- Italy

- /

- Gas Utilities

- /

- BIT:SRG

Assessing Snam (BIT:SRG): Is There More Value Left After Recent Share Price Moves?

Reviewed by Simply Wall St

If you have been watching Snam (BIT:SRG) lately, you have probably noticed some modest ups and downs in the share price. While there has been no single major event driving the latest move, the shifts in trading could still catch the attention of investors wondering whether the market is signaling something beneath the surface about Snam’s future. With utilities often viewed as safe havens, any unexplained movement might prompt a closer look, especially when there is no breaking news or headlines to point to as the cause.

Zooming out, Snam’s year-to-date performance shows steady upward momentum, with the stock climbing 18% over the year and delivering a 19% total return to shareholders. That is especially interesting considering more muted performance in previous quarters and some minor pullbacks in recent weeks. While recent revenue and net income figures have grown, overall stock momentum appears to be building gradually rather than surging. This might suggest the market is cautiously optimistic but not racing ahead.

So is Snam’s current share price reflecting all the growth it has in store, or could there be value left on the table for those willing to take a closer look?

Most Popular Narrative: 5% Undervalued

According to the most widely followed narrative, Snam is currently valued about 5% below its calculated fair value, suggesting modest upside potential based on analyst consensus assumptions.

Strengthening energy security and supply diversification across Europe, highlighted by Italy's shift away from Russian pipeline imports toward increased LNG capacity and diversified sourcing (North Africa, Azerbaijan, U.S. LNG), will require ongoing infrastructure upgrades and expansion. This supports regulated revenue growth and improves long-term earnings visibility.

Curious about what powers this bullish forecast? The fair value model banks on several bold projections, such as multi-year earnings increases and a future profit multiple that would exceed industry averages. Want to discover the ambitious financial targets analysts believe Snam will hit to justify this price? Dig into the core assumptions and see if you agree with the narrative driving Snam's upside.

Result: Fair Value of €5.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors such as stricter regulation or a sharp decline in gas demand could challenge this growth story and limit Snam’s long-term upside.

Find out about the key risks to this Snam narrative.Another View: Our DCF Model Offers a Different Take

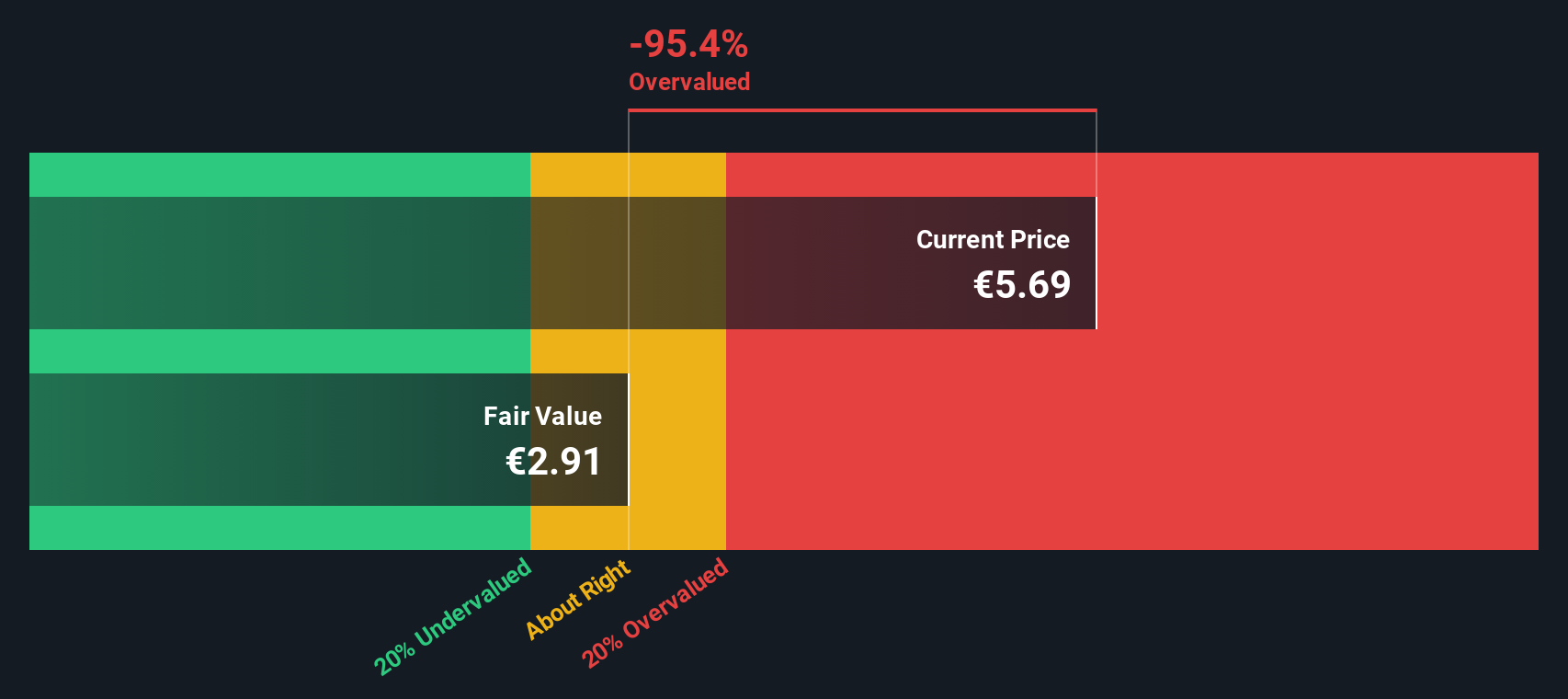

While analysts see Snam as 5% undervalued based on typical forecasts, our DCF model tells a different story. It suggests the shares may actually be overvalued. Could these models be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Snam for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Snam Narrative

If you see things differently or would like to explore the numbers from your own perspective, you can build a unique narrative in just a few minutes. Do it your way.

A great starting point for your Snam research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Uncover More Smart Opportunities?

Why settle for just one promising stock when you could be investing in the next breakout star? Use the powerful Simply Wall Street Screener to pinpoint companies with standout potential and never miss a beat in the market.

- Tap into the potential of high-growth medical technology by searching for companies at the forefront of the healthcare AI revolution with healthcare AI stocks.

- Capture reliable income and portfolio stability by uncovering businesses known for generous cash returns through dividend stocks with yields > 3%.

- Spot stocks trading well below their intrinsic value. Seize unique value opportunities right now, powered by undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:SRG

Snam

Engages in the operation of natural gas transport and storage infrastructure.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion