- Japan

- /

- Auto Components

- /

- TSE:6473

Assessing JTEKT (TSE:6473) Valuation After Recent Momentum in Share Price

Reviewed by Simply Wall St

Price-to-Earnings of 51.8x: Is it justified?

JTEKT is currently trading at a price-to-earnings (P/E) ratio of 51.8x, which is considerably higher than the estimated fair P/E ratio for the company as well as those of its peers and the broader auto components industry.

The P/E ratio measures a company's current share price relative to its per-share earnings, serving as a key indicator for evaluating whether a stock is priced appropriately. In the auto components sector, this metric is crucial because it reflects market expectations about future profit growth and sector stability.

Given that JTEKT's P/E far exceeds not only its estimated fair value but also industry and peer averages, the market appears to be pricing in elevated expectations for earnings growth or future profitability. However, it raises questions about whether such optimism is fully warranted or sustainable based on the company's fundamentals.

Result: Fair Value of ¥5716.55 (OVERVALUED)

See our latest analysis for JTEKT.However, a sharp slowdown in revenue growth or a correction in market sentiment could challenge the current optimism surrounding JTEKT’s share price.

Find out about the key risks to this JTEKT narrative.Another View: What Does the SWS DCF Model Reveal?

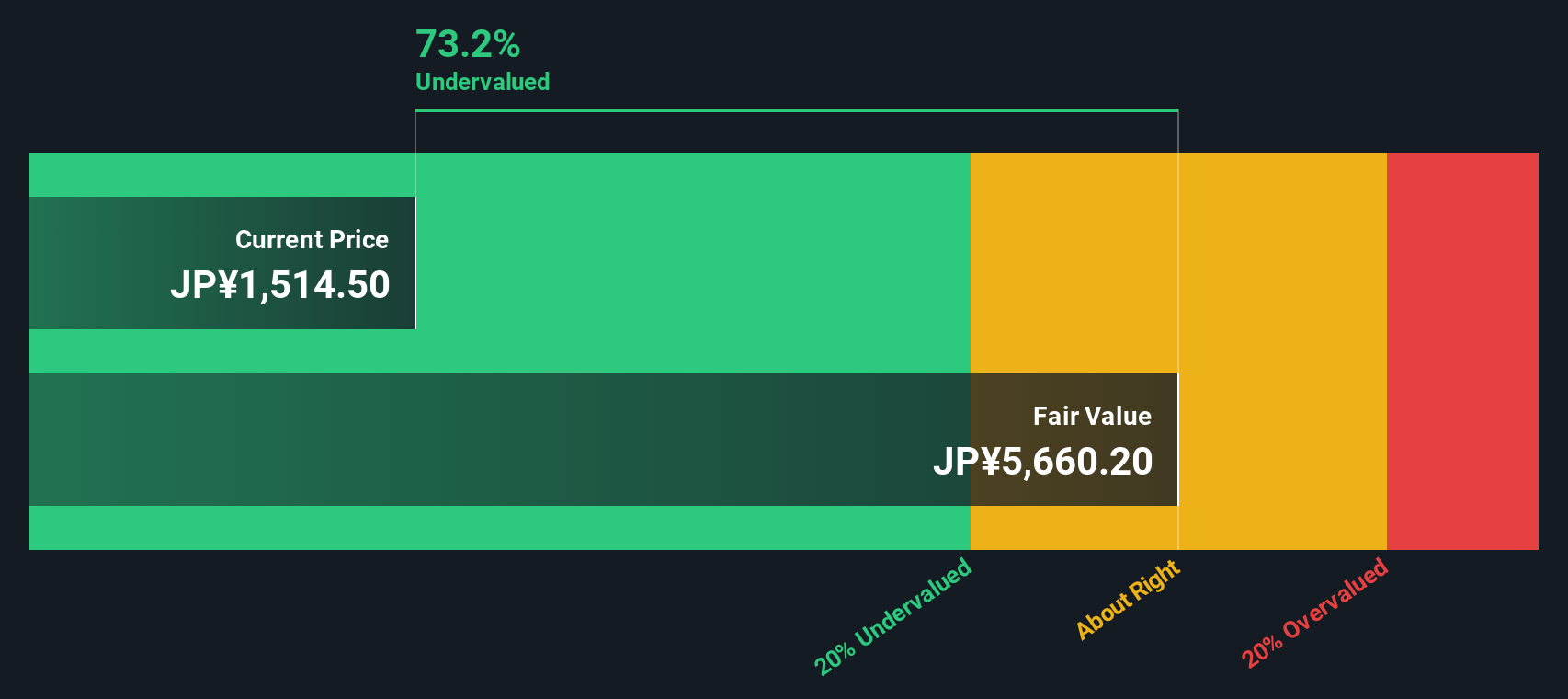

Looking at JTEKT from another angle, our DCF model tells a different story and points to the stock trading well below its fair value. Does this challenge the high valuation suggested by earnings multiples?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own JTEKT Narrative

If you would rather draw your own conclusions or prefer digging into the numbers yourself, you can quickly build your own perspective from scratch. Do it your way

A great starting point for your JTEKT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Unlock powerful portfolio moves by branching out to unique sectors and trendsetters on Simply Wall Street. You owe it to yourself to see what you could be missing.

- Capture growth potential by searching for AI penny stocks, companies revolutionizing industries with transformative artificial intelligence solutions and real-world applications.

- Boost your income strategy by finding dividend stocks with yields > 3%, stocks that pay reliably high yields and support wealth-building with steady cash flow.

- Tap into tomorrow's tech boom with quantum computing stocks, companies poised to reshape computing, encryption, and innovation at a global scale.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6473

JTEKT

Manufactures and sells steering systems, driveline components, bearings, machine tools, electronic control devices, and home accessory equipment.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion