- Italy

- /

- Construction

- /

- BIT:NXT

Discovering Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating consumer confidence and mixed economic indicators, global markets have experienced moderate gains, with major indices like the Nasdaq Composite and S&P MidCap 400 showing resilience. In this environment, identifying stocks with promising potential requires a keen understanding of market dynamics and an eye for companies that can navigate economic uncertainties while demonstrating strong fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Next Geosolutions Europe (BIT:NXT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Next Geosolutions Europe SpA offers geoscience and engineering services to the energy, infrastructure, and utilities sectors with a market cap of €399.36 million.

Operations: The company generates revenue primarily from engineering services, amounting to €246.37 million.

Next Geosolutions Europe, a promising player in its field, is trading at 64.9% below estimated fair value, offering an enticing opportunity compared to industry peers. The company boasts a robust EBIT coverage of interest payments at 28.8 times, indicating strong financial health. Over the past year, earnings surged by 98.9%, surpassing the construction industry's growth rate of 56.5%. However, profit margins have narrowed from last year's 27% to 14.7%. Despite this contraction in margins, Next Geosolutions remains cash-positive and forecasts suggest continued earnings growth of approximately 17.72% annually.

- Dive into the specifics of Next Geosolutions Europe here with our thorough health report.

Evaluate Next Geosolutions Europe's historical performance by accessing our past performance report.

Ålandsbanken Abp (HLSE:ALBAV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ålandsbanken Abp operates as a commercial bank serving private individuals and companies in Finland and Sweden, with a market capitalization of €520.95 million.

Operations: Ålandsbanken Abp generates revenue primarily from its Private Banking (including Asset Management) and Premium Banking segments, with contributions of €100.64 million and €73.37 million, respectively. The bank's IT segment also adds €52.97 million to the revenue stream, while Corporate activities contribute €8.42 million.

Ålandsbanken Abp, with total assets of €4.8 billion and equity at €325 million, is a financial entity that stands out for its robust earnings growth of 36% over the past year, surpassing industry averages. The bank's total deposits amount to €3.4 billion against loans of €3.5 billion, reflecting a net interest margin of 1.8%. Despite trading at 26% below estimated fair value and having primarily low-risk funding sources covering 76% of liabilities, it grapples with high bad loans at 2%, coupled with an insufficient allowance set at just 24%. Recent activities include a successful fixed-income offering worth €250 million in December 2024.

- Click here to discover the nuances of Ålandsbanken Abp with our detailed analytical health report.

Examine Ålandsbanken Abp's past performance report to understand how it has performed in the past.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Value Rating: ★★★★★★

Overview: Synektik Spólka Akcyjna offers products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland with a market capitalization of PLN1.69 billion.

Operations: Synektik generates revenue through its diverse offerings in surgery, diagnostic imaging, and nuclear medicine solutions. The company's market cap stands at PLN1.69 billion, reflecting its significant presence in Poland's healthcare sector.

