Discover 3 Promising Penny Stocks With Over US$90M Market Cap

Reviewed by Simply Wall St

Global markets have been experiencing significant movements, with U.S. stocks rallying to record highs following a "red sweep" in the elections, which has raised expectations for growth and tax reforms. In this context of shifting economic policies and market optimism, investors are increasingly looking at under-the-radar opportunities that can offer potential growth without excessive risk. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies with the potential for substantial upside when backed by strong fundamentals and sound financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.46 | MYR2.29B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$144.95M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.06 | THB1.67B | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.63 | £190.08M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.93 | MYR2.02B | ★★★★★☆ |

Click here to see the full list of 5,755 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cyberoo (BIT:CYB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cyberoo S.p.A. offers managed and cyber security services with a market cap of €92.34 million.

Operations: The company's revenue is derived from Managed Services (€4.53 million), Digital Transformation (€0.15 million), and Cyber Security & Device Security (€16.60 million).

Market Cap: €92.34M

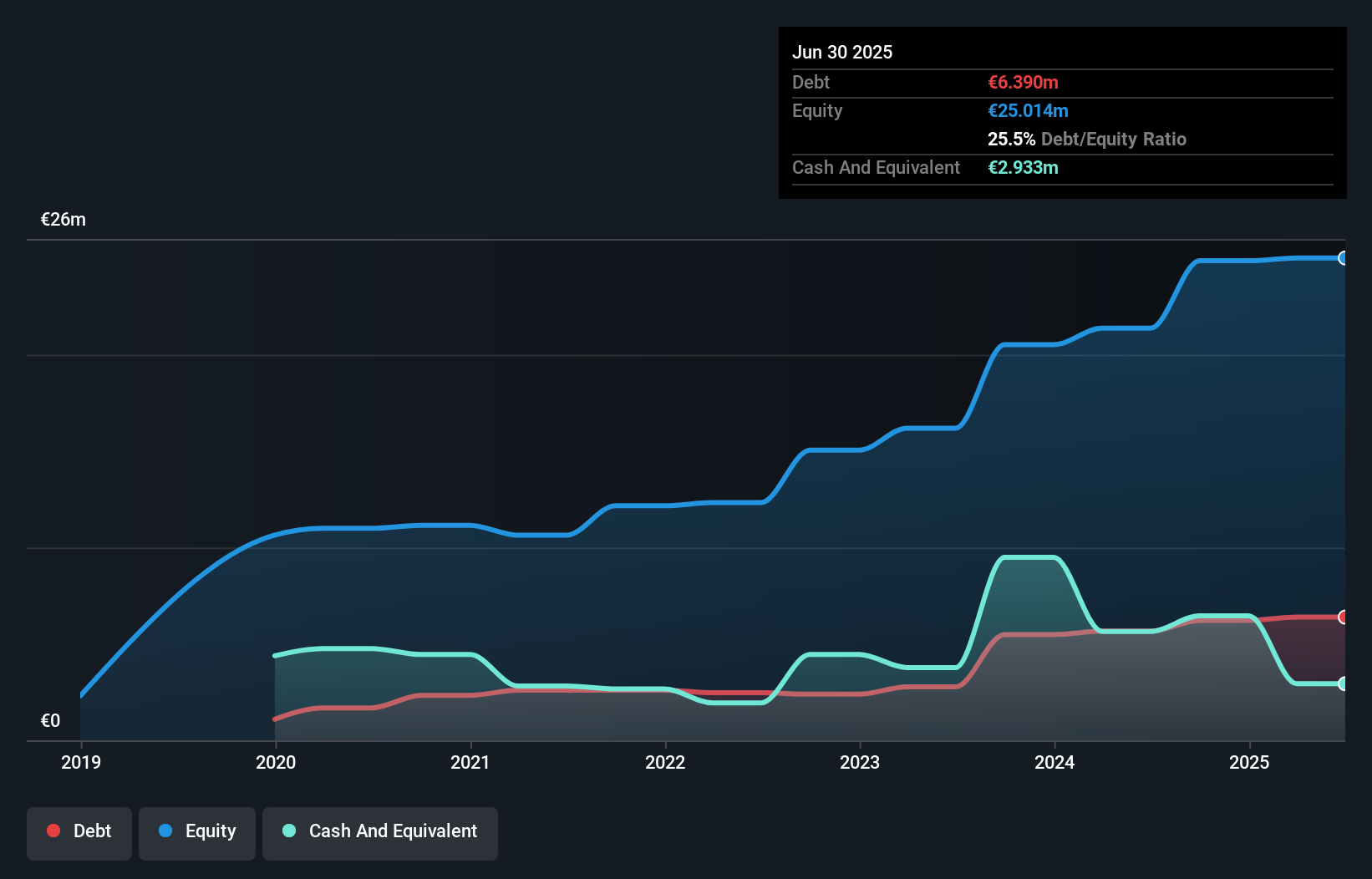

Cyberoo S.p.A., with a market cap of €92.34 million, has shown significant earnings growth over the past five years, averaging 58% annually. However, recent performance indicates a slowdown with only 6% growth last year. The company’s revenue streams are primarily from Cyber Security & Device Security (€16.60 million) and Managed Services (€4.53 million). Despite increased debt levels over five years, its debt is well covered by operating cash flow and interest payments are adequately managed by EBIT. Recent earnings reported for the half-year show increased sales but a decline in net income compared to the previous year.

