- Italy

- /

- Infrastructure

- /

- BIT:ENAV

ENAV Valuation in Focus After 64% Five Year Share Price Climb

Reviewed by Simply Wall St

Thinking about what to do with ENAV stock? You are definitely not alone. With the shares up 64.2% over the last five years and notching a respectable 15.6% gain in the past year, ENAV has caught the attention of long-term investors and newcomers alike. Even so, the ride has not been perfectly smooth lately. The stock dipped by 1.4% this week and is down 1.2% for the month, which hints at some shifting sentiment or perhaps just broader market noise. Still, the bigger picture remains positive, with a 3.6% increase year-to-date.

Much of the company’s long-term performance tracks alongside developments in European air traffic, where ENAV remains a key player. Periodic bursts of optimism, often linked to wider market trends or improvements in travel volumes, have helped drive its shares higher. Recent pullbacks feel more like pauses than warning signs.

A major part of finding your footing with ENAV now is figuring out what the stock is actually worth. Investors love to look for value, and by some standard measures, ENAV is currently undervalued in just one out of six key checks, leaving it with a valuation score of 1. That number alone will not settle the debate, so let’s dig in and see what the main valuation approaches tell us and why there might be a smarter way to judge ENAV’s worth by the end of this article.

ENAV scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: ENAV Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common method for estimating a company’s true worth. It works by projecting future Free Cash Flows (FCF) and “discounting” them back to today’s value, so investors can see what those future earnings are worth in present terms.

Looking at ENAV, the latest trailing twelve months Free Cash Flow stands at €193.5 million. Analysts forecast ENAV’s FCF to remain relatively stable over the next several years, with an estimate of €218.0 million for 2026 and gradually tapering to €177 million by 2029. Beyond these analyst-backed estimates, further FCF projections through 2035 are extrapolated using trend analysis rather than direct analyst forecasts.

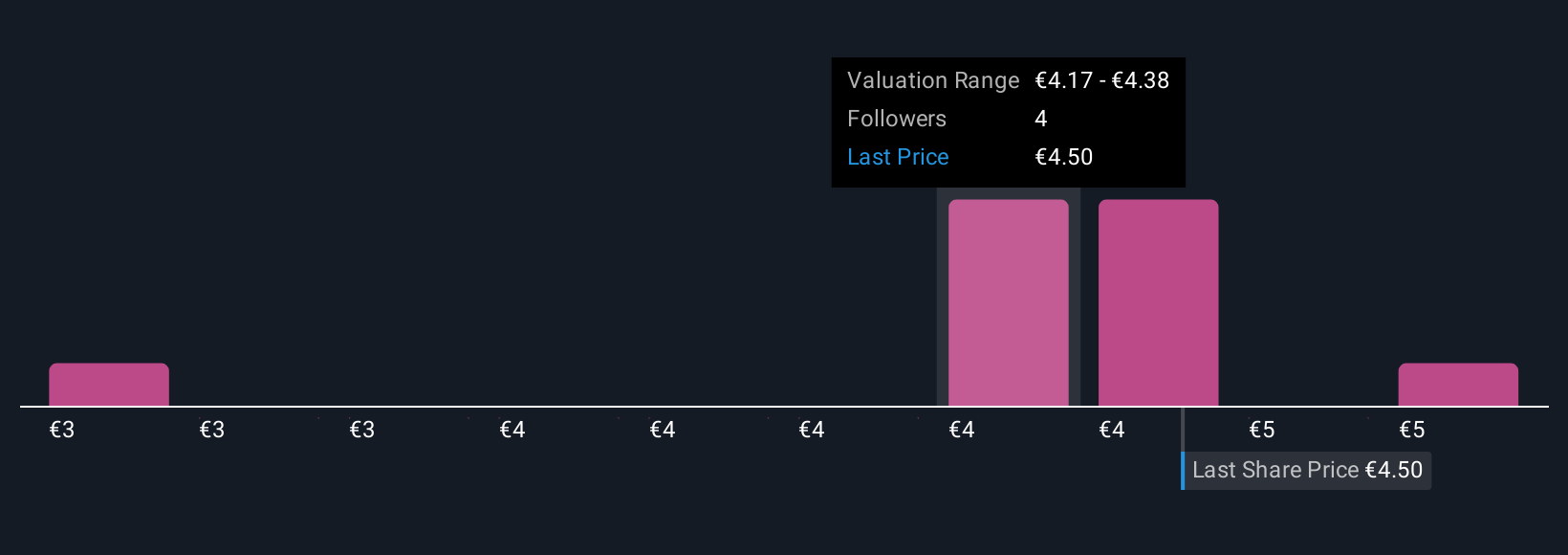

Based on these figures, the DCF approach calculates an intrinsic value of €3.13 per share for ENAV. With the current share price sitting about 36.6% above this value, ENAV’s stock appears significantly overvalued from a discounted cash flow perspective.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for ENAV.

