- Italy

- /

- Gas Utilities

- /

- BIT:SRG

Snam's (BIT:SRG) Shareholders Will Receive A Bigger Dividend Than Last Year

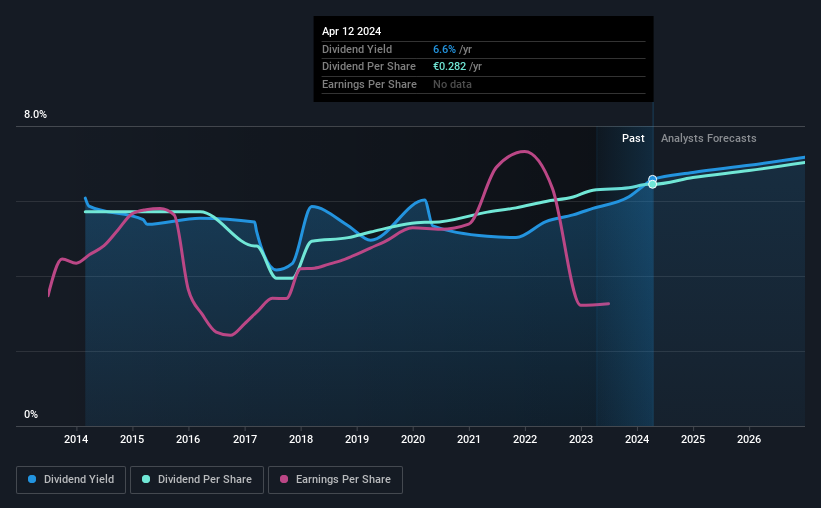

Snam S.p.A.'s (BIT:SRG) periodic dividend will be increasing on the 26th of June to €0.1692, with investors receiving 2.5% more than last year's €0.165. This makes the dividend yield 6.6%, which is above the industry average.

Check out our latest analysis for Snam

Snam's Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, the dividend made up 136% of earnings, and the company was generating negative free cash flows. This high of a dividend payment could start to put pressure on the balance sheet in the future.

Over the next year, EPS is forecast to expand by 5.3%. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 78% - on the higher side, but we wouldn't necessarily say this is unsustainable.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the annual payment back then was €0.25, compared to the most recent full-year payment of €0.282. This works out to be a compound annual growth rate (CAGR) of approximately 1.2% a year over that time. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Snam May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings per share has been crawling upwards at 4.0% per year. The earnings growth is anaemic, and the company is paying out 136% of its profit. Limited recent earnings growth and a high payout ratio makes it hard for us to envision strong future dividend growth, unless the company should have substantial pricing power or some form of competitive advantage.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think Snam will make a great income stock. The track record isn't great, and the payments are a bit high to be considered sustainable. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Snam that investors need to be conscious of moving forward. Is Snam not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:SRG

Snam

Engages in the operation of natural gas transport and storage infrastructure.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives