As of July 2025, the European market has shown mixed results, with the pan-European STOXX Europe 600 Index remaining relatively flat amidst ongoing U.S. and European trade discussions, while Germany's DAX and France's CAC 40 Index have seen little change. In this climate of cautious optimism and economic uncertainty, identifying high growth tech stocks in Europe involves looking for companies that demonstrate resilience through innovation and adaptability to shifting trade dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Archos | 24.72% | 39.34% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Rubean | 45.56% | 108.82% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Digital Value (BIT:DGV)

Simply Wall St Growth Rating: ★★★★★☆

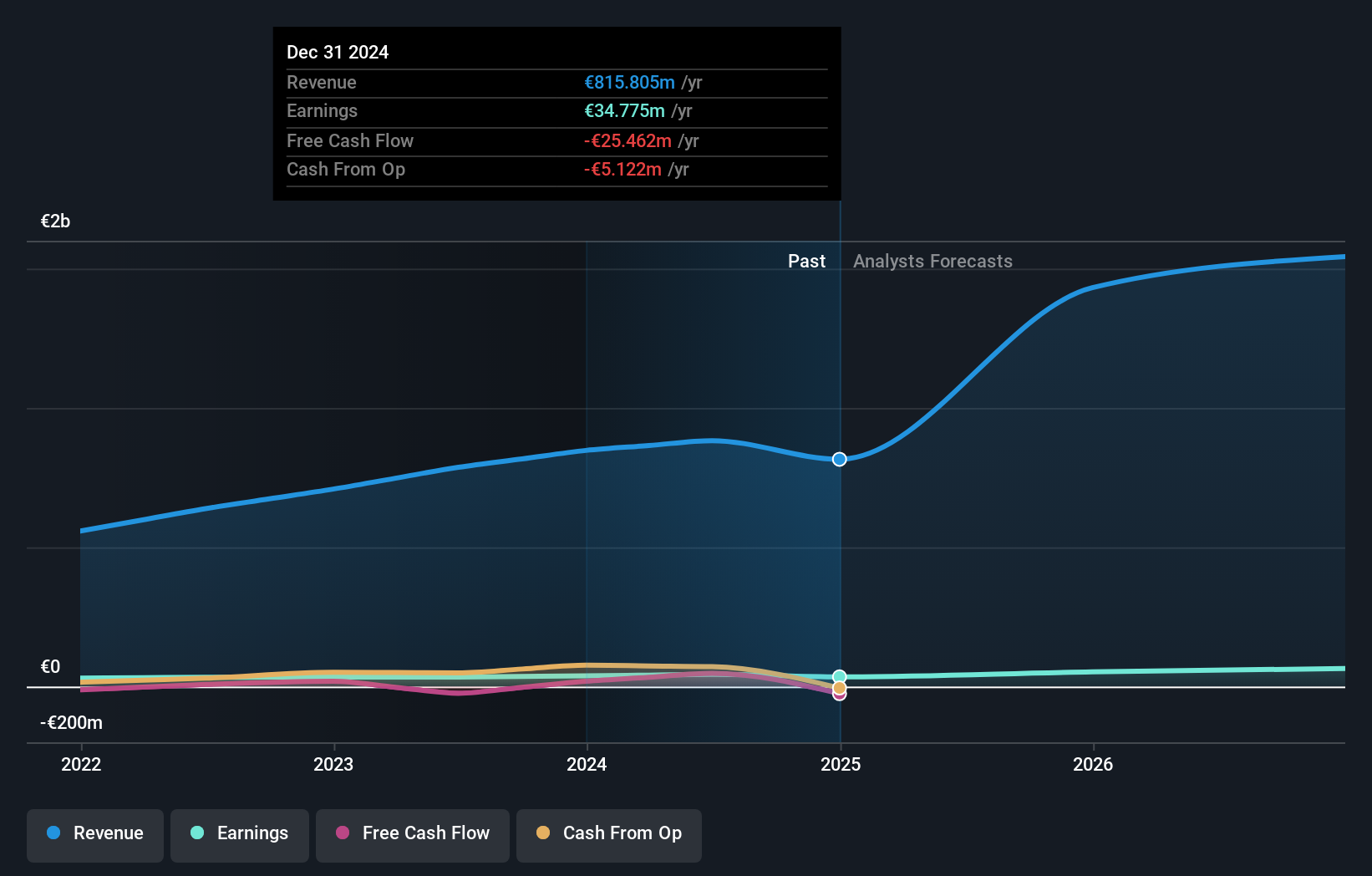

Overview: Digital Value S.p.A. is an Italian company that offers IT solutions and services, with a market capitalization of €304.43 million.

