- Italy

- /

- Construction

- /

- BIT:MAIRE

3 Stocks Estimated To Be Up To 39.5% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets experience fluctuations with U.S. consumer confidence declining and mixed economic signals from major regions, investors are keenly observing opportunities that may arise in this environment. In such a landscape, identifying stocks that are potentially undervalued becomes crucial, as these could offer significant upside if their intrinsic value is realized in the market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.83 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.77 | €5.51 | 49.7% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.66 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7645.06 | 49.8% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.77 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.15 | US$129.87 | 49.8% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Maire (BIT:MAIRE)

Overview: Maire S.p.A. develops and implements solutions for the energy transition, with a market cap of €2.70 billion.

Operations: The company's revenue is primarily derived from Integrated E&C Solutions, contributing €4.98 billion, and Sustainable Technology Solutions, accounting for €321.47 million.

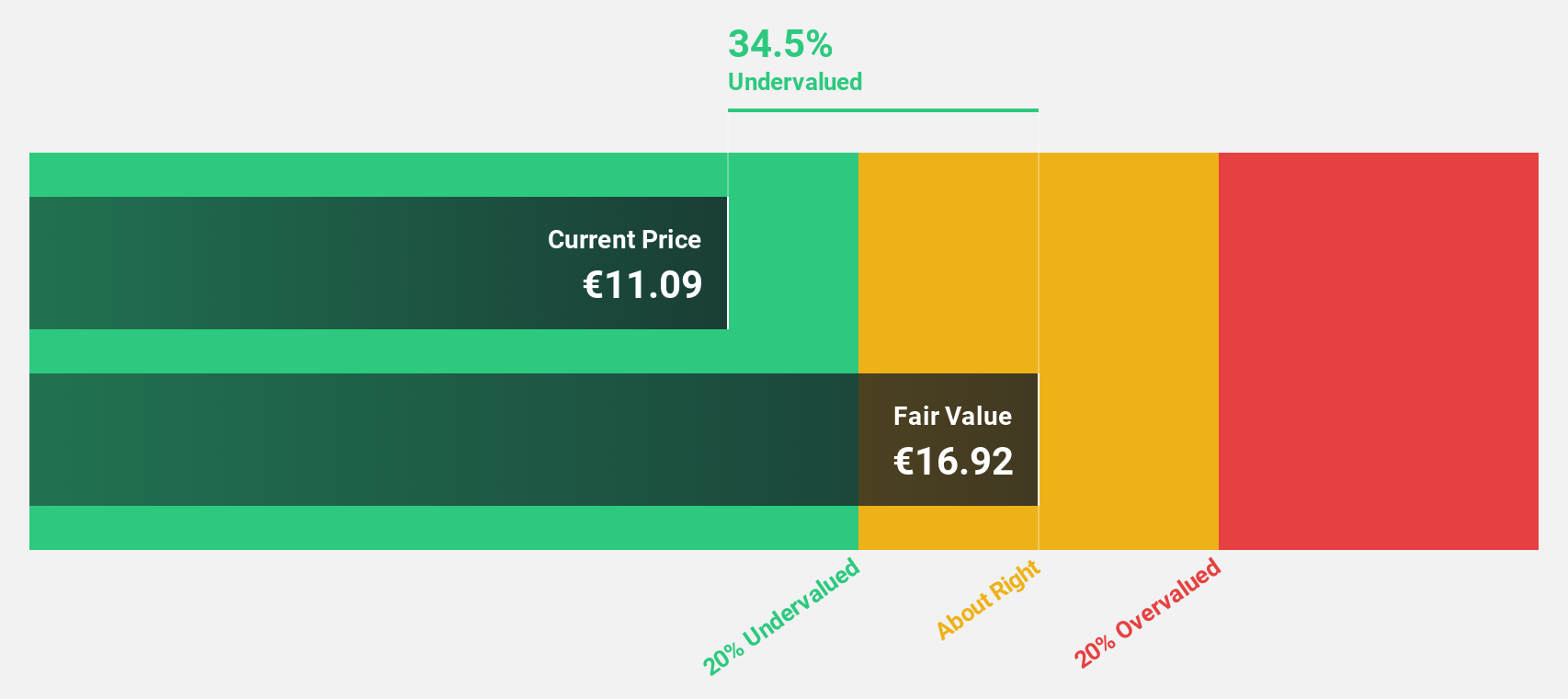

Estimated Discount To Fair Value: 39.5%

Maire S.p.A. is trading at €8.26, significantly below its estimated fair value of €13.66, and 39.5% below our valuation estimate, indicating potential undervaluation based on cash flows. The company reported robust earnings growth of 62.7% over the past year, with revenue reaching €4.13 billion for the first nine months of 2024 and a net income increase to €137.61 million from €82.2 million last year, despite an unstable dividend track record.

- Upon reviewing our latest growth report, Maire's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Maire's balance sheet health report.

Allied Machinery (SHSE:605060)

Overview: Allied Machinery Co., Ltd. specializes in designing, researching, developing, producing, and selling high-precision mechanical parts and precision cavity mold products in China and the United States, with a market cap of CN¥4.21 billion.

Operations: The company generates revenue from the production and sale of high-precision mechanical parts and precision cavity mold products across China and the United States.

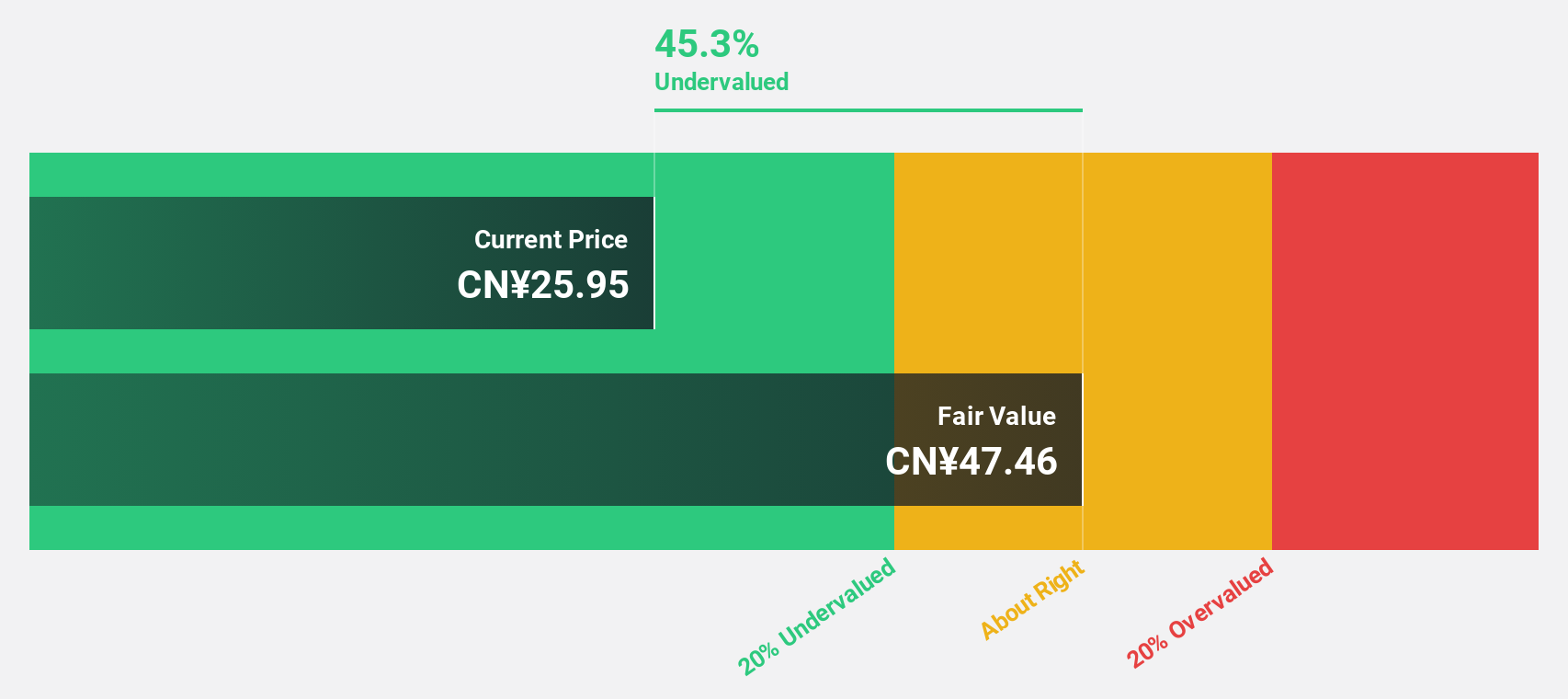

Estimated Discount To Fair Value: 24.7%

Allied Machinery is trading at CNY 17.47, below its estimated fair value of CNY 23.21, suggesting potential undervaluation based on cash flows. Despite a drop in the S&P Global BMI Index and declining nine-month sales to CNY 851.34 million from CNY 928.3 million last year, earnings are forecasted to grow significantly by 29.32% annually over the next three years, outpacing market expectations but facing challenges with dividend coverage from free cash flows.

- The growth report we've compiled suggests that Allied Machinery's future prospects could be on the up.

- Take a closer look at Allied Machinery's balance sheet health here in our report.

GNI Group (TSE:2160)

Overview: GNI Group Ltd. is involved in the research, development, manufacture, and sale of pharmaceutical drugs both in Japan and internationally, with a market cap of ¥170.63 billion.

Operations: The company's revenue is derived from its pharmaceutical segment, which generates ¥18.31 billion, and its medical device segment, contributing ¥4.34 billion.

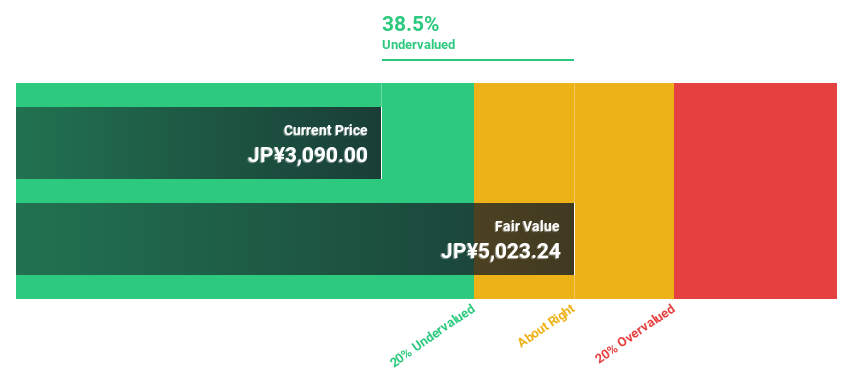

Estimated Discount To Fair Value: 34.6%

GNI Group, trading at ¥3405, is considered undervalued with a fair value estimate of ¥5210.37. Despite recent share price volatility, the company demonstrates strong growth prospects with earnings expected to grow 22.5% annually, surpassing the JP market's 7.8%. Revenue is also set to increase by 23.5% per year, outpacing market averages. However, its return on equity forecast remains modest at 16.4%, and it maintains a high level of non-cash earnings.

- In light of our recent growth report, it seems possible that GNI Group's financial performance will exceed current levels.

- Click here to discover the nuances of GNI Group with our detailed financial health report.

Make It Happen

- Delve into our full catalog of 878 Undervalued Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MAIRE

Maire

MAIRE S.p.A. develops and implements various solutions to enable the energy transition.

Flawless balance sheet with solid track record.