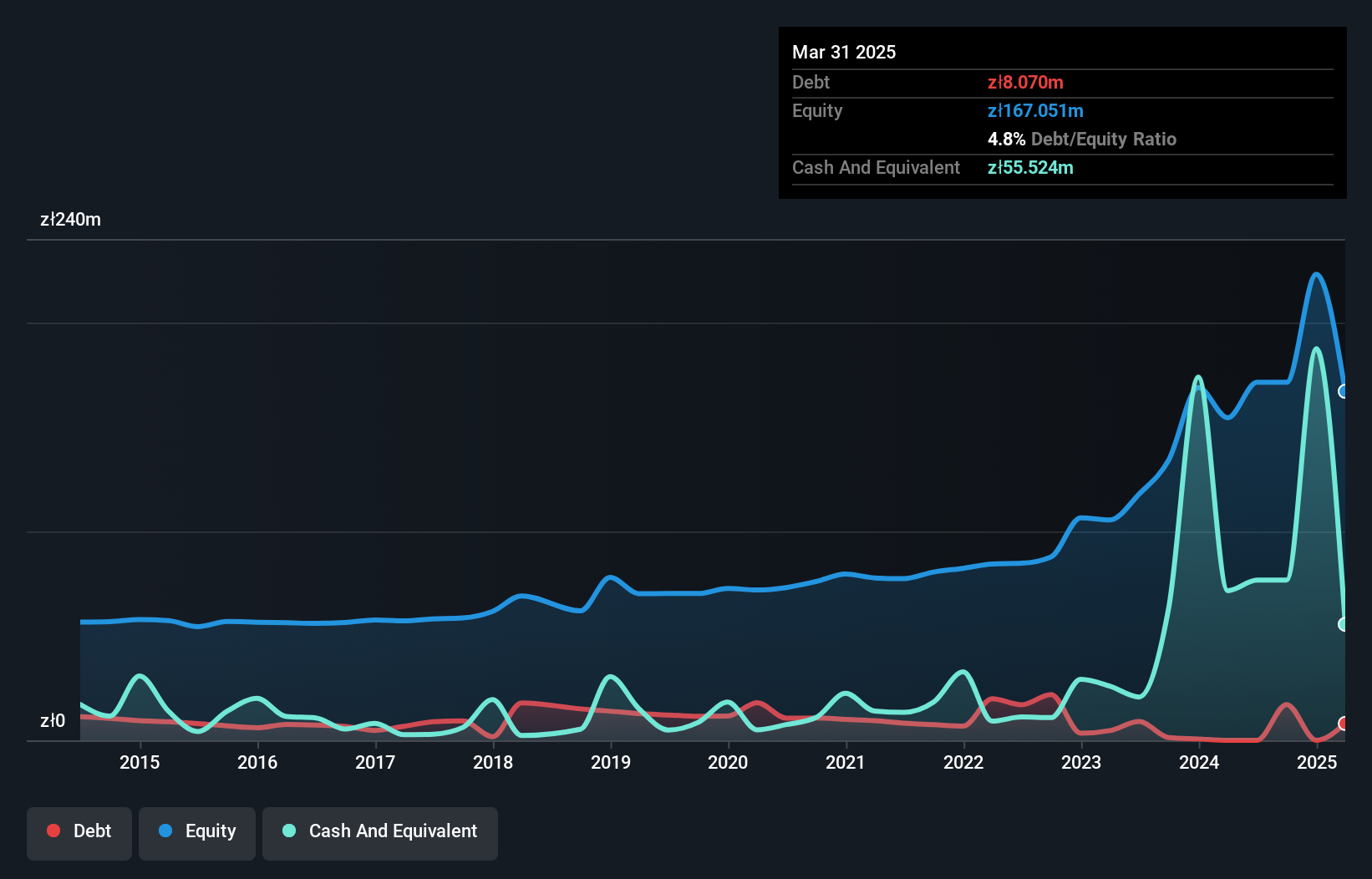

With a promising trajectory, Synektik Spólka Akcyjna seems to be carving out its niche in the healthcare sector. Earnings surged by 61% last year, significantly outpacing the industry's 3.6% growth rate. The company boasts high-quality earnings and maintains an impressive EBIT coverage of debt interest at 14 times, indicating robust financial health. Over five years, its debt-to-equity ratio improved from 16% to 10%, highlighting prudent financial management. Trading at approximately 39% below estimated fair value suggests potential undervaluation in the market. Upcoming earnings results on November 14 could further illuminate its growth prospects and valuation dynamics.

- Delve into the full analysis health report here for a deeper understanding of Synektik Spólka Akcyjna.

Understand Synektik Spólka Akcyjna's track record by examining our Past report.

Summing It All Up

- Investigate our full lineup of 4638 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Next Geosolutions Europe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NXT

Next Geosolutions Europe

Provides geoscience and engineering services for energy, infrastructure, and utilities sectors.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives