Investors more bullish on Relatech (BIT:RLT) this week as stock pops 11%, despite earnings trending downwards over past three years

Investors can buy low cost index fund if they want to receive the average market return. But across the board there are plenty of stocks that underperform the market. Unfortunately for shareholders, while the Relatech S.p.A. (BIT:RLT) share price is up 13% in the last three years, that falls short of the market return. Zooming in, the stock is actually down 0.6% in the last year.

Since it's been a strong week for Relatech shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Relatech

SWOT Analysis for Relatech

- Debt is not viewed as a risk.

- Earnings declined over the past year.

- Shareholders have been diluted in the past year.

- Annual earnings are forecast to grow faster than the Italian market.

- Trading below our estimate of fair value by more than 20%.

- No apparent threats visible for RLT.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, Relatech actually saw its earnings per share (EPS) drop 28% per year.

Earnings per share have melted like a stack of ice cubes, in stark contrast to the share price. So we'll need to take a look at some different metrics to try to understand why the share price remains solid.

It could be that the revenue growth of 42% per year is viewed as evidence that Relatech is growing. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

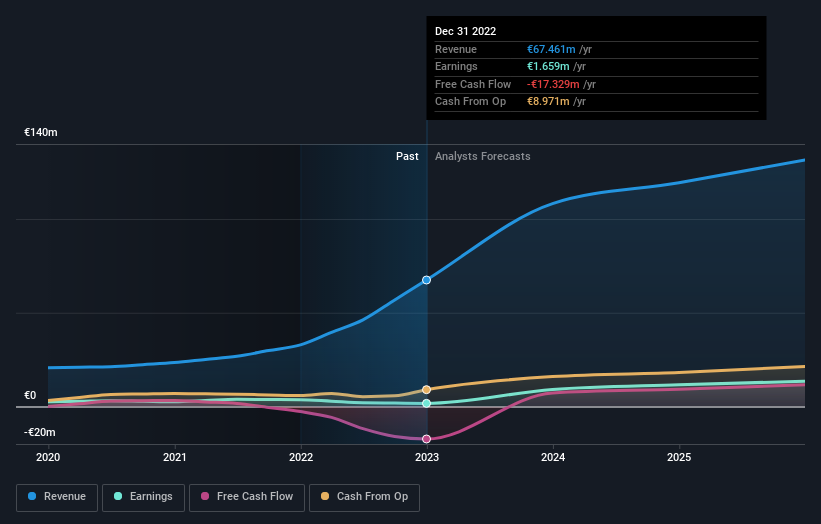

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

The last twelve months weren't great for Relatech shares, which cost holders 0.6%, while the market was up about 6.2%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Fortunately the longer term story is brighter, with total returns averaging about 4% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Relatech has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

We will like Relatech better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:RLT

Relatech

A digital enabler solution know-how company, provides various digital solutions in Milan and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives