- Italy

- /

- Electric Utilities

- /

- BIT:ENEL

Assessing Enel (BIT:ENEL) Valuation After Securing Chile’s 3.36 TWh Multi‑Year Power Tender

Reviewed by Simply Wall St

Enel (BIT:ENEL) just secured the entire 3.36 TWh per year on offer in Chile's latest national power tender, locking in multi year power purchase agreements that improve cash flow visibility and strengthen its presence in Chile.

See our latest analysis for Enel.

That backdrop of long term power contracts in Chile, plus recent affirmations of group credit strength, helps explain why Enel’s share price return is up strongly year to date and its multi year total shareholder return still looks robust. This suggests momentum is gradually rebuilding after a softer recent month.

If this Chile tender win has you thinking about the next opportunity in energy and infrastructure, it might be worth scanning fast growing stocks with high insider ownership for under the radar ideas with aligned management incentives.

Yet even with Chilean PPAs, solid credit ratings, and a strong multi year share price run, Enel still trades only slightly below consensus targets. This raises the question: is there genuine upside left, or is future growth already priced in?

Most Popular Narrative Narrative: 1% Undervalued

With Enel last closing at €8.72 versus a narrative fair value near €8.80, the story leans toward modest upside rather than a dramatic mispricing.

The analysts have a consensus price target of €8.491 for Enel based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €10.0, and the most bearish reporting a price target of just €7.6.

Curious why a mature utility gets a premium style earnings multiple and steady growth path baked into its fair value playbook? The answer hides in how future revenues, margins, and earnings are expected to compound together, and which specific year becomes the turning point in the narrative’s math.

Result: Fair Value of €8.80 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value case could wobble if European regulation turns less friendly or if Latin American currency volatility continues to erode reported earnings.

Find out about the key risks to this Enel narrative.

Another View: Value Signals From Earnings

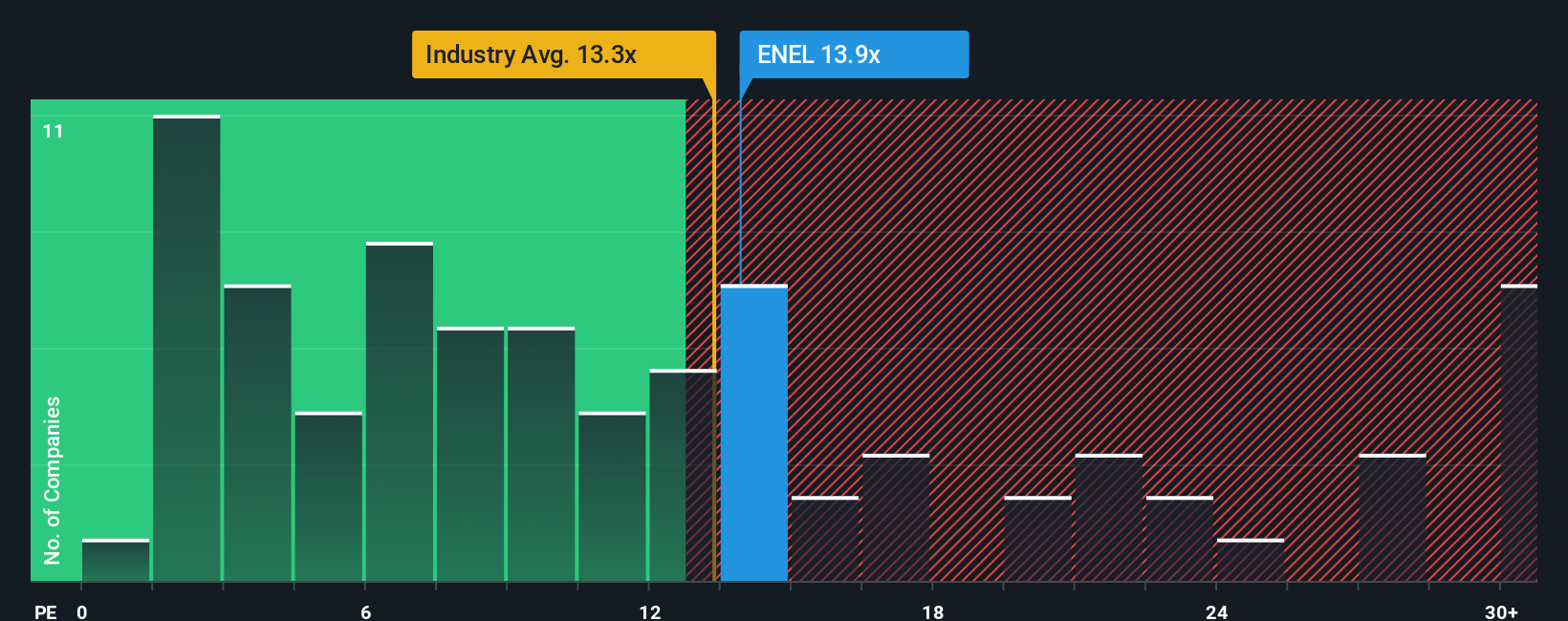

While the narrative fair value points to Enel being about right, its current price to earnings ratio of 14.3 times still sits well below a fair ratio of 18.9 times and under the peer average of 23 times, even if it is slightly richer than the wider European utilities on 13.6 times.

If the market gradually leans toward that higher fair ratio, current holders could still see upside. However, if sentiment cools, is today’s premium to the sector a reward for quality or a warning on valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Enel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Enel Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your Enel research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not leave your next move to chance. Use the Simply Wall Street Screener to uncover focused opportunities that match your strategy before the market catches on.

- Capture potential multi baggers early by scanning these 3609 penny stocks with strong financials for smaller companies showing surprisingly strong balance sheets and disciplined capital allocation.

- Ride structural growth in automation and data by targeting these 25 AI penny stocks that pair real revenue traction with compelling innovation, not just hype.

- Lock in income and stability by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with the financial strength to keep paying through economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENEL

Enel

Operates as an integrated operator in electricity and gas industries worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion