- Japan

- /

- Auto Components

- /

- TSE:5191

Best Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a tumultuous period marked by mixed earnings reports and economic data, investors are keenly observing the performance of major indices, with the Nasdaq Composite and S&P MidCap 400 Index experiencing significant fluctuations. Amidst this backdrop of cautious optimism and market volatility, dividend stocks continue to attract attention for their potential to provide steady income streams. In such an environment, a good dividend stock is often characterized by its ability to maintain reliable payouts despite economic uncertainties, making it an appealing option for those seeking stability in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.82% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.16% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

Click here to see the full list of 1991 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

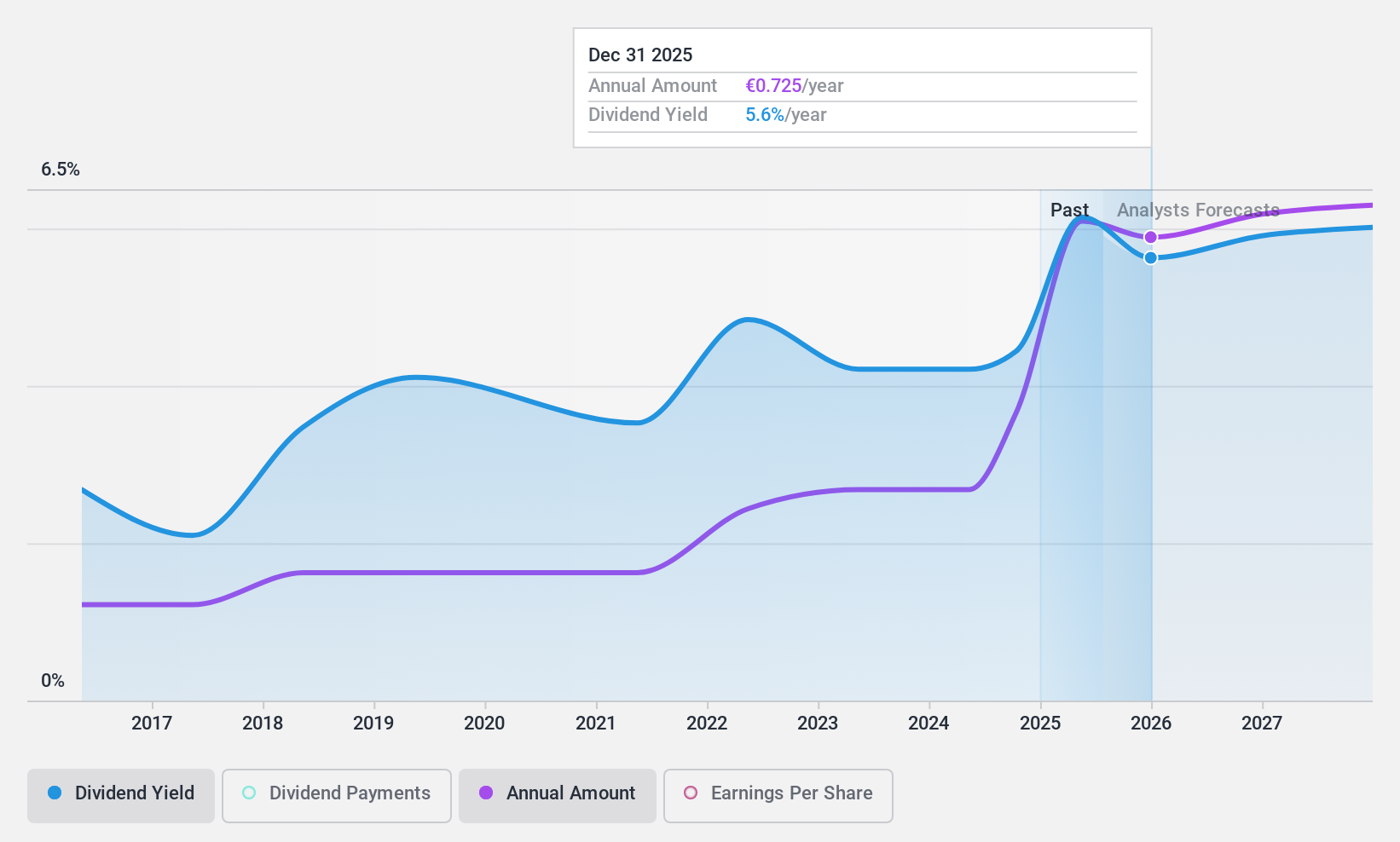

Credito Emiliano (BIT:CE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Credito Emiliano S.p.A. operates as a commercial bank and wealth management service provider for retail and corporate clients mainly in Italy, with a market capitalization of approximately €3.37 billion.

