Expert System S.p.A. (BIT:EXSY) Released Earnings Last Week And Analysts Lifted Their Price Target To €5.00

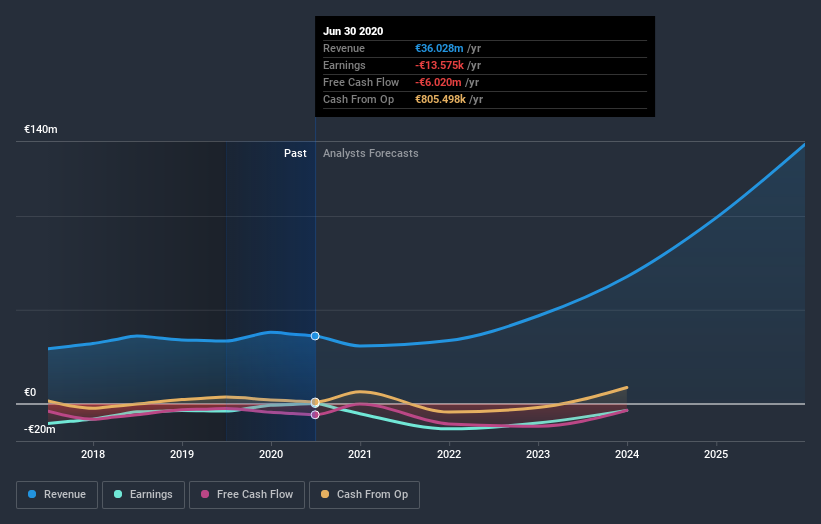

As you might know, Expert System S.p.A. (BIT:EXSY) recently reported its full-year numbers. It was a pretty good result, with revenues of €36m, and Expert System came in a solid 17% ahead of expectations. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for Expert System

Taking into account the latest results, the current consensus, from the three analysts covering Expert System, is for revenues of €33.6m in 2021, which would reflect a perceptible 6.9% reduction in Expert System's sales over the past 12 months. Per-share losses are expected to explode, reaching €0.26 per share. Before this earnings announcement, the analysts had been modelling revenues of €33.6m and losses of €0.25 per share in 2021. Overall it looks as though the analysts were a bit mixed on the latest consensus updates. Although sales forecasts held steady, the consensus also made a moderate increase in its losses per share forecasts.

Despite expectations of heavier losses next year,the analysts have lifted their price target 49% to €5.00, perhaps implying these losses are not expected to be recurring over the long term. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Expert System, with the most bullish analyst valuing it at €6.30 and the most bearish at €3.70 per share. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Expert System's past performance and to peers in the same industry. We would highlight that sales are expected to reverse, with a forecast 6.9% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 8.0% over the last year. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 20% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Expert System is expected to lag the wider industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Expert System. On the plus side, there were no major changes to revenue estimates; although forecasts imply revenues will perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Expert System going out to 2025, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Expert System that you should be aware of.

If you decide to trade Expert System, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Expert.ai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:EXAI

Expert.ai

An artificial intelligence (AI) platform company, develops and sells cognitive computing software products based on AI algorithms to read and understand written language worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026