Operations: Digital Value S.p.A. generates revenue primarily through its Hyper VAR (Value Added Reseller) activity, amounting to €815.80 million.

Despite a recent dip in earnings, Digital Value S.p.A. demonstrates robust potential with forecasted annual revenue and earnings growth rates at 28.8% and 29.4% respectively, significantly outpacing the broader Italian market's projections of 4.2% for revenue and 7.4% for earnings growth. The company's commitment to innovation is evident from its substantial R&D expenses, ensuring its competitiveness in the rapidly evolving tech landscape. However, it’s crucial to note that despite these positive indicators, the company reported a decrease in net income from EUR 38.37 million to EUR 35.27 million year-over-year and has shown high share price volatility over the past three months, which could concern risk-averse investors.

- Get an in-depth perspective on Digital Value's performance by reading our health report here.

Gain insights into Digital Value's past trends and performance with our Past report.

Wiit (BIT:WIIT)

Simply Wall St Growth Rating: ★★★★★☆

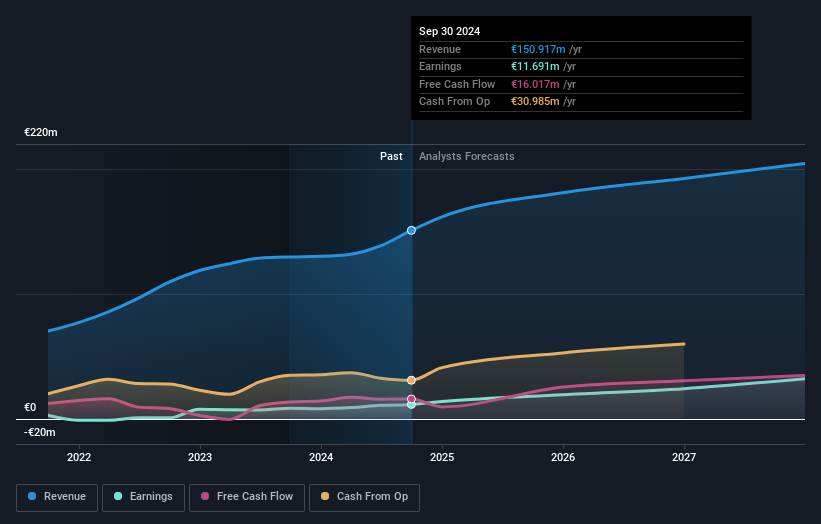

Overview: Wiit S.p.A. is an Italian company that offers cloud services to businesses both domestically and internationally, with a market capitalization of €427.53 million.

Operations: Wiit S.p.A. specializes in delivering cloud services to businesses across Italy and beyond. The company's revenue model primarily revolves around providing these services, which cater to a diverse range of business needs.

Wiit S.p.A. stands out in the European tech scene with its impressive earnings growth of 31.85% per year, significantly surpassing Italy's average of 7.4%. This growth is underpinned by a robust R&D commitment, as reflected in their strategic investments which have nurtured high-quality earnings and innovation. Despite challenges in covering interest payments fully with earnings, Wiit's financial agility is evident from its positive free cash flow and a projected Return on Equity of an exceptional 45.6% in three years. Moreover, recent financial results highlight a steady increase in quarterly revenues to €41.11 million and net income rising to €3.16 million, showcasing sustained operational success amidst competitive pressures.

- Unlock comprehensive insights into our analysis of Wiit stock in this health report.

Explore historical data to track Wiit's performance over time in our Past section.

Amper (BME:AMP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amper, S.A. offers technological, industrial, and engineering solutions across defense, security, energy, sustainability, and telecommunications sectors both in Spain and globally with a market capitalization of approximately €247.25 million.

Operations: Amper, S.A. generates revenue primarily from its Energy and Sustainability segment (€339.33 million) and Defense, Security, and Telecommunications segment (€84.44 million). The company operates in both domestic and international markets.

Amper's recent strategic maneuvers, including a substantial follow-on equity offering raising €77.17 million, underscore its aggressive capital acquisition tactics to fuel expansion. Despite a one-off loss of €20.3 million last year impacting earnings, the company's revenue is expected to climb by 9.5% annually, outpacing the Spanish market's 4.5%. This growth trajectory is bolstered by an impressive forecast of annual earnings growth at 33.8%, significantly higher than the broader market's 5.9%. These figures reflect Amper’s resilience and adaptability in a competitive tech landscape, positioning it well for sustained growth amidst ongoing financial strategies and market challenges.

- Take a closer look at Amper's potential here in our health report.

Assess Amper's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Discover the full array of 229 European High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wiit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:WIIT

Wiit

Provides cloud services for various businesses in Italy and internationally.

High growth potential with questionable track record.

Market Insights

Community Narratives