Operations: Credito Emiliano S.p.A.'s revenue is primarily derived from Commercial Banking (€1.34 billion), Private Banking (€290.30 million), Asset Management (€134.20 million), Insurance (€95.20 million), and Parabanking, Consumer Credit, IT Technology services (€221.20 million).

Dividend Yield: 4.3%

Credito Emiliano's dividend payments have been volatile over the past decade, with significant annual drops. Despite this instability, the dividends are currently well covered by earnings, supported by a low payout ratio of 26.1%, and are expected to remain sustainable in three years with a forecasted payout ratio of 45.2%. The stock is trading at a substantial discount to its estimated fair value, although its dividend yield of 4.27% is below top-tier Italian market payers. Recent earnings growth may bolster future stability despite forecasts of declining earnings over the next three years.

- Click here and access our complete dividend analysis report to understand the dynamics of Credito Emiliano.

- The valuation report we've compiled suggests that Credito Emiliano's current price could be quite moderate.

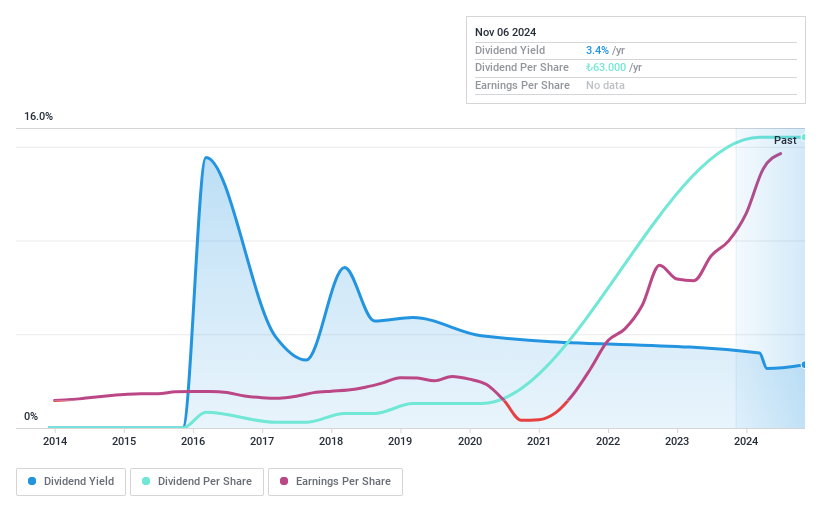

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Çelebi Hava Servisi A.S. offers ground handling, cargo, and warehouse services to both domestic and international airlines as well as private air cargo companies primarily in Turkey, with a market cap of TRY42.57 billion.

Operations: Çelebi Hava Servisi A.S. generates revenue from two main segments: Airport Ground Services, including ground handling services, contributing TRY9.82 billion, and Cargo and Warehouse Services, contributing TRY5.18 billion.

Dividend Yield: 3.4%

Çelebi Hava Servisi's dividend payments have been inconsistent over the past nine years, experiencing significant volatility. Despite this, the dividends are presently covered by both earnings and cash flows with payout ratios of 69.5% and 60.5%, respectively. The company's recent inclusion in major indices like S&P Global BMI and FTSE All-World Index highlights its growing market presence, while strong earnings growth of TRY 1.12 billion for the first half of 2024 supports potential future dividend stability.

- Get an in-depth perspective on Çelebi Hava Servisi's performance by reading our dividend report here.

- Our expertly prepared valuation report Çelebi Hava Servisi implies its share price may be too high.

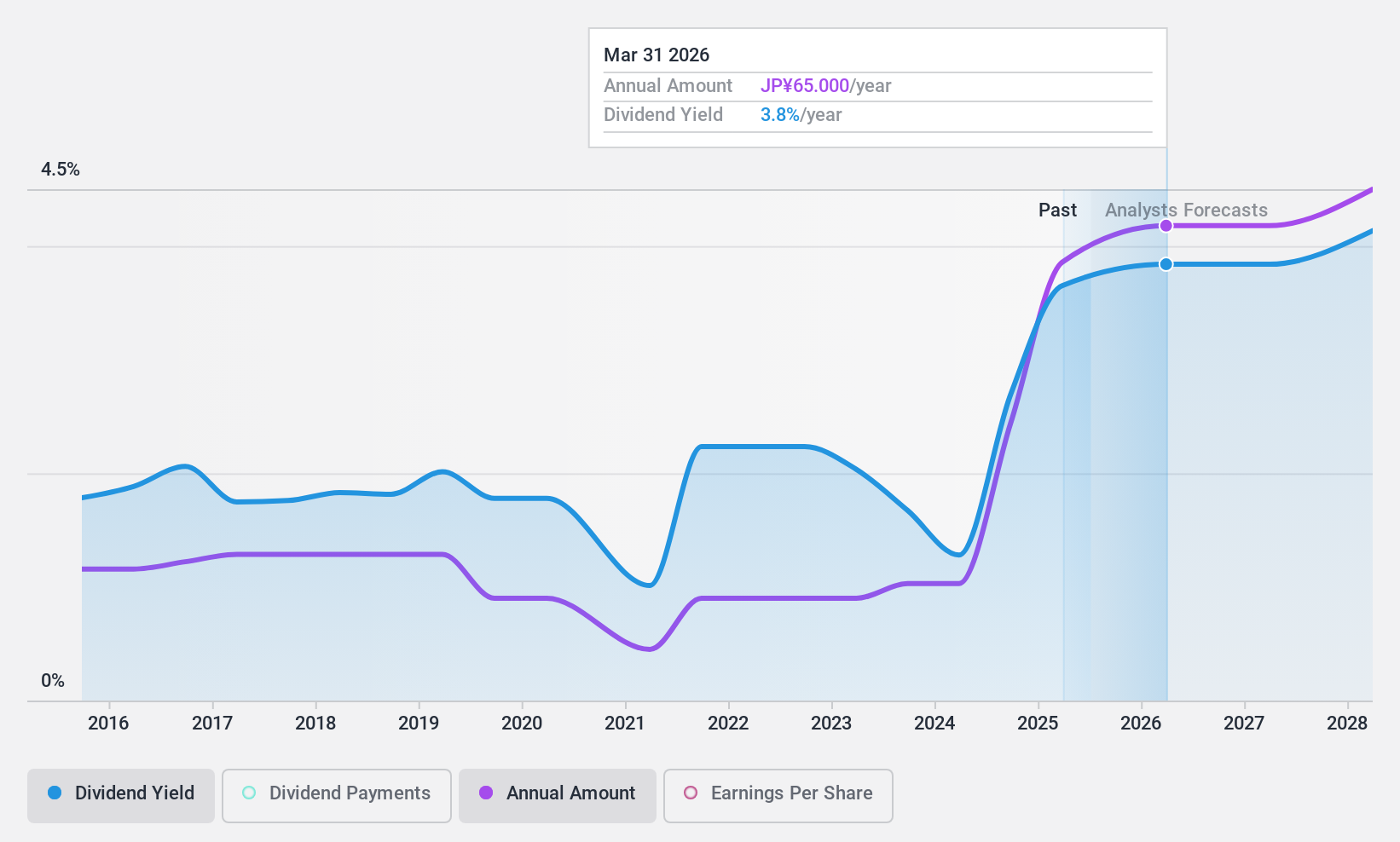

Sumitomo Riko (TSE:5191)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Riko Company Limited manufactures and sells automotive parts, with a market cap of ¥166.43 billion.

Operations: Sumitomo Riko Company Limited generates revenue primarily from its automotive parts segment.

Dividend Yield: 3.3%

Sumitomo Riko's dividend payments have been unreliable over the past decade, marked by volatility despite recent growth. The dividend yield of 3.31% is below the top tier in Japan, but payouts are well-covered by earnings and cash flows with low payout ratios of 16.4% and 17.4%, respectively. Trading at a price-to-earnings ratio of 7.3x, it presents good value compared to the broader market average of 13.2x.

- Take a closer look at Sumitomo Riko's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sumitomo Riko shares in the market.

Summing It All Up

- Click through to start exploring the rest of the 1988 Top Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5191

Flawless balance sheet, good value and pays a dividend.