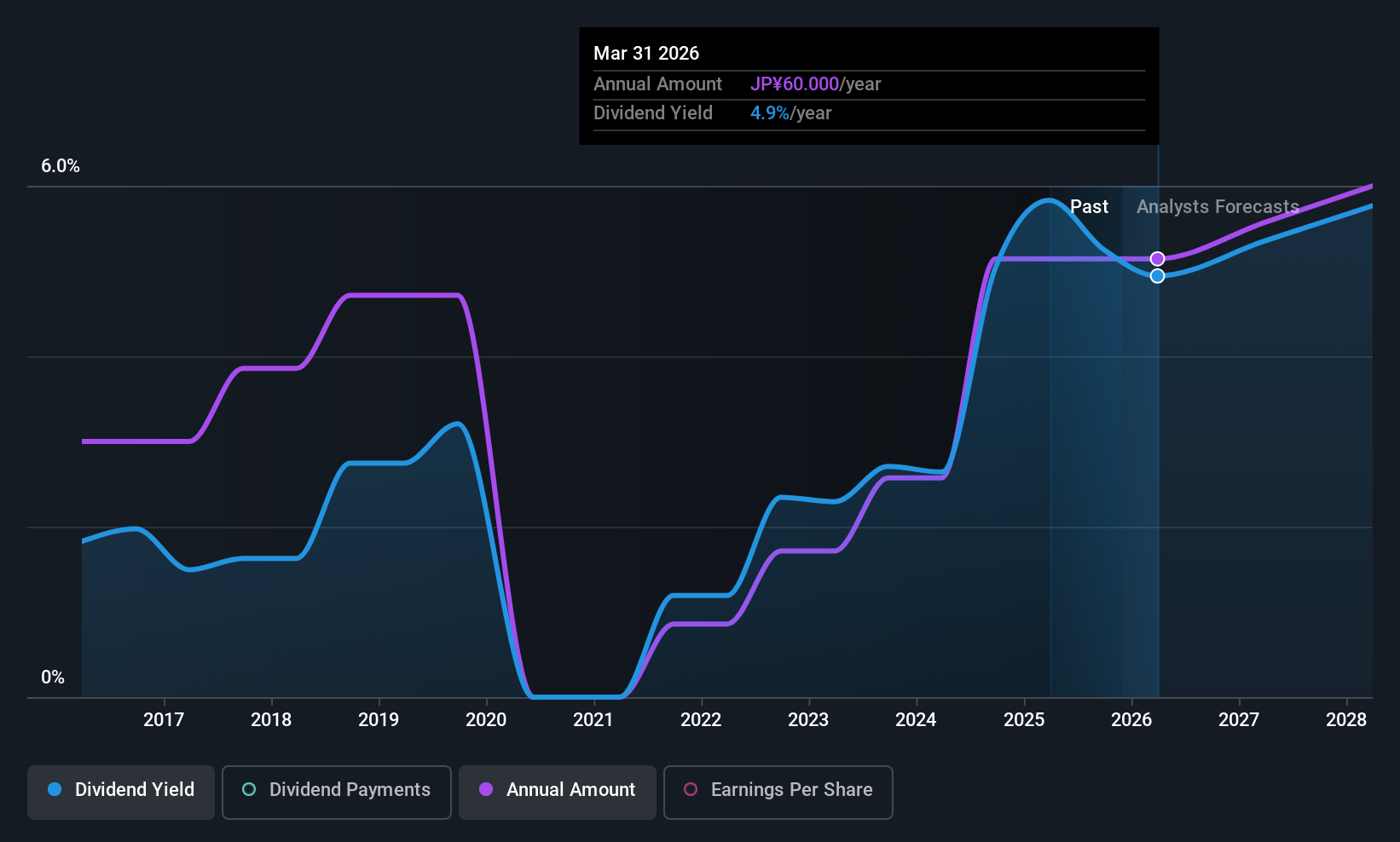

Unipres Corporation's (TSE:5949) investors are due to receive a payment of ¥30.00 per share on 29th of June. Based on this payment, the dividend yield on the company's stock will be 4.9%, which is an attractive boost to shareholder returns.

Unipres' Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Unipres' Could Struggle to Maintain Dividend Payments In The Future

Unipres' Future Dividends May Potentially Be At Risk

If the payments aren't sustainable, a high yield for a few years won't matter that much. Unipres is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Over the next year, EPS is forecast to expand by 109.0%. If the dividend continues on its recent course, the payout ratio in 12 months could be 156%, which is a bit high and could start applying pressure to the balance sheet.

See our latest analysis for Unipres

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2015, the dividend has gone from ¥25.00 total annually to ¥60.00. This means that it has been growing its distributions at 9.1% per annum over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Unipres might have put its house in order since then, but we remain cautious.

The Company Could Face Some Challenges Growing The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Unipres has seen EPS rising for the last five years, at 20% per annum. Even though the company isn't making a profit, strong earnings growth could turn that around in the near future. As long as the company becomes profitable soon, it is on a trajectory that could see it being a solid dividend payer.

Our Thoughts On Unipres' Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Unipres' payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Unipres that you should be aware of before investing. Is Unipres not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5949

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026