- Japan

- /

- Auto Components

- /

- TSE:6209

Exploring MIXI And 2 Other Undiscovered Gems with Solid Foundations

Reviewed by Simply Wall St

In a week marked by market volatility and shifting economic policies under the new Trump administration, investors are navigating a landscape of uncertainty with key indices like the S&P 600 reflecting these changes. Amidst this backdrop, identifying stocks with solid foundations becomes crucial for those seeking potential opportunities in small-cap markets. In this article, we explore three such undiscovered gems, including MIXI, that demonstrate resilience and robust fundamentals despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Infinity Capital Investments | 0.61% | 8.72% | 14.99% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Vivo Energy Mauritius | NA | 13.58% | 14.34% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

MIXI (TSE:2121)

Simply Wall St Value Rating: ★★★★★☆

Overview: MIXI, Inc. operates in Japan across sports, digital entertainment, lifestyle, and investment sectors with a market capitalization of ¥186.72 billion.

Operations: The company generates revenue primarily from its digital entertainment business, which accounts for ¥98.12 billion, followed by the sports and lifestyle segments contributing ¥33.96 billion and ¥13.73 billion respectively. The investment segment adds ¥1.73 billion to the total revenue. The net profit margin trend is notable for its variability over recent periods, reflecting fluctuations in profitability across its diverse operations.

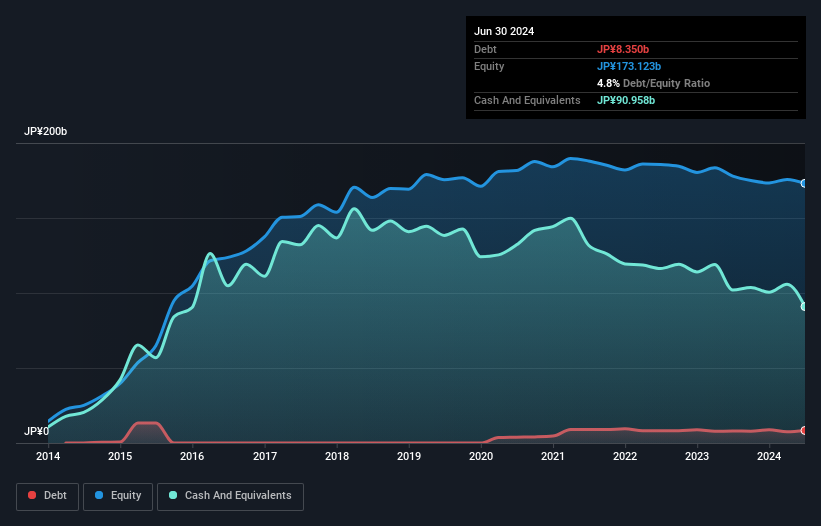

MIXI stands out with its robust earnings growth of 171.1% over the past year, significantly outperforming the Entertainment industry's -13.5%. Its debt to equity ratio has risen from 0% to 4.8% in five years, but it remains manageable given that MIXI has more cash than total debt and interest payments are well covered by EBIT at a multiple of 448x. Trading at 6.4% below estimated fair value, MIXI also repurchased shares worth ¥3,306 million recently, indicating confidence in its valuation and future prospects amidst positive free cash flow generation.

- Unlock comprehensive insights into our analysis of MIXI stock in this health report.

Understand MIXI's track record by examining our Past report.

Avant Group (TSE:3836)

Simply Wall St Value Rating: ★★★★★★

Overview: Avant Group Corporation, with a market cap of ¥74.11 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: Avant Group's revenue streams primarily derive from its subsidiaries' offerings in accounting, business intelligence, and outsourcing services. The company has a market cap of ¥74.11 billion.

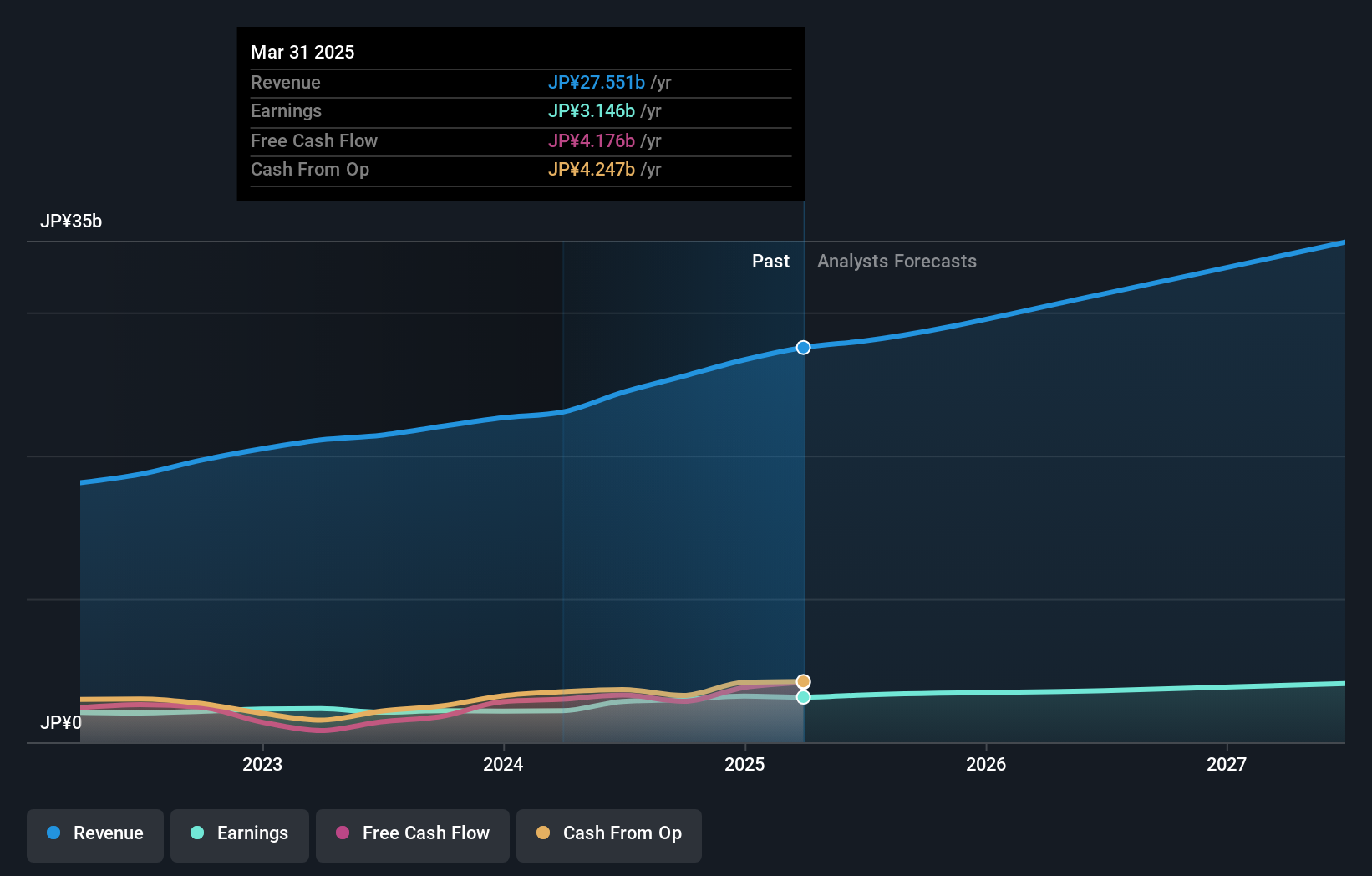

Avant Group stands out with its debt-free status, highlighting financial prudence. Over the past year, earnings surged by 35.2%, significantly outpacing the IT industry's 10.1% growth rate. This robust performance is complemented by high-quality earnings and a valuation that appears attractive, trading at 46.1% below estimated fair value. Despite recent share price volatility, Avant's future looks promising with an anticipated annual earnings growth of 18.1%. The company has also actively repurchased shares, buying back 615,600 shares for ¥828.93 million recently, suggesting confidence in its own prospects and value proposition within the market landscape.

- Click to explore a detailed breakdown of our findings in Avant Group's health report.

Explore historical data to track Avant Group's performance over time in our Past section.

NPR-Riken (TSE:6209)

Simply Wall St Value Rating: ★★★★★☆

Overview: NPR-Riken Corporation, along with its subsidiaries, is engaged in the manufacturing and sale of automobile and marine engine parts both domestically in Japan and internationally, with a market capitalization of ¥64.31 billion.

Operations: The primary revenue stream for NPR-Riken comes from its Automotive-related Products segment, generating ¥67.15 billion. The Piping/Construction Equipment Business contributes an additional ¥2.32 billion in revenue.

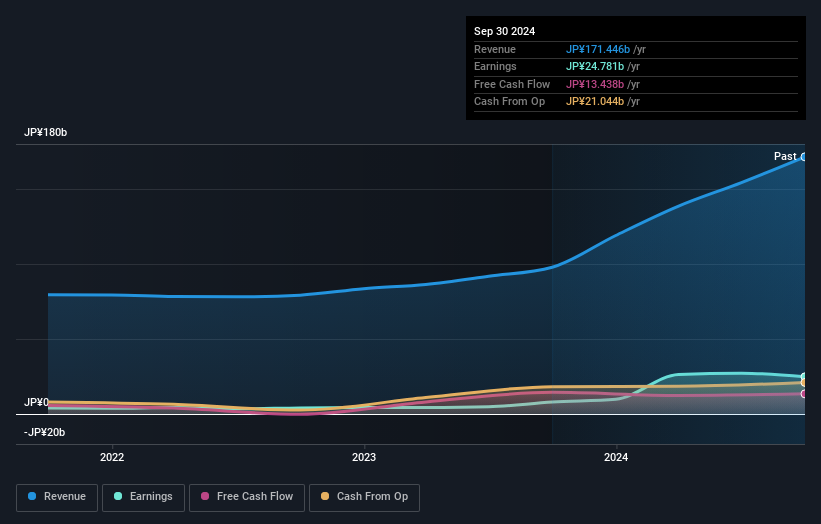

NPR-Riken, a nimble player in the auto components sector, has seen earnings surge by 467% over the past year, outpacing the industry's 5.9% growth. Despite an increased debt to equity ratio from 13% to 15.3% over five years, it holds more cash than total debt, indicating financial resilience. The company trades at a significant discount of 72% below its estimated fair value and enjoys robust interest coverage. However, a ¥18 billion one-off gain has notably skewed recent profits, suggesting that while current results are strong, they may not fully reflect ongoing operational performance.

- Navigate through the intricacies of NPR-Riken with our comprehensive health report here.

Assess NPR-Riken's past performance with our detailed historical performance reports.

Summing It All Up

- Delve into our full catalog of 4646 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NPR-Riken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6209

NPR-Riken

Manufactures and sells automobile engine parts, marine engine parts, and other products in Japan and internationally.

Excellent balance sheet established dividend payer.