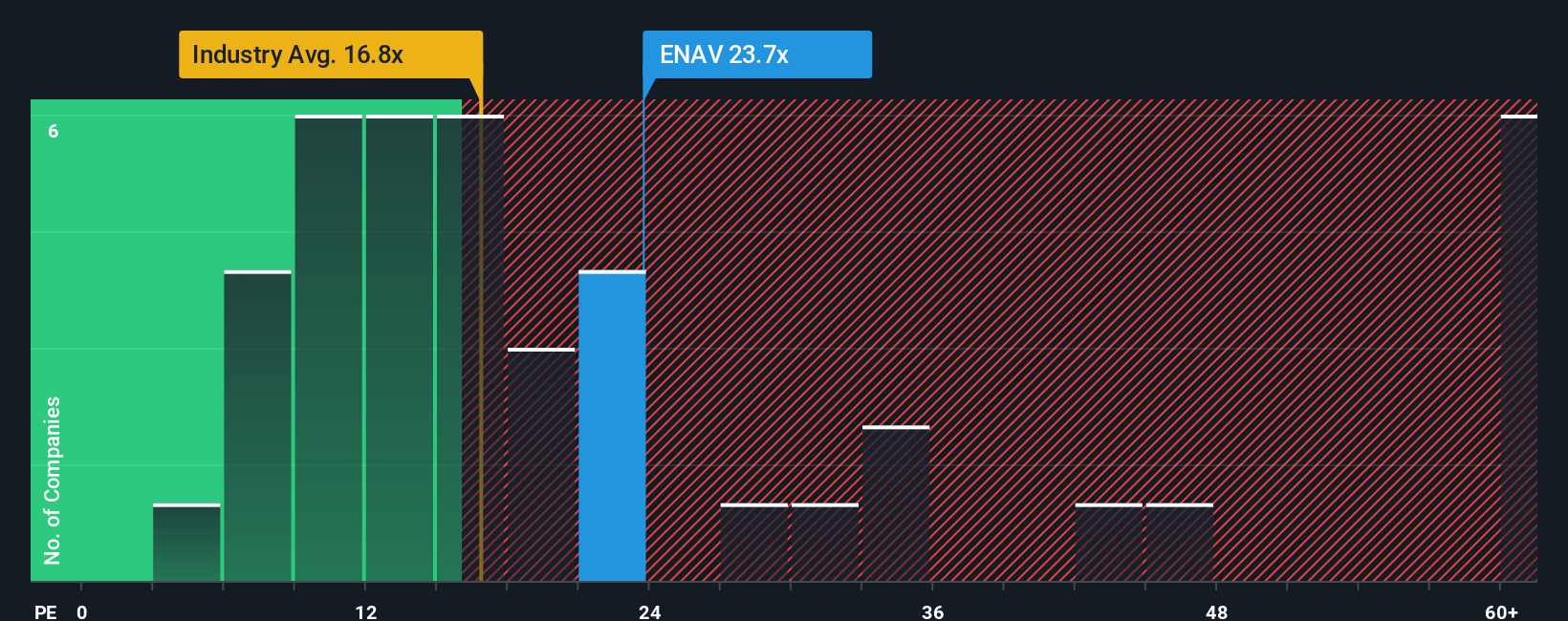

Approach 2: ENAV Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a well-established tool for valuing profitable companies such as ENAV, because it ties the company’s share price directly to its earnings. This multiple is particularly useful when a business is consistently generating profits, offering investors a straightforward way to compare valuation with peers and the wider sector.

What constitutes a “normal” or “fair” PE ratio can fluctuate depending on how quickly a company is expected to grow its earnings and how much risk is present in its business or industry. Higher growth prospects and lower risk usually justify a higher PE, while slower-growing or riskier companies often command a lower one.

Currently, ENAV trades at a PE ratio of 21.1x. This is above the Infrastructure industry average of 14.6x but is still below the peer average of 29.2x. Simply Wall St’s Fair Ratio, a proprietary estimate reflecting ENAV's size, growth outlook, profitability, industry, and risk, comes in at 19.9x. The Fair Ratio offers a more tailored benchmark than simply comparing with peers or the industry, as it adjusts for ENAV’s specific fundamentals and risk profile.

Since ENAV’s PE of 21.1x is only modestly above the Fair Ratio of 19.9x, the difference is not significant, suggesting the stock is priced about fairly on an earnings basis.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your ENAV Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique story and perspective on a company, connecting the numbers, such as your own fair value estimate and assumptions about future revenues or margins, to a bigger picture about how the business will perform.

Unlike static models, Narratives on Simply Wall St let investors bridge the company’s story, their forecasts, and a resulting fair value. This offers a holistic and personalized investment viewpoint. Narratives are easy to use and are available to millions of investors within our Community page, making this tool accessible whether you are new to investing or bringing years of experience.

By building a Narrative, you compare your fair value directly with the current share price, helping you decide when to buy, hold, or sell based on your conviction rather than relying solely on standard ratios. As new information like quarterly earnings or industry news emerges, Narratives automatically update to ensure your view remains current and relevant.

For example, right now investors’ Narratives for ENAV range from a bullish price target of €4.9, highlighting faith in a sustained air traffic recovery, to a more cautious target near €3.6 due to worries about regulatory risks and margin pressure.

Do you think there's more to the story for ENAV? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ENAV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENAV

ENAV

Provides air traffic control and management, and other air navigation services in Italy, the rest of Europe, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)