- Jump into the full analysis health report here for a deeper understanding of Cyberoo.

- Evaluate Cyberoo's prospects by accessing our earnings growth report.

Innate Pharma (ENXTPA:IPH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Innate Pharma S.A. is a biotechnology company focused on developing immunotherapies for cancer patients in France and internationally, with a market cap of €136.32 million.

Operations: The company generates €33.79 million in revenue from its biotechnology segment.

Market Cap: €136.32M

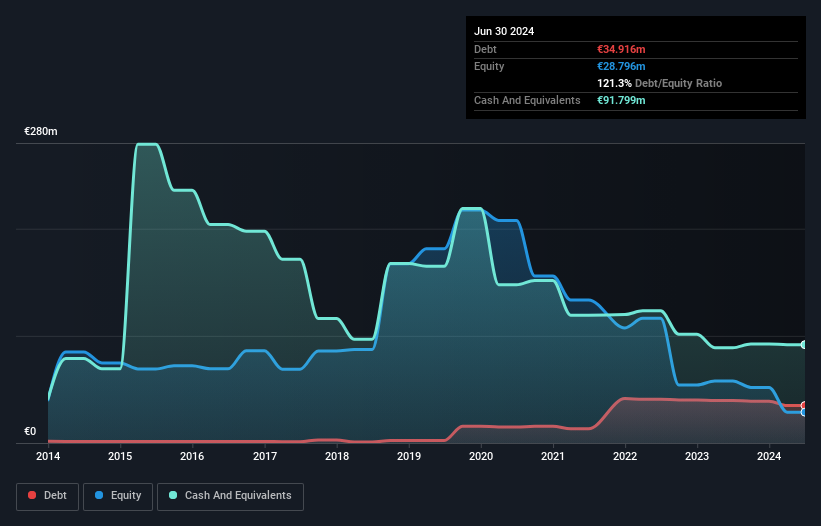

Innate Pharma S.A., with a market cap of €136.32 million, is actively advancing its cancer immunotherapy pipeline, including the promising IPH4502 and IPH6501 candidates currently in early-stage clinical trials. Despite generating €33.79 million in revenue, the company remains unprofitable with increasing losses over five years at 26.4% annually and a negative return on equity of -118.25%. However, it maintains financial stability with short-term assets exceeding liabilities and sufficient cash runway for over three years without meaningful shareholder dilution recently. The recent appointment of Jonathan Dickinson as CEO brings seasoned leadership to navigate these challenges and opportunities ahead.

- Get an in-depth perspective on Innate Pharma's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Innate Pharma's future.

3D Medicines (SEHK:1244)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3D Medicines Inc. is a biopharmaceutical company focused on researching, developing, and commercializing oncology products for cancer treatment in Mainland China, with a market cap of approximately HK$548.89 million.

Operations: The company generates revenue from its biopharmaceutical research and development activities, amounting to CN¥488.82 million.

Market Cap: HK$548.89M

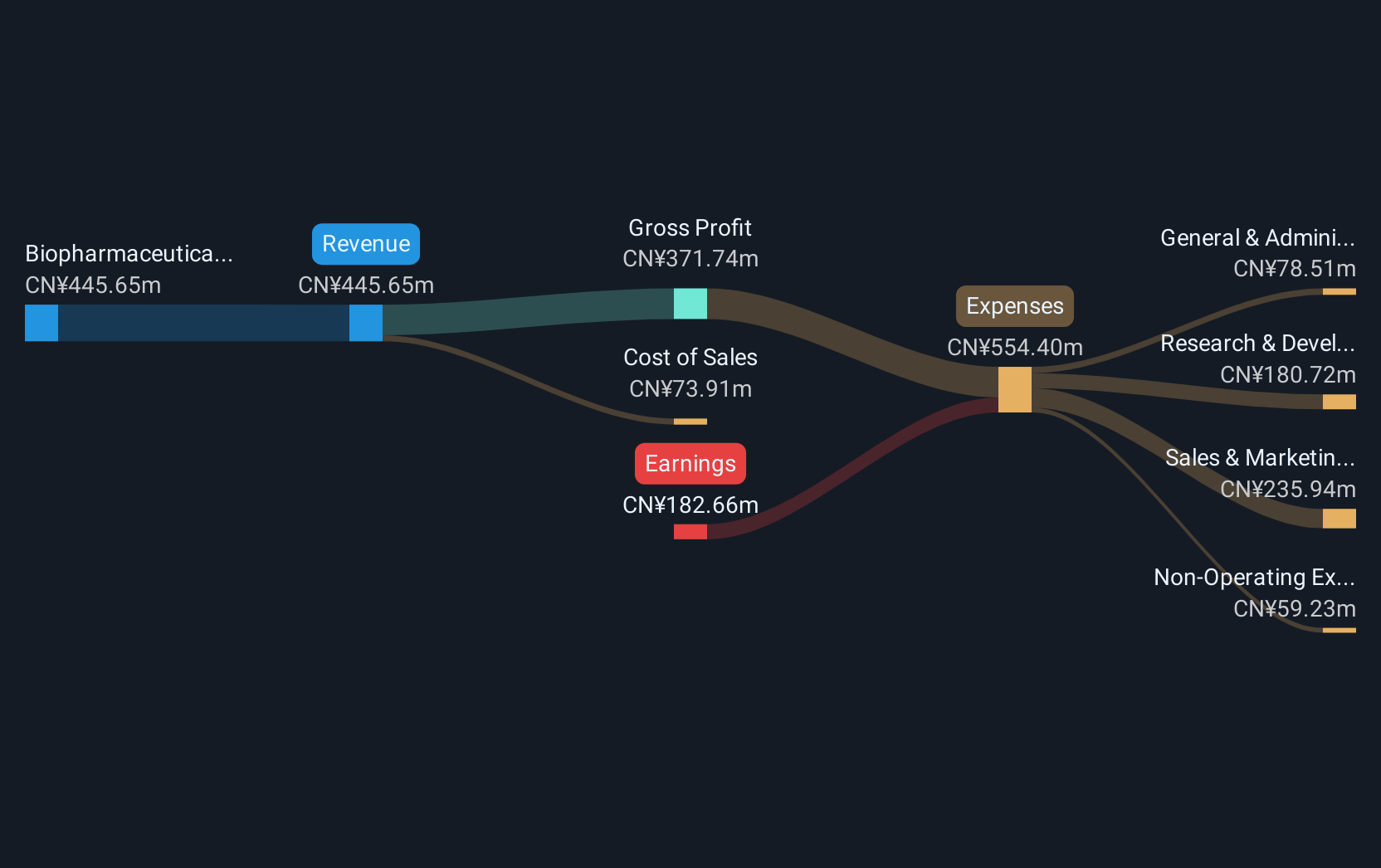

3D Medicines Inc., with a market cap of approximately HK$548.89 million, focuses on oncology products in Mainland China. Despite being unprofitable, it has reduced losses by 18.2% annually over five years and reported CN¥206.42 million in sales for the first half of 2024, down from CN¥352.55 million the previous year. The company maintains financial stability with short-term assets exceeding liabilities and more cash than debt, ensuring a cash runway exceeding three years at current free cash flow levels. However, shareholder dilution occurred last year as shares outstanding increased by 8.1%.

- Take a closer look at 3D Medicines' potential here in our financial health report.

- Evaluate 3D Medicines' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Take a closer look at our Penny Stocks list of 5,755 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3D Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1244

3D Medicines

A biopharmaceutical company, researches, develops, and commercializes oncology products and other drug candidates for the treatment of patients with various cancers in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives