MailUp S.p.A. (BIT:MAIL) Just Reported Yearly Earnings: Have Analysts Changed Their Mind On The Stock?

Last week, you might have seen that MailUp S.p.A. (BIT:MAIL) released its yearly result to the market. The early response was not positive, with shares down 4.0% to €4.32 in the past week. It was an okay report, and revenues came in at €65m, approximately in line with analyst estimates leading up to the results announcement. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for MailUp

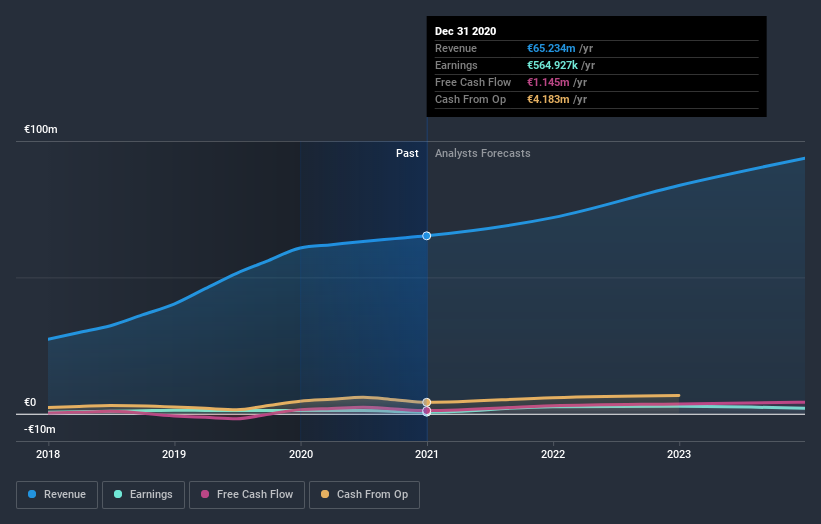

Following the latest results, MailUp's dual analysts are now forecasting revenues of €71.9m in 2021. This would be a meaningful 10% improvement in sales compared to the last 12 months. Per-share earnings are expected to jump 108% to €0.16. Before this earnings report, the analysts had been forecasting revenues of €77.0m and earnings per share (EPS) of €0.15 in 2021. If anything, the analysts look to have become slightly more optimistic overall; while they decreased their revenue forecasts, EPS predictions increased and ultimately earnings are more important.

The consensus has made no major changes to the price target of €6.13, suggesting the forecast improvement in earnings is expected to offset the decline in revenues next year.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the MailUp's past performance and to peers in the same industry. It's pretty clear that there is an expectation that MailUp's revenue growth will slow down substantially, with revenues to the end of 2021 expected to display 10% growth on an annualised basis. This is compared to a historical growth rate of 33% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 19% per year. Factoring in the forecast slowdown in growth, it seems obvious that MailUp is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards MailUp following these results. Unfortunately, they also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. Yet - earnings are more important to the intrinsic value of the business. The consensus price target held steady at €6.13, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with MailUp , and understanding these should be part of your investment process.

If you decide to trade MailUp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:GROW

Growens

Engages in the cloud marketing technology business in Italy, other European countries, the Americas, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)