If You Had Bought Dominion Hosting Holding (BIT:DHH) Shares A Year Ago You'd Have Earned 134% Returns

When you buy shares in a company, there is always a risk that the price drops to zero. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example Dominion Hosting Holding S.p.A. (BIT:DHH). Its share price is already up an impressive 134% in the last twelve months. It's also good to see the share price up 14% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 9.8% in 90 days). And shareholders have also done well over the long term, with an increase of 67% in the last three years.

See our latest analysis for Dominion Hosting Holding

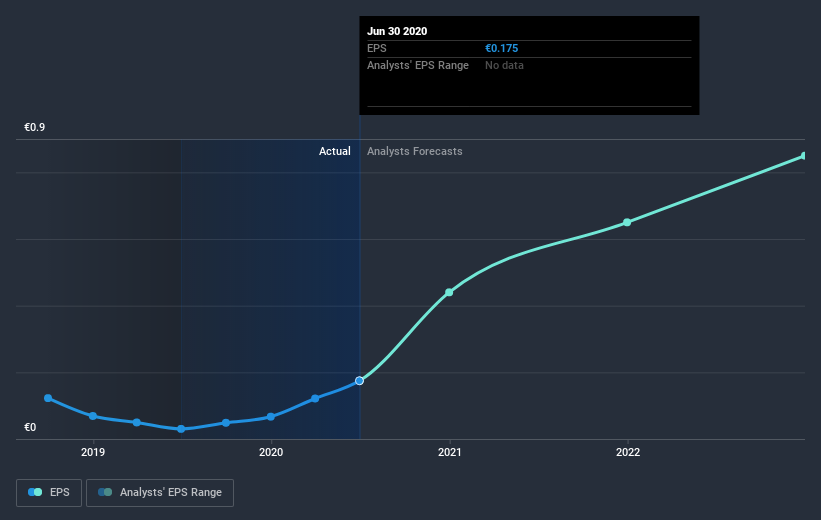

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Dominion Hosting Holding saw its earnings per share (EPS) increase strongly. While that particular rate of growth is unlikely to be sustained for long, it is still remarkable. So we'd expect to see the share price higher. We're real advocates of letting inflection points like this guide our research as stock pickers.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Dominion Hosting Holding has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It's nice to see that Dominion Hosting Holding shareholders have gained 134% (in total) over the last year. That's better than the annualized TSR of 19% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Dominion Hosting Holding on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Dominion Hosting Holding (1 is concerning!) that you should be aware of before investing here.

But note: Dominion Hosting Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you’re looking to trade Dominion Hosting Holding, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:DHH

Dominion Hosting Holding

Provides integrated B2B cloud and internet products and services in Italy, Croatia, Slovenia, Serbia, Switzerland, and Bulgaria.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026