A.L.A. società per azioni Leads These 3 Undiscovered European Gems

Reviewed by Simply Wall St

The European market has recently shown signs of resilience, with the pan-European STOXX Europe 600 Index ending a two-week losing streak amid hopes for increased government spending, although concerns about U.S. tariffs continue to loom. In this environment of mixed economic signals and cautious central bank policies, identifying promising small-cap stocks requires a focus on companies that demonstrate strong fundamentals and the ability to navigate trade-related uncertainties effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

A.L.A. società per azioni (BIT:ALA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: A.L.A. società per azioni is a supply chain solutions provider serving the aerospace and defense, rail, and high-tech sectors, with a market cap of €283.54 million.

Operations: With a market cap of €283.54 million, the company generates revenue primarily from its supply chain solutions in aerospace and defense, rail, and high-tech sectors. Its net profit margin has shown fluctuations over recent periods.

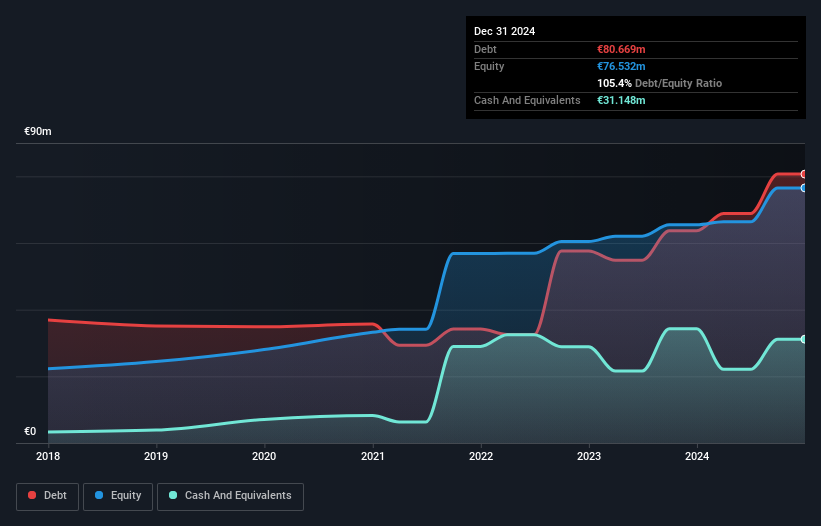

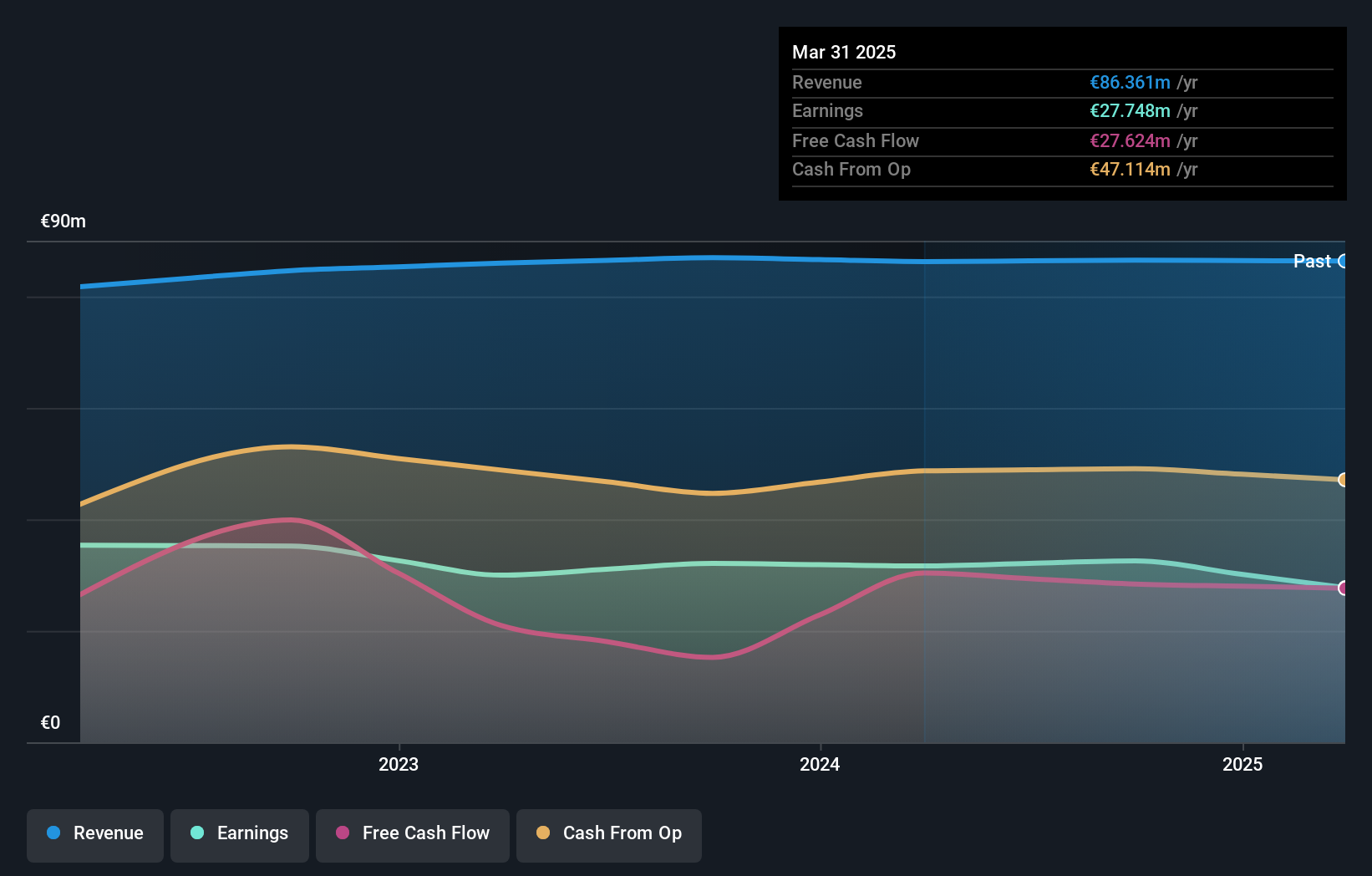

A.L.A. società per azioni, a small player in the logistics sector, has shown impressive resilience with its earnings growing 11% over the past year, outpacing the industry average. The company's debt to equity ratio has improved from 133% to 104% over five years, although its net debt to equity remains high at 70%. Trading at a discount of around 24% below estimated fair value suggests potential upside. Despite volatile share prices recently and free cash flow challenges, A.L.A.'s interest payments are comfortably covered by EBIT at a ratio of 4:1, indicating solid financial management amidst growth prospects forecasted at over 26%.

Fiducial Real Estate (ENXTPA:ORIA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fiducial Real Estate SA operates and manages real estate properties in France, with a market capitalization of €424.86 million.

Operations: The company generates revenue primarily from land activities (€73.03 million) and service provider activities (€23.21 million), while intersector sales reduce the total by €9.73 million.

Fiducial Real Estate, a smaller player in the European market, showcases solid financial health with a net debt to equity ratio of 28.4%, which is considered satisfactory. Despite earnings growth of 1.4% over the past year trailing the real estate industry’s 2.5%, its five-year earnings growth rate stands at a steady 3.5% annually, reflecting consistent performance. The company reported EUR 32.54 million in net income for the full year ending September 2024, slightly up from EUR 32.08 million previously, indicating stability amidst market fluctuations and suggesting potential resilience moving forward in its niche sector.

- Get an in-depth perspective on Fiducial Real Estate's performance by reading our health report here.

Gain insights into Fiducial Real Estate's past trends and performance with our Past report.

ASBISc Enterprises (WSE:ASB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ASBISc Enterprises Plc operates as a distributor of information and communications technology and Internet-of-Things products, solutions, and services across Europe, the Middle East, Africa, and globally, with a market capitalization of PLN1.46 billion.

Operations: ASBISc Enterprises generates revenue primarily from distributing IT products, amounting to $3.01 billion. The company's financial performance is characterized by its net profit margin, which reflects its profitability after accounting for all expenses.

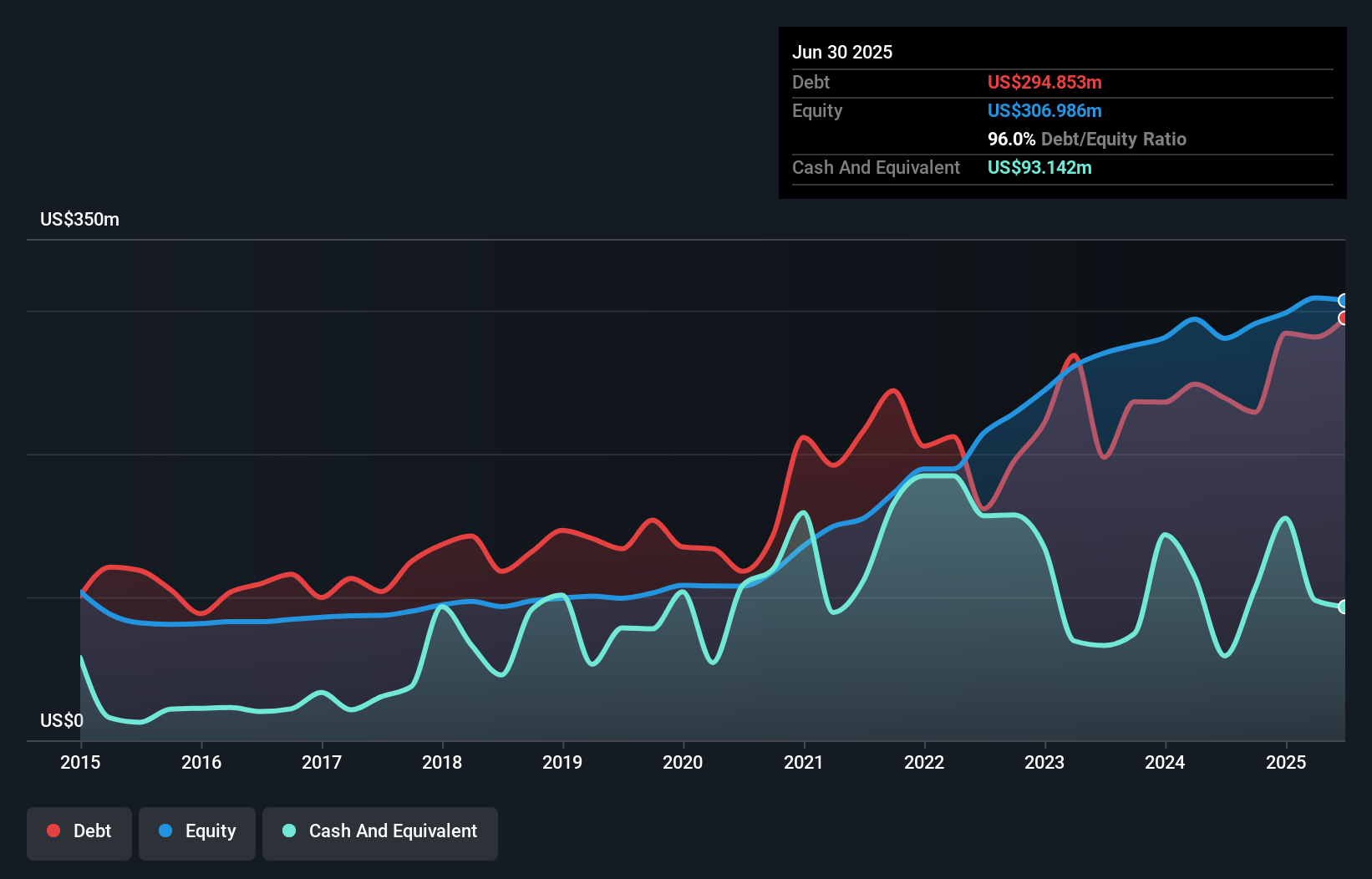

ASBISc Enterprises, a small European player in the electronics distribution space, shows a mixed financial picture. The company's earnings have grown 12% annually over five years, yet its net debt to equity ratio remains high at 43%. Despite this leverage concern, ASBISc's interest payments are well-covered by EBIT at 4.1 times. Recent earnings reports highlight a strong fourth quarter with net income jumping to US$24.53 million from US$1.86 million year-over-year, although annual sales dipped slightly to US$3 billion from US$3.06 billion previously. Trading at 35% below fair value suggests potential upside for investors seeking undervalued opportunities.

- Navigate through the intricacies of ASBISc Enterprises with our comprehensive health report here.

Examine ASBISc Enterprises' past performance report to understand how it has performed in the past.

Taking Advantage

- Click here to access our complete index of 350 European Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ALA

A.L.A. società per azioni

Operates as a supply chain solutions provider to the aerospace and defense, and rail and high-tech sectors.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives