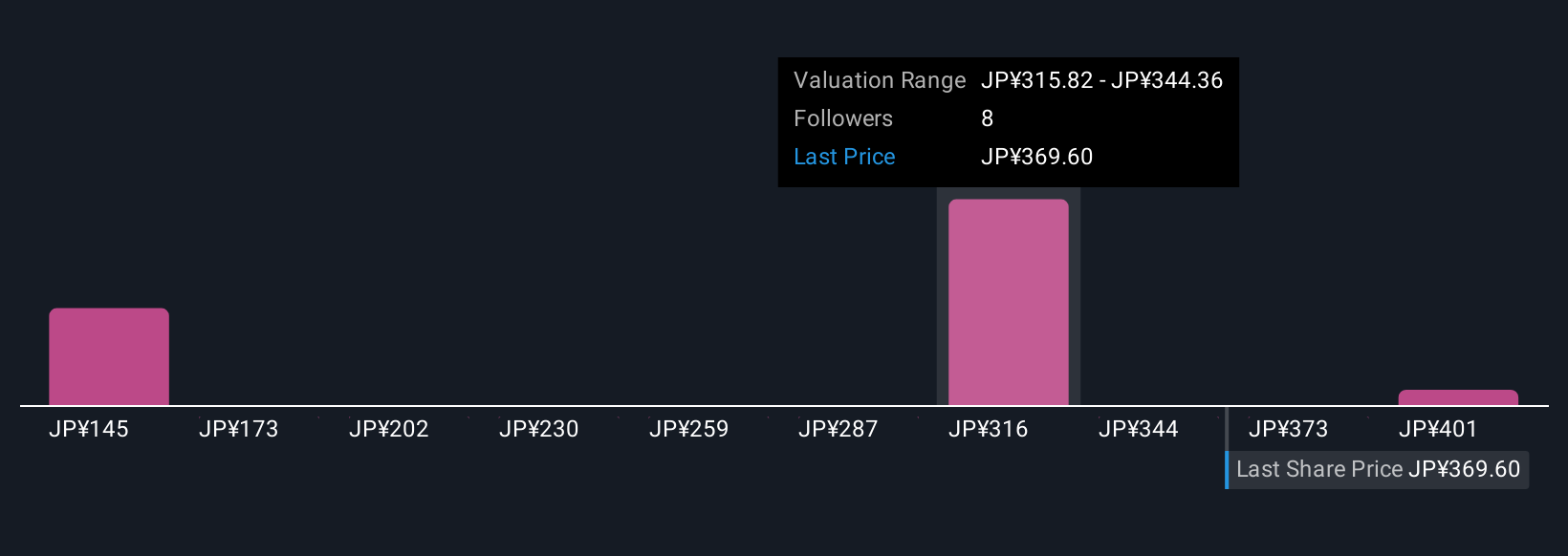

Uncover how Nissan Motor's forecasts yield a ¥336 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community participants pegged Nissan’s fair value estimates between ¥110.65 and ¥430, showing a wide spread in opinions. As new innovations highlight Nissan’s competitive potential, many investors are weighing those upside catalysts against the very real challenges of restoring free cash flow and margin stability.

Explore 3 other fair value estimates on Nissan Motor - why the stock might be worth as much as 23% more than the current price!

Build Your Own Nissan Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nissan Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nissan Motor's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7201

Nissan Motor

Manufactures and sells vehicles and automotive parts worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives