- France

- /

- Capital Markets

- /

- ENXTPA:VIL

VIEL & Cie Société Anonyme And 2 Other Reliable Dividend Stocks

Reviewed by Simply Wall St

As global markets react to recent political shifts and economic policies, investors are witnessing significant rallies in major indices like the S&P 500 and Nasdaq Composite, driven by optimism around growth and tax reforms. Amidst these dynamic conditions, dividend stocks remain a cornerstone for income-focused investors seeking stability; companies like VIEL & Cie Société Anonyme exemplify the attributes of reliable dividend payers by providing consistent returns even when market volatility is high.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.83% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.04% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.15% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

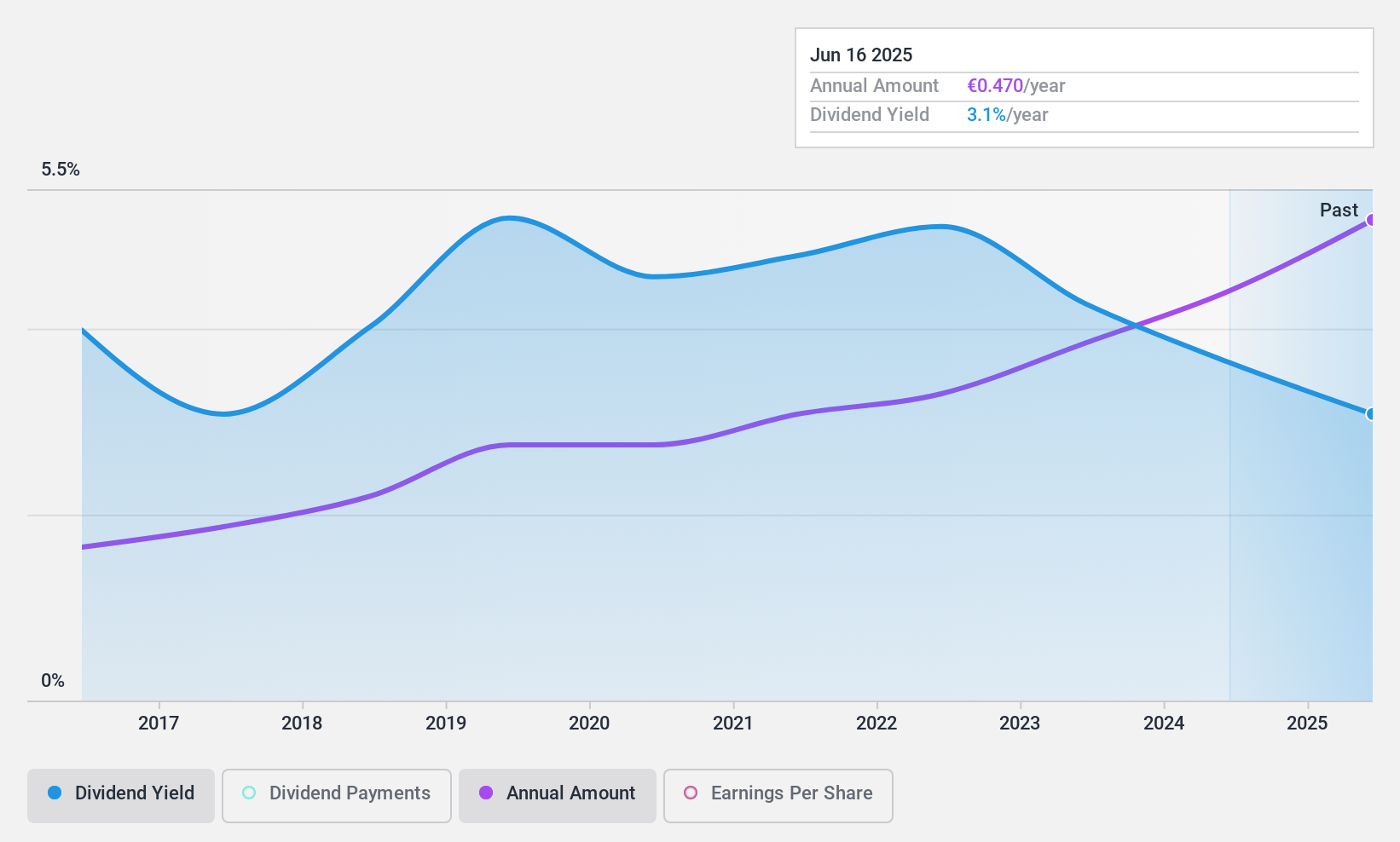

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region with a market cap of €708.48 million.

Operations: VIEL & Cie société anonyme generates its revenue from three main segments: Professional Intermediation (€1.05 billion), Stock Exchange Online (€71.02 million), and Contribution from Holdings (€3.63 million).

Dividend Yield: 3.6%

VIEL & Cie société anonyme offers a stable dividend profile with payments well covered by earnings and cash flows, evidenced by low payout ratios of 22.4% and 22.1%, respectively. Despite its reliable dividend history over the past decade, its yield of 3.56% is below the top quartile in France's market. Recent financials show growth, with half-year revenue at €598.8 million and net income rising to €65.4 million, supporting sustainable dividends moving forward.

- Click to explore a detailed breakdown of our findings in VIEL & Cie société anonyme's dividend report.

- Our expertly prepared valuation report VIEL & Cie société anonyme implies its share price may be lower than expected.

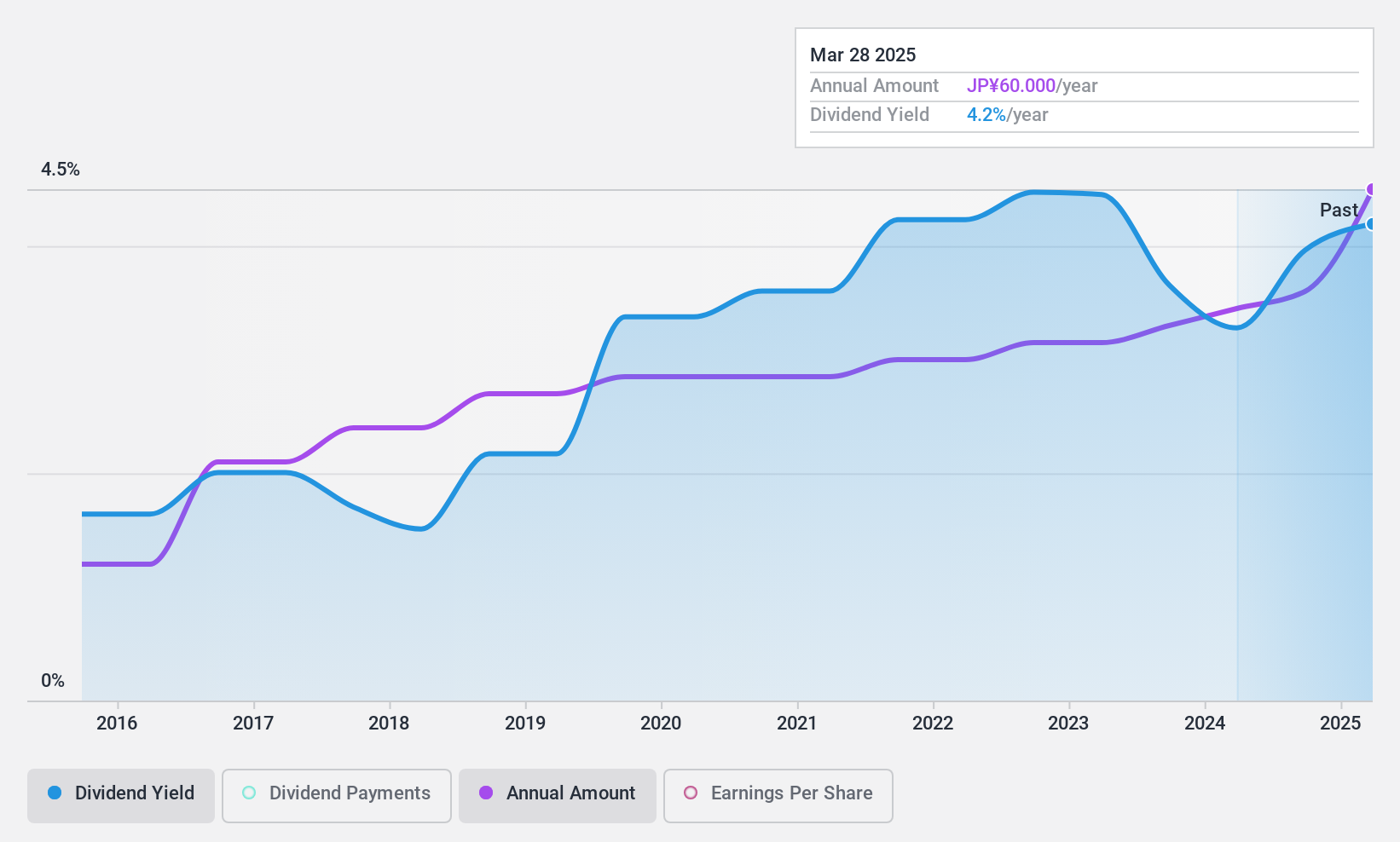

Nihon Tokushu Toryo (TSE:4619)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Nihon Tokushu Toryo Co., Ltd. manufactures and sells automobile products, paints, and coatings in Japan, with a market capitalization of ¥25.55 billion.

Operations: Nihon Tokushu Toryo Co., Ltd. generates revenue from its Paint Related segment amounting to ¥21.81 billion and Automotive Products-Related segment totaling ¥43.84 billion.

Dividend Yield: 4%

Nihon Tokushu Toryo Co., Ltd. provides a compelling dividend profile, offering a high yield of 3.97%, which is among the top 25% in Japan. The dividends are well-supported by earnings and cash flows, with low payout ratios of 23.4% and 12.9%, respectively, ensuring sustainability. Over the past decade, dividends have grown steadily without volatility. Recent earnings growth of 68.2% further strengthens its ability to maintain reliable dividend payments while trading significantly below fair value estimates.

- Click here to discover the nuances of Nihon Tokushu Toryo with our detailed analytical dividend report.

- According our valuation report, there's an indication that Nihon Tokushu Toryo's share price might be on the cheaper side.

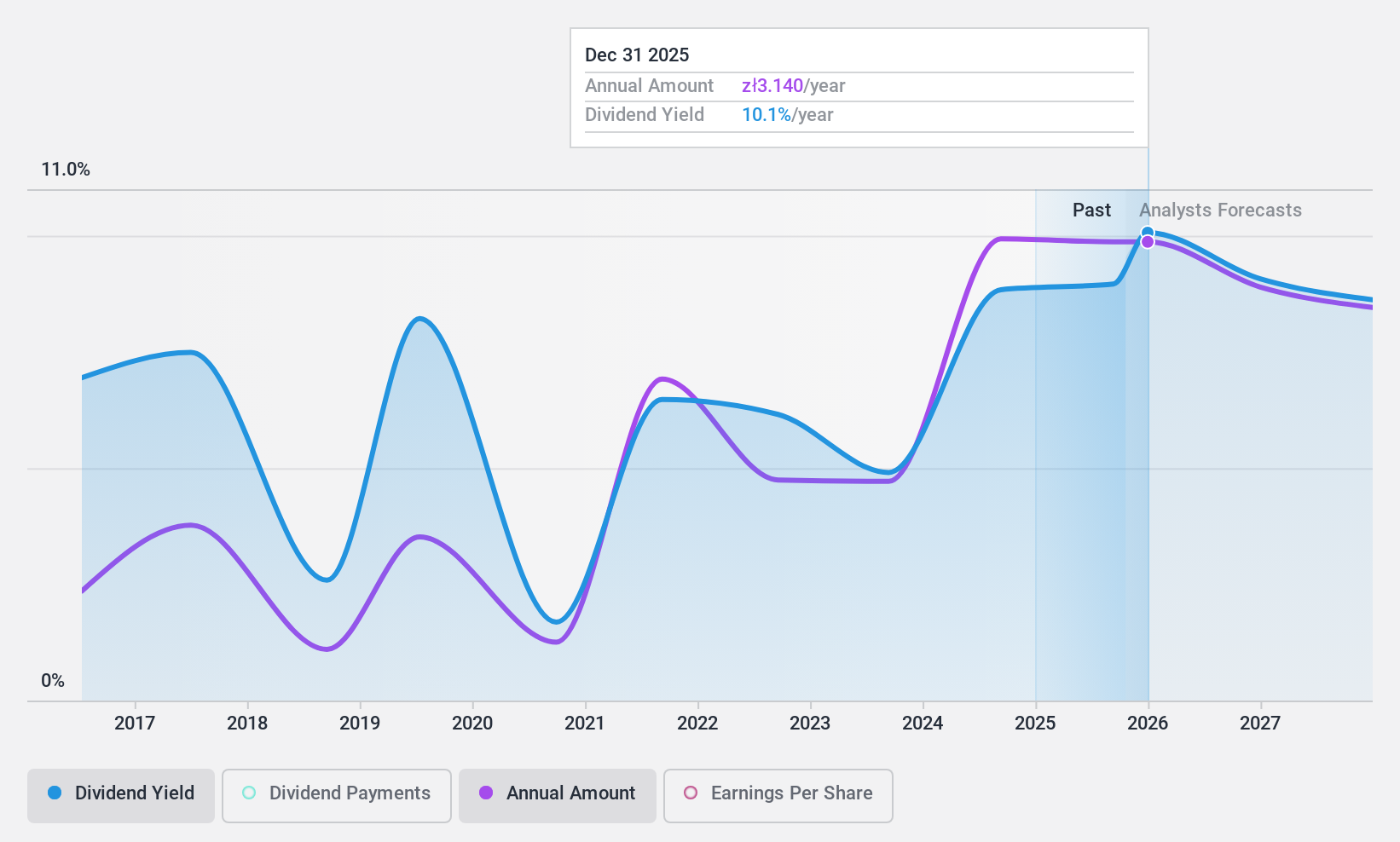

FERRO (WSE:FRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FERRO S.A. manufactures and sells sanitary and plumbing fixtures in Poland and internationally, with a market cap of PLN730.75 million.

Operations: FERRO S.A.'s revenue is primarily derived from its Sanitary Fittings segment at PLN371.45 million, followed by Installation Fittings at PLN268.67 million and Heat Sources at PLN135.28 million.

Dividend Yield: 9.2%

FERRO S.A.'s dividend yield of 9.19% is among the highest in Poland, but its sustainability is questionable due to a high payout ratio of 95.5%, indicating dividends are not well covered by earnings despite being covered by cash flows with a cash payout ratio of 37.3%. Dividends have been volatile over the past decade, and while recent earnings growth of 26.5% is positive, historical dividend reliability remains a concern.

- Take a closer look at FERRO's potential here in our dividend report.

- The valuation report we've compiled suggests that FERRO's current price could be quite moderate.

Seize The Opportunity

- Discover the full array of 1939 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIL

VIEL & Cie société anonyme

An investment company, provides interdealer broking, online trading, and private banking services in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region.

Outstanding track record with excellent balance sheet and pays a dividend.