- Japan

- /

- Auto Components

- /

- TSE:5105

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting economic policies, U.S. stock indexes are climbing toward record highs, buoyed by optimism around trade negotiations and robust growth in certain sectors. In this dynamic environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those looking to balance growth with consistent returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

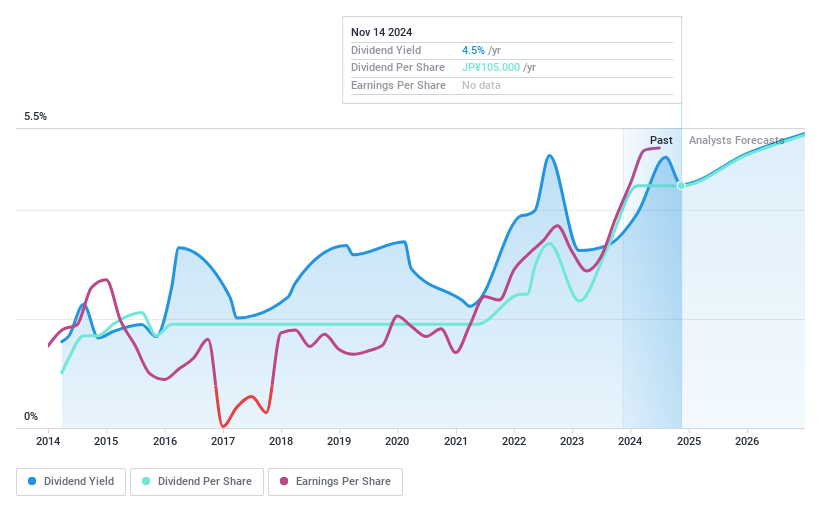

Toyo Tire (TSE:5105)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyo Tire Corporation manufactures and sells tires in Japan, North America, and internationally, with a market cap of ¥400.57 billion.

Operations: Toyo Tire Corporation's revenue segments include the manufacturing and sale of tires in Japan, North America, and international markets.

Dividend Yield: 4%

Toyo Tire's dividend payments, while covered by earnings and cash flows with payout ratios of 23.5% and 41.2% respectively, have been volatile over the past decade, indicating an unstable track record. Despite trading at a significant discount to its estimated fair value, the company's dividends are not consistently reliable. Recent strategic moves include transferring European management functions to Serbia and selling a major stake in its Chinese subsidiary, which could impact future financial stability and dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Toyo Tire.

- Our expertly prepared valuation report Toyo Tire implies its share price may be lower than expected.

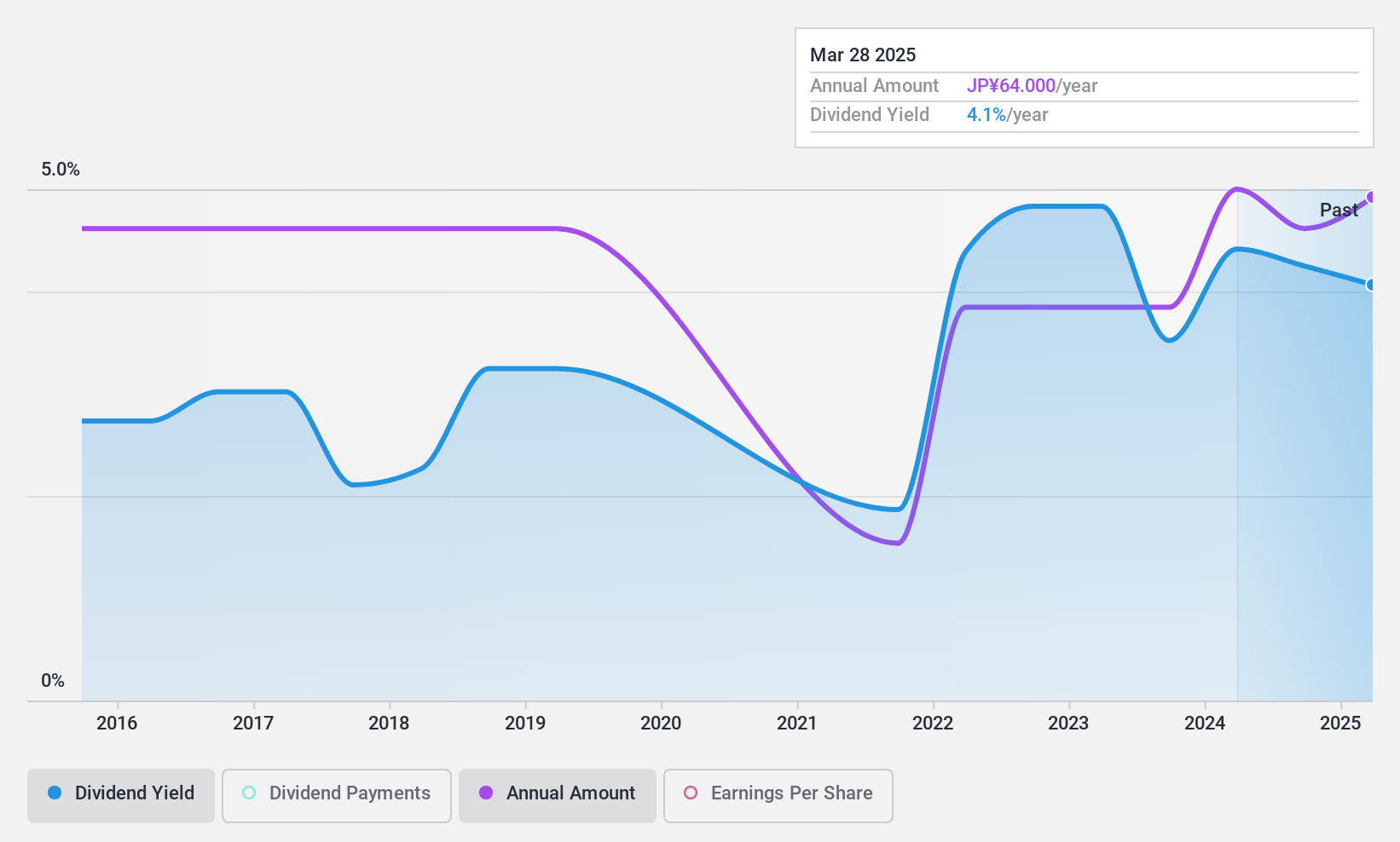

Mitsubishi Steel Mfg (TSE:5632)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Steel Mfg. Co., Ltd. is engaged in the manufacturing and sale of steel products, construction machinery parts, automotive parts, and machinery and equipment, with a market capitalization of ¥25.36 billion.

Operations: Mitsubishi Steel Mfg. Co., Ltd. generates revenue through its diverse operations, including steel products, construction machinery parts, automotive components, and various machinery and equipment.

Dividend Yield: 3.8%

Mitsubishi Steel Mfg. shows a mixed dividend profile, with a low cash payout ratio of 13.2% indicating coverage by cash flows, yet the high payout ratio of 163.4% suggests dividends aren't covered by earnings. Despite trading at 66.7% below estimated fair value and having grown earnings by 54.5% last year, its dividends have been volatile and unreliable over the past decade due to large one-off items and high debt levels impacting financial stability.

- Click here to discover the nuances of Mitsubishi Steel Mfg with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Mitsubishi Steel Mfg's current price could be inflated.

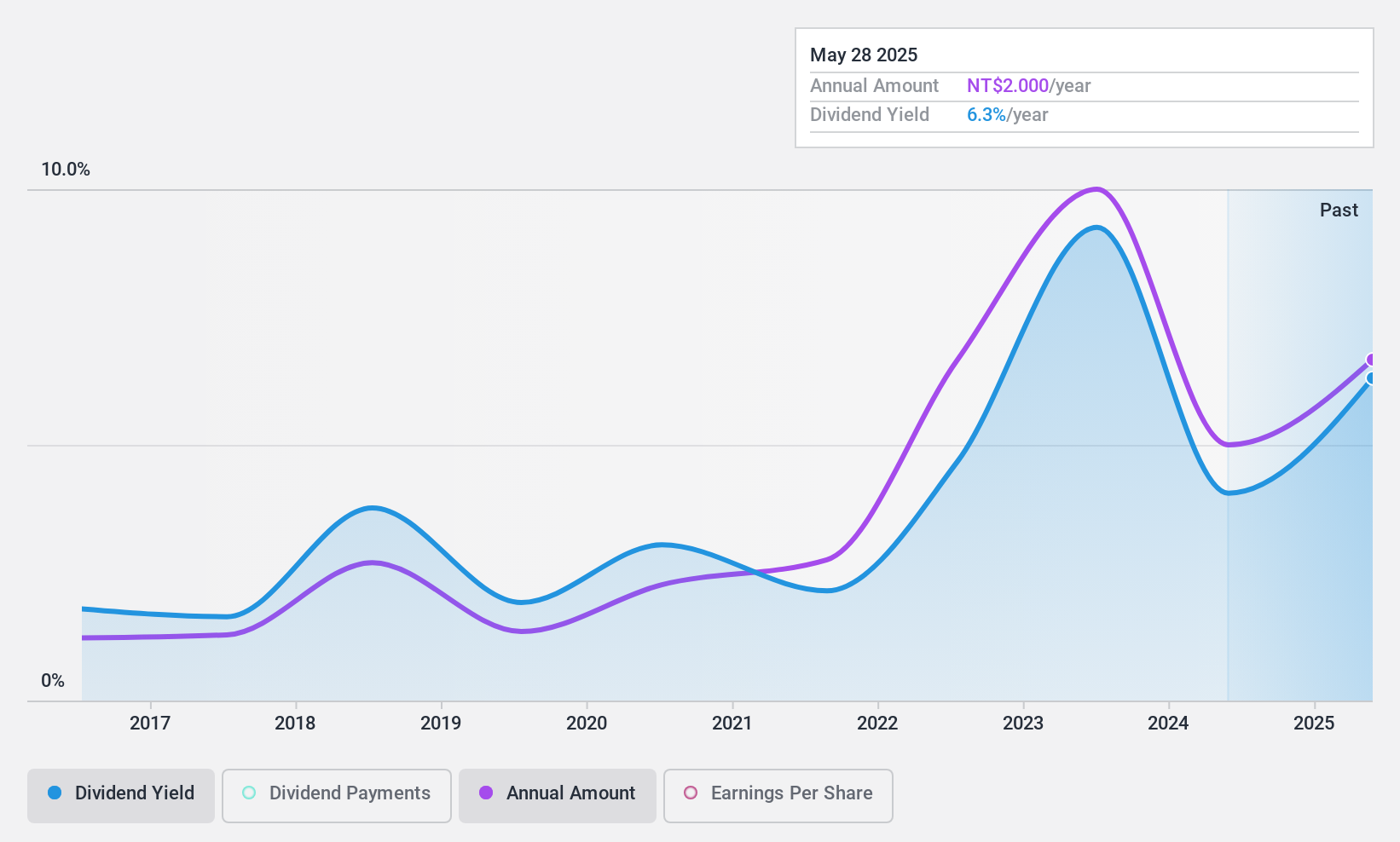

Sesoda (TWSE:1708)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sesoda Corporation is a Taiwanese company that manufactures and markets sulfate of potash (SOP) with a market cap of NT$9.56 billion.

Operations: Sesoda Corporation's revenue segments include Catering (NT$33.11 million), Shipping (NT$1.81 billion), Motor Freight (NT$19.02 million), Textile Products - Export (NT$2.61 billion), and Textile Products - Domestic Sale (NT$1.70 billion).

Dividend Yield: 3.9%

Sesoda's dividend profile is characterized by a low payout ratio of 42.6%, suggesting dividends are well-covered by earnings, and a cash payout ratio of 27.9% indicates coverage by cash flows. Despite becoming profitable this year and trading at 69.9% below estimated fair value, its dividend yield (3.93%) lags behind the top tier in Taiwan's market, and past volatility raises concerns about reliability over the last decade.

- Get an in-depth perspective on Sesoda's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Sesoda's current price could be quite moderate.

Make It Happen

- Navigate through the entire inventory of 1983 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Toyo Tire, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toyo Tire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5105

Toyo Tire

Manufactures and sells tires in Japan, North America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives