- Belgium

- /

- Entertainment

- /

- ENXTBR:KIN

3 Stocks That May Be Trading Below Their Intrinsic Value By Up To 45.3%

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by mixed corporate earnings, AI competition fears, and geopolitical uncertainties. While the Federal Reserve held interest rates steady amidst persistent inflation concerns, European markets were buoyed by strong earnings and an ECB rate cut. In such uncertain times, identifying stocks that may be trading below their intrinsic value can be an attractive strategy for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wistron (TWSE:3231) | NT$99.00 | NT$197.62 | 49.9% |

| Alltop Technology (TPEX:3526) | NT$265.00 | NT$528.78 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.90 | CA$11.79 | 50% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.31 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.72 | €5.43 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.22 | SEK165.90 | 49.8% |

| Spin Master (TSX:TOY) | CA$30.23 | CA$60.17 | 49.8% |

| Coastal Financial (NasdaqGS:CCB) | US$86.74 | US$172.68 | 49.8% |

| Equifax (NYSE:EFX) | US$266.77 | US$531.78 | 49.8% |

| Facephi Biometria (BME:FACE) | €2.23 | €4.45 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

TXT e-solutions (BIT:TXT)

Overview: TXT e-solutions S.p.A. is a company that offers software and service solutions both in Italy and internationally, with a market cap of €464.69 million.

Operations: The company's revenue is derived from Smart Solutions (€57.03 million), Digital Advisory (€43.22 million), and Software Engineering (€184.35 million).

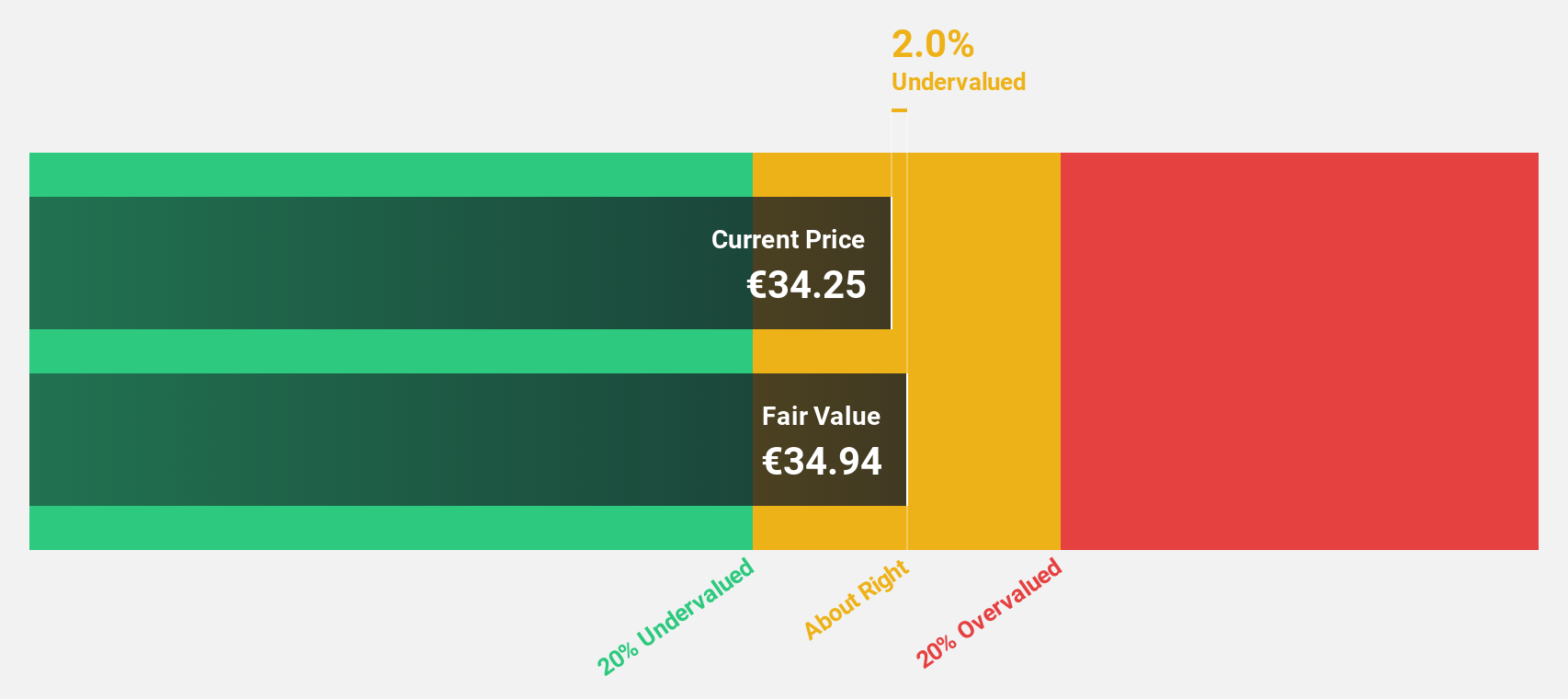

Estimated Discount To Fair Value: 38.3%

TXT e-solutions appears undervalued, trading at €38.55 compared to an estimated fair value of €62.51. Despite its debt not being well covered by operating cash flow, the company's earnings have grown 45% annually over five years and are forecasted to grow 22.93% per year, outpacing the Italian market's growth rate. Recent earnings reports show increased sales and net income, reinforcing its potential as an undervalued stock based on cash flows.

- In light of our recent growth report, it seems possible that TXT e-solutions' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of TXT e-solutions stock in this financial health report.

Kinepolis Group (ENXTBR:KIN)

Overview: Kinepolis Group NV operates cinema complexes across several countries including Belgium, the Netherlands, France, and others, with a market cap of €1.01 billion.

Operations: The company's revenue segments include Box Office (€294.05 million), In-Theatre Sales (€177.61 million), Real Estate (€13.88 million), Film Distribution (€4.07 million), and Technical Department (€0.07 million).

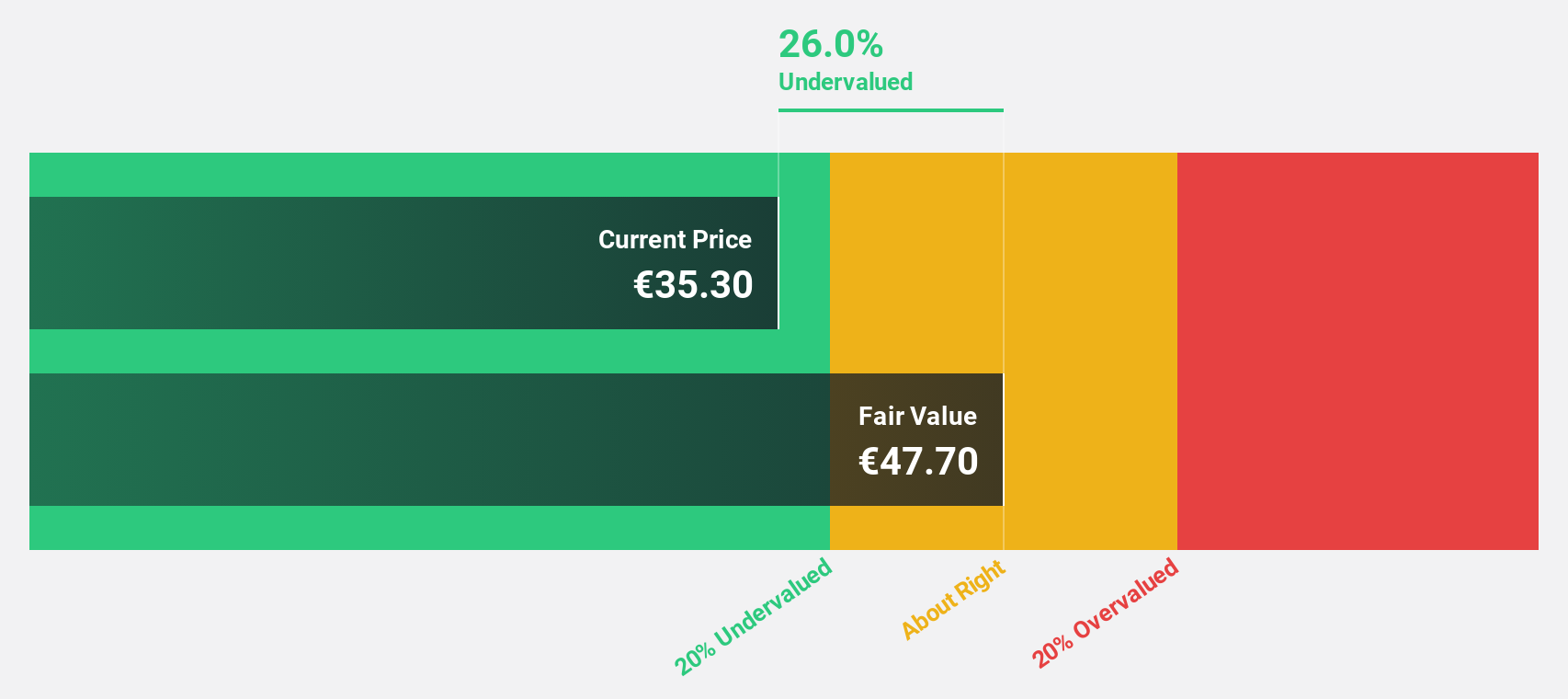

Estimated Discount To Fair Value: 40.2%

Kinepolis Group is trading at €38.6, significantly below its estimated fair value of €64.57, suggesting it may be undervalued based on cash flows. Although revenue growth is modest at 4.8% annually, earnings are expected to grow significantly at 25.7% per year, outpacing the Belgian market's average growth rate of 18.7%. Despite a high level of debt, analysts anticipate a stock price increase of 34.5%, highlighting potential investment appeal amidst valuation concerns.

- The analysis detailed in our Kinepolis Group growth report hints at robust future financial performance.

- Navigate through the intricacies of Kinepolis Group with our comprehensive financial health report here.

DO & CO (WBAG:DOC)

Overview: DO & CO Aktiengesellschaft is a catering service provider operating in Austria, Turkey, Great Britain, the United States, Spain, Germany, and internationally with a market cap of €2.09 billion.

Operations: The company's revenue segments include Airline Catering (€1.60 billion), International Event Catering (€317.15 million), and Restaurants, Lounges & Hotels (€156.81 million).

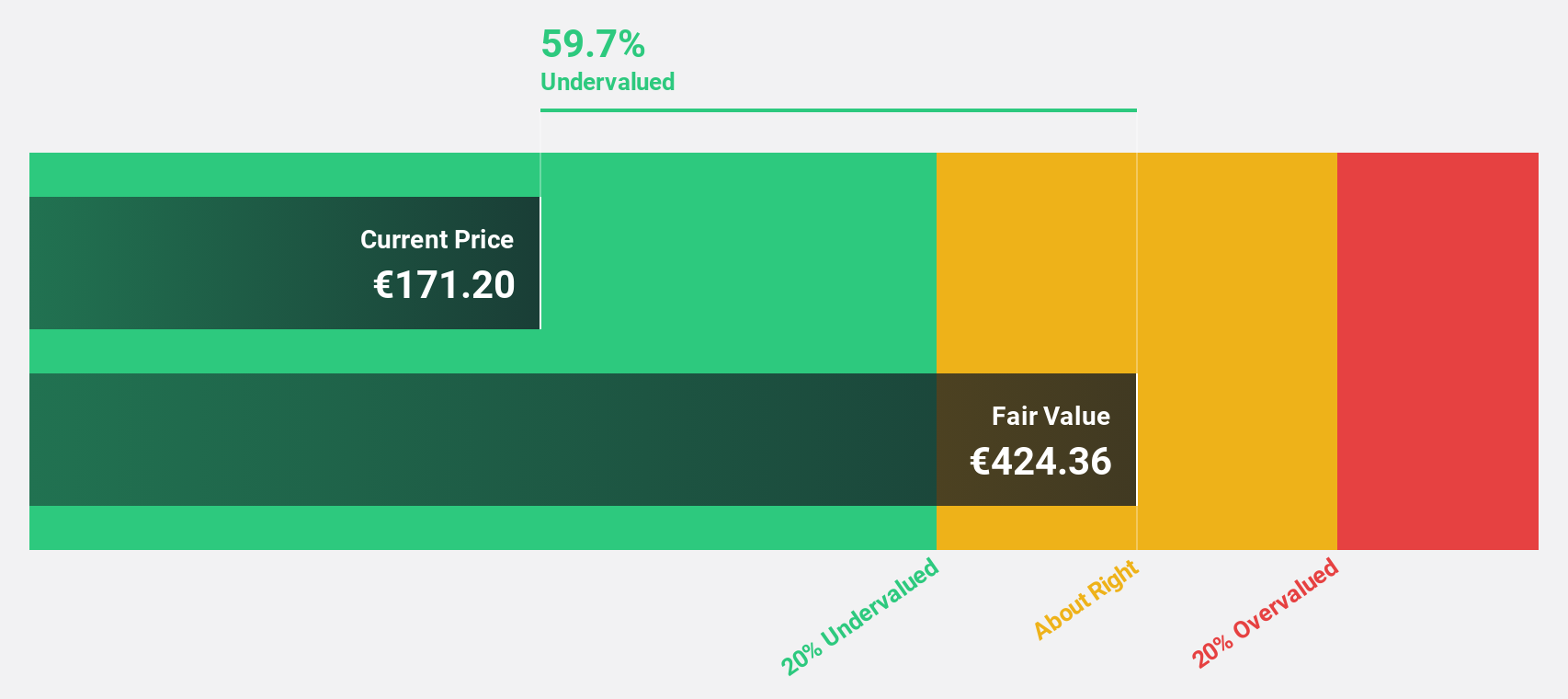

Estimated Discount To Fair Value: 45.3%

DO & CO is trading at €190.4, significantly below its estimated fair value of €347.99, indicating potential undervaluation based on cash flows. The company reported strong earnings growth of 36.1% over the past year, with future earnings expected to grow at 19.2% annually, surpassing the Austrian market's average growth rate of 10%. Despite recent share price volatility, DO & CO's high forecasted return on equity and undervaluation underscore its investment appeal amidst valuation concerns.

- Our expertly prepared growth report on DO & CO implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on DO & CO's balance sheet by reading our health report here.

Key Takeaways

- Click through to start exploring the rest of the 927 Undervalued Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinepolis Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:KIN

Kinepolis Group

Operates cinema complexes in Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives