Olidata And 2 European Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As European markets continue to rally, with the STOXX Europe 600 Index reaching record levels due to a surge in technology stocks and expectations of lower U.S. borrowing costs, investors are keenly observing opportunities across various sectors. In such an environment, identifying stocks that offer both affordability and growth potential becomes crucial. Penny stocks, often associated with smaller or newer companies, remain relevant as they can present unique investment opportunities when backed by strong financials. This article explores three European penny stocks that exhibit promising potential amidst current market dynamics.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.06 | €1.41B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.19 | €17.68M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.31 | €43.96M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €2.17 | €29.56M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.96M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.44 | DKK112.26M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.88 | €39.57M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.30 | SEK200.77M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €295.1M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 272 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Olidata (BIT:OLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Olidata S.p.A. operates as a systems integration and technology consulting company with a market cap of €52.07 million.

Operations: No revenue segments have been reported.

Market Cap: €52.07M

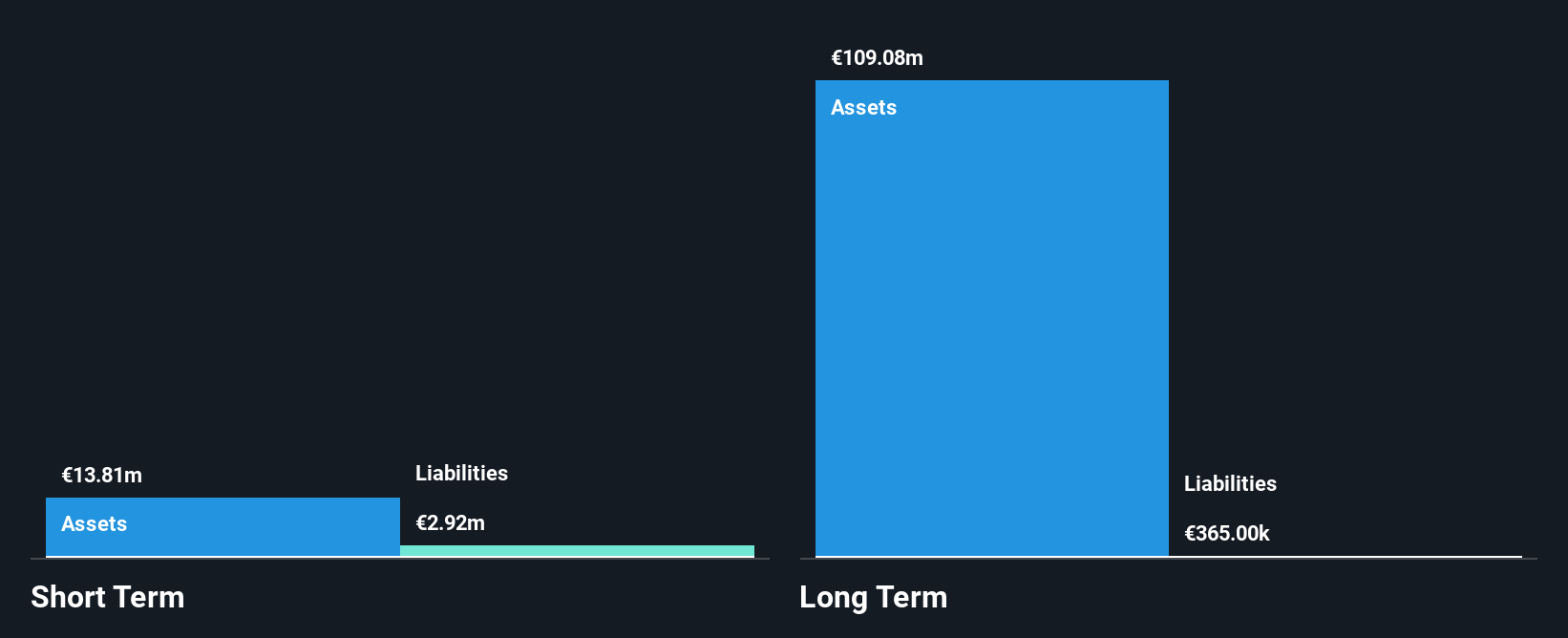

Olidata S.p.A., with a market cap of €52.07 million, faces challenges typical of penny stocks, such as high volatility and financial instability. Despite having more cash than total debt and its interest payments well covered by EBIT, the company struggles with short-term liabilities exceeding assets and a volatile share price. Recent results were impacted by a significant one-off loss of €76.5 million, contributing to negative earnings growth over the past year. Although Olidata has become profitable over five years, its current profit margins have declined compared to last year. The board's inexperience might also affect strategic decisions moving forward.

- Navigate through the intricacies of Olidata with our comprehensive balance sheet health report here.

- Understand Olidata's earnings outlook by examining our growth report.

Catena Media (OM:CTM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Catena Media plc, with a market cap of SEK160.38 million, offers affiliation marketing services for online sports betting and casino operators in North America and Latin America.

Operations: The company generates revenue from two primary segments: Casino, contributing €31.34 million, and Sports, accounting for €8.91 million.

Market Cap: SEK160.38M

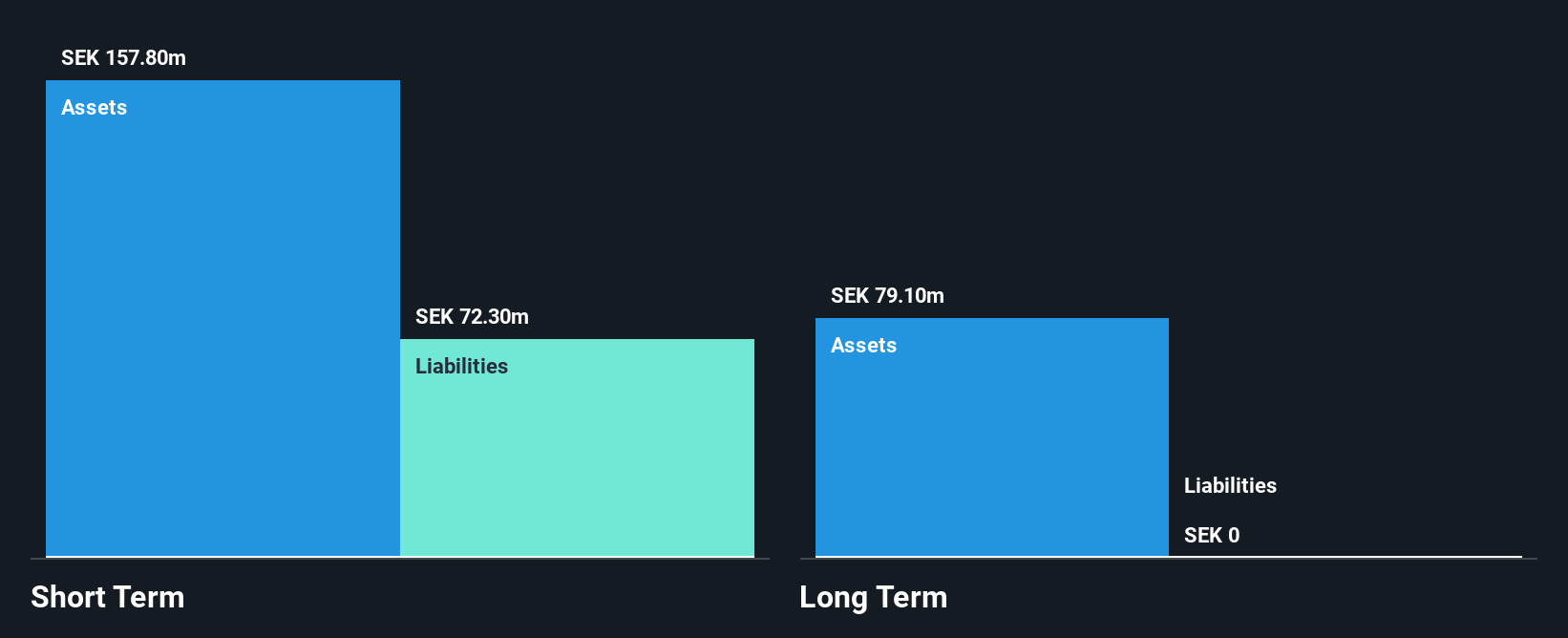

Catena Media plc, with a market cap of SEK160.38 million, navigates challenges common to penny stocks, such as high volatility and financial instability. Despite being debt-free and having short-term assets exceeding liabilities, the company remains unprofitable with a negative return on equity of -35.75%. Recent earnings showed improved net income compared to last year but still reflect declining revenues. The launch of MRKTPLAYS.com aims to bolster growth in North America by enhancing affiliate networks and operator reach. However, inexperienced management and board teams may impact strategic execution amidst volatile share price movements over recent months.

- Dive into the specifics of Catena Media here with our thorough balance sheet health report.

- Learn about Catena Media's historical performance here.

Impact Coatings (OM:IMPC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Impact Coatings AB (publ) offers PVD technology-based coating solutions across Sweden, China, the United States, South Korea, and Germany with a market cap of SEK300.95 million.

Operations: The company generates SEK97.7 million in revenue from its Specialty Chemicals segment.

Market Cap: SEK300.95M

Impact Coatings AB, with a market cap of SEK300.95 million, faces challenges typical of penny stocks, including high volatility and financial instability. The company is debt-free and has short-term assets exceeding liabilities but remains unprofitable with a negative return on equity of -27.07%. Recent earnings revealed declining sales and increased net losses compared to the previous year. Despite revenue growth forecasts, the company's cash runway is less than a year if free cash flow continues to decrease at historical rates. A recent management change sees Daniel Zilén appointed as COO, potentially bringing fresh perspectives to operations amidst these challenges.

- Get an in-depth perspective on Impact Coatings' performance by reading our balance sheet health report here.

- Gain insights into Impact Coatings' future direction by reviewing our growth report.

Where To Now?

- Navigate through the entire inventory of 272 European Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CTM

Catena Media

Provides affiliation marketing services for operators of online sports betting and casino platforms in North America and Latin America.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives