- Italy

- /

- Other Utilities

- /

- BIT:A2A

3 Leading Dividend Stocks Yielding Up To 8.5%

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of fluctuating consumer confidence and economic indicators, investors are increasingly drawn to the stability offered by dividend stocks. In times of uncertainty, these stocks can provide a reliable income stream, making them an attractive option for those seeking to balance growth with income in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

A2A (BIT:A2A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: A2A S.p.A. is involved in the production, sale, and distribution of gas and electricity, as well as district heating both in Italy and internationally, with a market cap of €6.72 billion.

Operations: A2A S.p.A. generates revenue from several segments, including Waste (€1.53 billion), Market (€6.56 billion), and Smart Infrastructures (€1.49 billion).

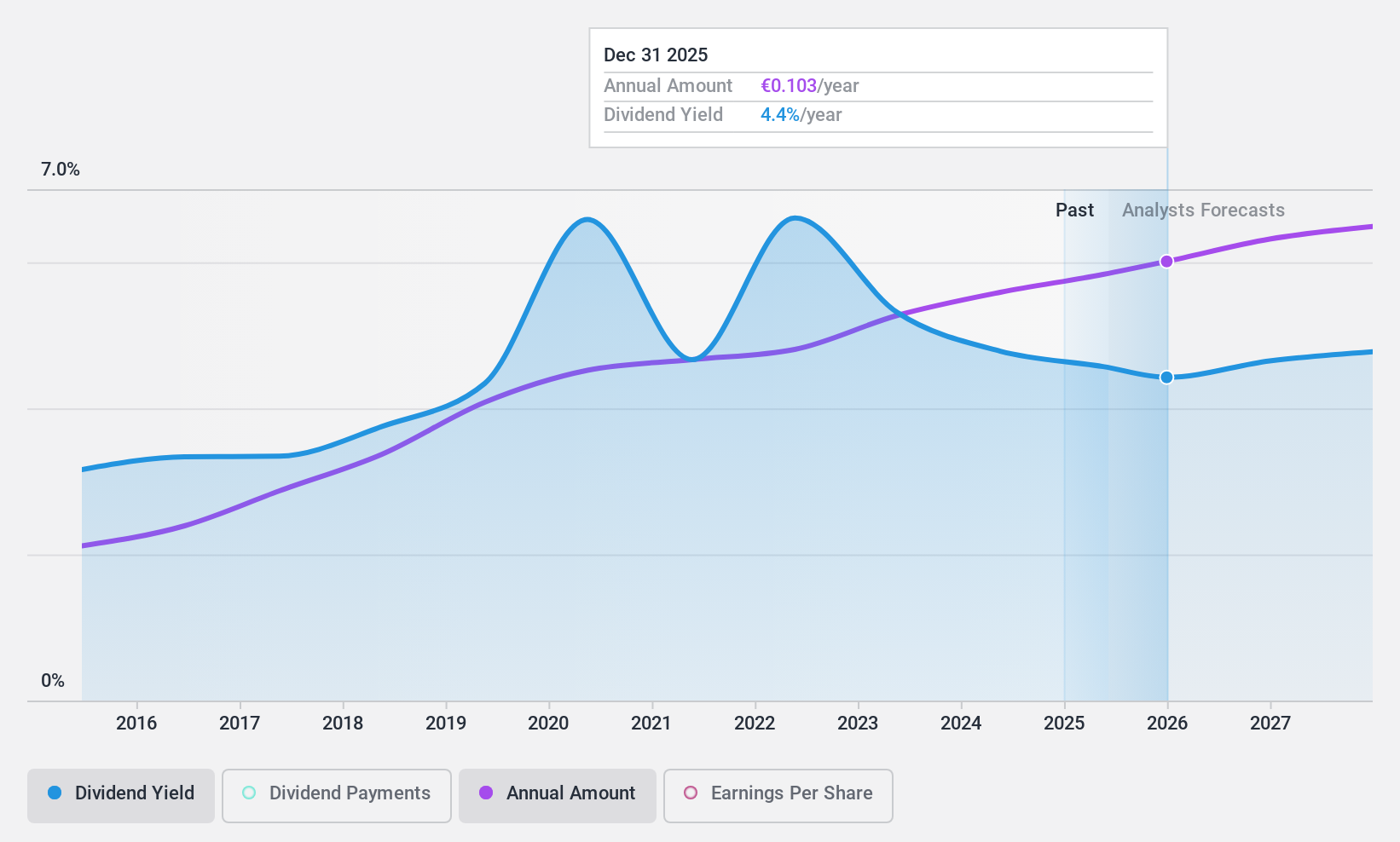

Dividend Yield: 4.4%

A2A's dividend yield of 4.38% is below the top quartile in Italy, and its dividends are not fully covered by cash flows, with a high cash payout ratio of 150.8%. However, the payout ratio from earnings is low at 34.6%, indicating coverage by earnings despite financial strain from debt levels. Dividends have been stable and growing over the past decade but may face pressure due to forecasted earnings decline. Recent strategic moves include potential acquisitions and infrastructure projects, which could impact future financial stability and dividend sustainability.

- Unlock comprehensive insights into our analysis of A2A stock in this dividend report.

- Our valuation report unveils the possibility A2A's shares may be trading at a discount.

Orion Oyj (HLSE:ORNBV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orion Oyj is a pharmaceutical company that develops, manufactures, and markets human and veterinary pharmaceuticals as well as active pharmaceutical ingredients across Finland, Scandinavia, Europe, North America, and internationally with a market cap of €6 billion.

Operations: Orion Oyj's revenue from its pharmaceuticals segment amounts to €1.43 billion.

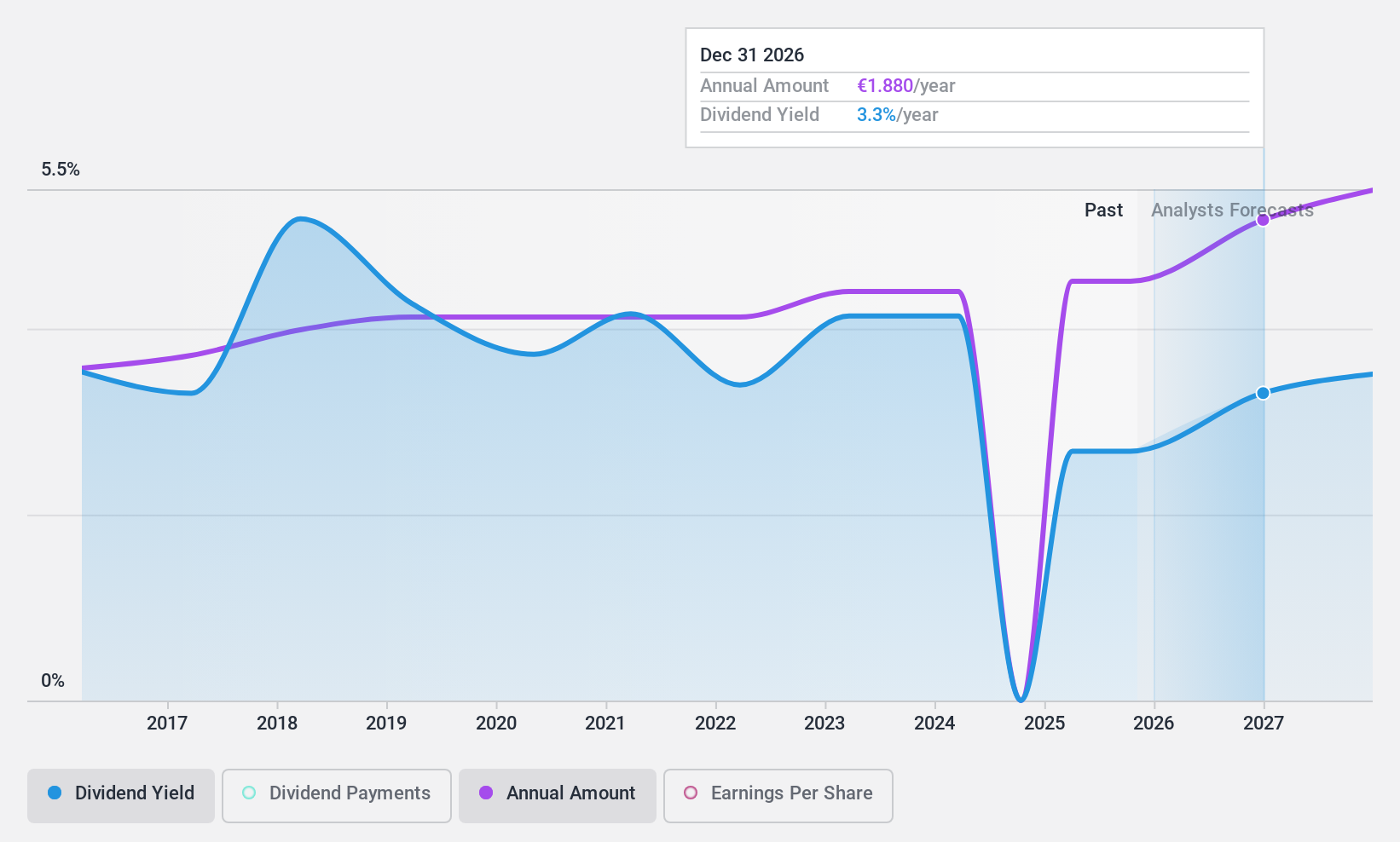

Dividend Yield: 3.7%

Orion Oyj's dividend yield of 3.71% is below the top quartile in Finland and not well covered by free cash flows, with a high cash payout ratio of 132.9%. Despite this, dividends have been stable and growing over the past decade, supported by a reasonable payout ratio from earnings at 68.6%. Recent strategic shifts include terminating ganaxolone activities in Europe and focusing on oncology and pain therapeutics, which may affect future dividend sustainability.

- Get an in-depth perspective on Orion Oyj's performance by reading our dividend report here.

- Our expertly prepared valuation report Orion Oyj implies its share price may be lower than expected.

Südzucker (XTRA:SZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südzucker AG produces and sells sugar products across Germany, the European Union, the United Kingdom, the United States, and internationally, with a market cap of €2.12 billion.

Operations: Südzucker AG's revenue is derived from several segments: Fruit (€1.60 billion), Sugar (€4.62 billion), Starch (€1.11 billion), CropEnergies (€1.13 billion), and Special Products excluding Starch (€2.37 billion).

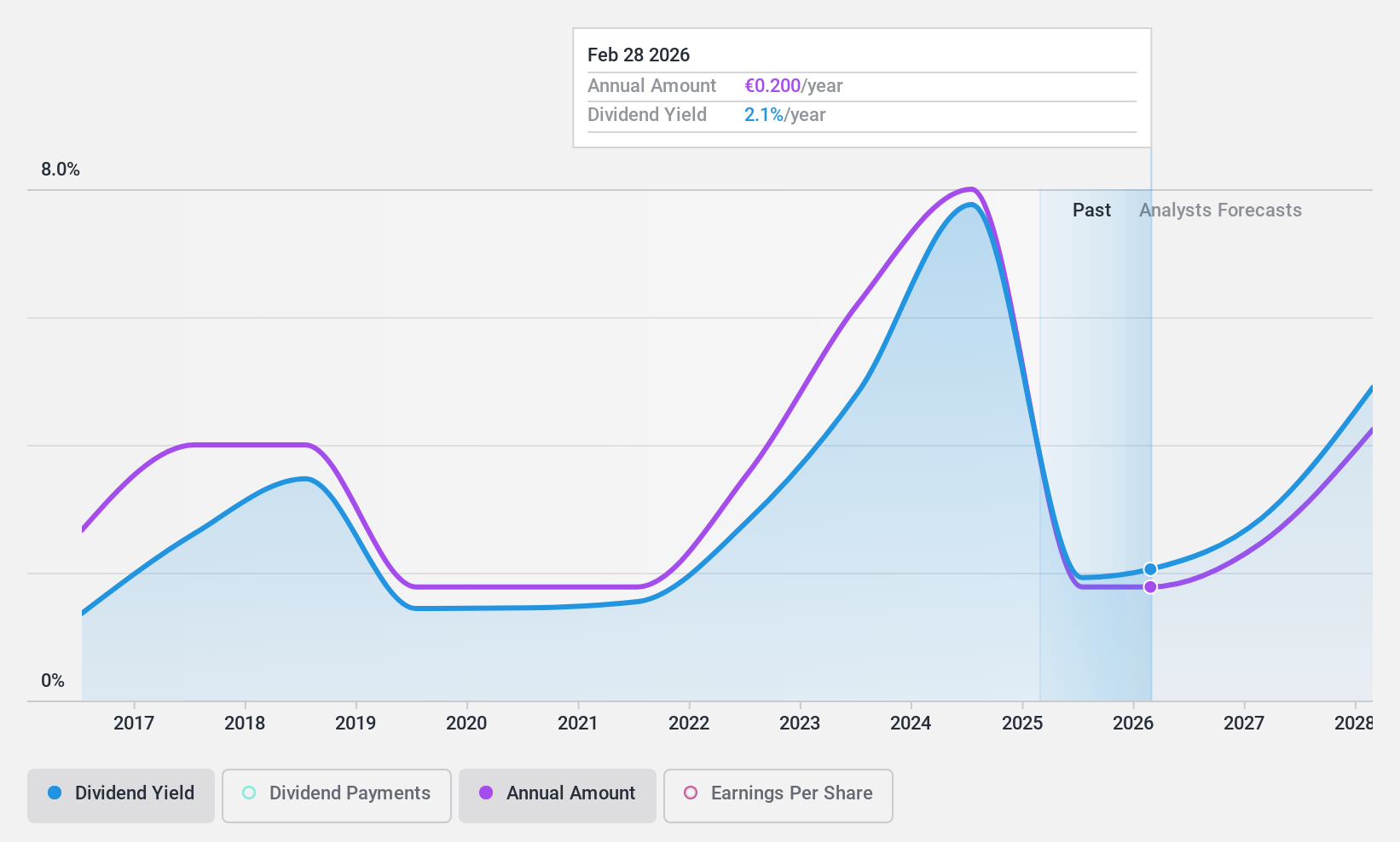

Dividend Yield: 8.5%

Südzucker's dividend yield of 8.53% ranks in the top 25% in Germany, though its dividend history is marked by volatility and unreliability over the past decade. Despite this, dividends are well covered by earnings and cash flows with payout ratios of 54.7% and 48.2%, respectively. The company's financial position includes high debt levels, while recent earnings showed a decline in net income to €59 million for Q2 2025 compared to €189 million a year ago.

- Click here to discover the nuances of Südzucker with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Südzucker is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1958 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:A2A

A2A

Engages in the production, sale, and distribution of gas and electricity, and district heating in Italy and internationally.

Solid track record with adequate balance sheet and pays a dividend.