- Japan

- /

- Auto Components

- /

- TSE:6473

JTEKT (TSE:6473): Assessing Valuation After a Strong Share Price Run in 2024

Reviewed by Simply Wall St

JTEKT (TSE:6473) has quietly delivered a strong run, with the stock up about 17% over the past 3 months and more than 50% this year, drawing fresh attention to its valuation.

See our latest analysis for JTEKT.

The recent climb, including a 9.36% 1 month share price return and a 63.47% 1 year total shareholder return, suggests momentum is building as investors reassess JTEKT's earnings recovery and longer term growth prospects.

If JTEKT's move has you rethinking the auto space, it could be worth exploring auto manufacturers for other manufacturers showing promising fundamentals and price momentum.

Yet with JTEKT trading just below analyst targets but at a hefty intrinsic discount, investors face a key question: is the market still underestimating its recovery, or already pricing in the next leg of growth?

Price-to-Earnings of 28.6x: Is it justified?

JTEKT looks richly priced on a headline basis, with its last close of ¥1,764.5 equating to a 28.6x price to earnings multiple, well above peers and fair value estimates.

The price to earnings ratio compares the current share price to the company’s earnings per share, making it a quick way to gauge how much investors are paying for each unit of profit. For an auto components manufacturer with cyclical demand and relatively thin margins, this metric is often a primary yardstick for how the market is valuing current and future profitability.

In JTEKT’s case, the 28.6x price to earnings multiple stands out because our SWS DCF model estimates the shares are trading at a 60.7% discount to an intrinsic value of about ¥4,495.48. This implies the current market price is not simply reflecting near term earnings. Instead, investors seem to be paying a premium multiple relative to what our fair price to earnings ratio of 20.1x suggests, potentially overcompensating for the company’s forecast earnings growth and recent profitability turnaround.

That premium becomes even more pronounced when stacked against the JP Auto Components industry average price to earnings ratio of 9.9x and the peer average of 11.6x. This underscores how aggressively the market is valuing JTEKT’s earnings compared to sector norms and to where our fair ratio indicates it could eventually settle.

Explore the SWS fair ratio for JTEKT

Result: Price-to-Earnings of 28.6x (OVERVALUED)

However, downside risks remain if global auto demand softens or margins compress again, which could quickly challenge today’s optimism and elevated valuation.

Find out about the key risks to this JTEKT narrative.

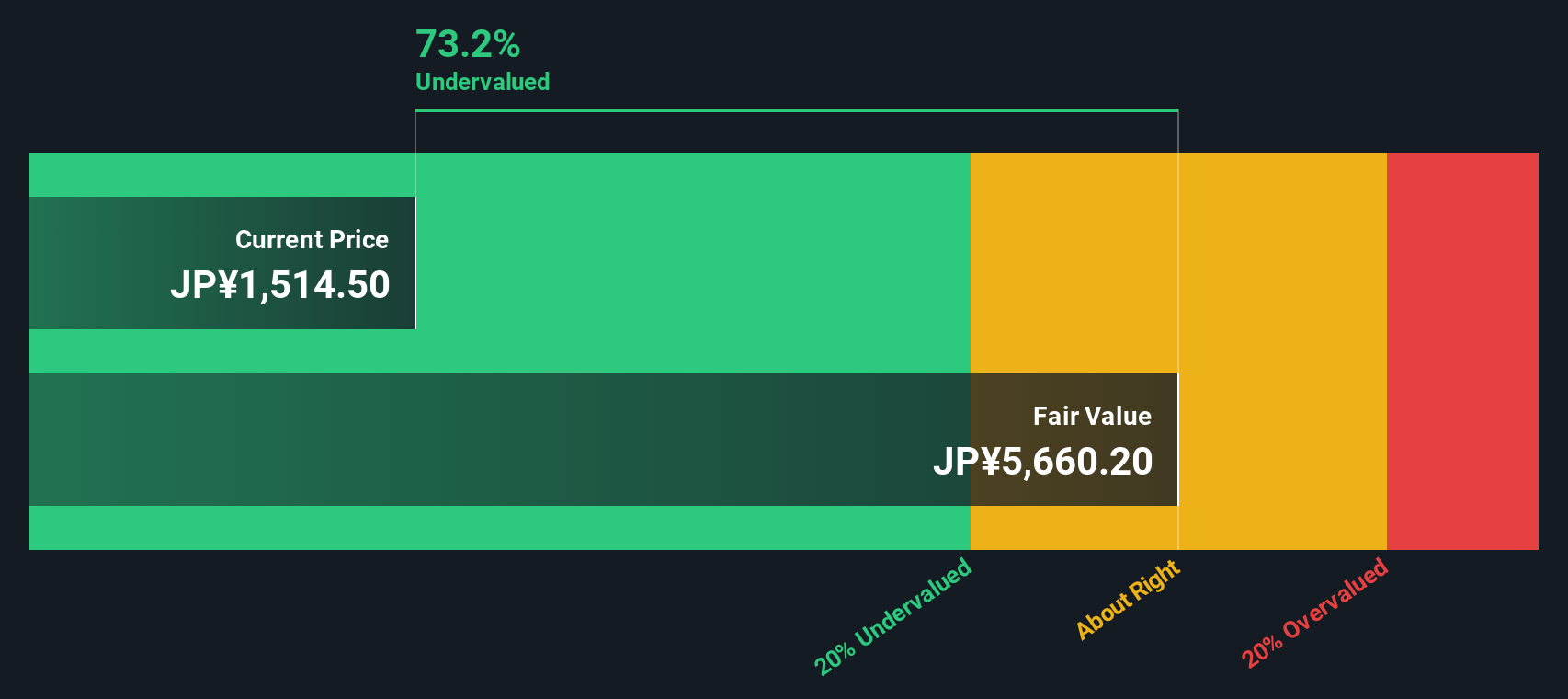

Another View: DCF Points the Other Way

While the 28.6x price to earnings ratio suggests the stock is expensive, our SWS DCF model sends a very different signal. It suggests JTEKT trades at roughly a 60.7% discount to its estimated fair value of about ¥4,495.48. Is the market missing a long term earnings reset, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JTEKT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JTEKT Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can construct a personalised view of JTEKT in minutes: Do it your way.

A great starting point for your JTEKT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before this momentum passes you by, put your research to work with targeted screeners on Simply Wall St that surface high conviction opportunities tailored to your strategy.

- Capture potential bargains early by tracking companies that look mispriced on fundamentals through these 908 undervalued stocks based on cash flows and position yourself ahead of a possible rerating.

- Ride powerful innovation trends by zeroing in on next generation businesses shaping automation and intelligent software using these 26 AI penny stocks.

- Strengthen your income stream by focusing on reliable payers with attractive yields via these 13 dividend stocks with yields > 3%, so your portfolio works harder while you stay in control.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6473

JTEKT

Manufactures and sells steering systems, driveline components, bearings, machine tools, electronic control devices, and home accessory equipment.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)