- Italy

- /

- Retail Distributors

- /

- BIT:TIME

What Compagnia dei Caraibi S.p.A.'s (BIT:TIME) 53% Share Price Gain Is Not Telling You

Compagnia dei Caraibi S.p.A. (BIT:TIME) shareholders have had their patience rewarded with a 53% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 46% over that time.

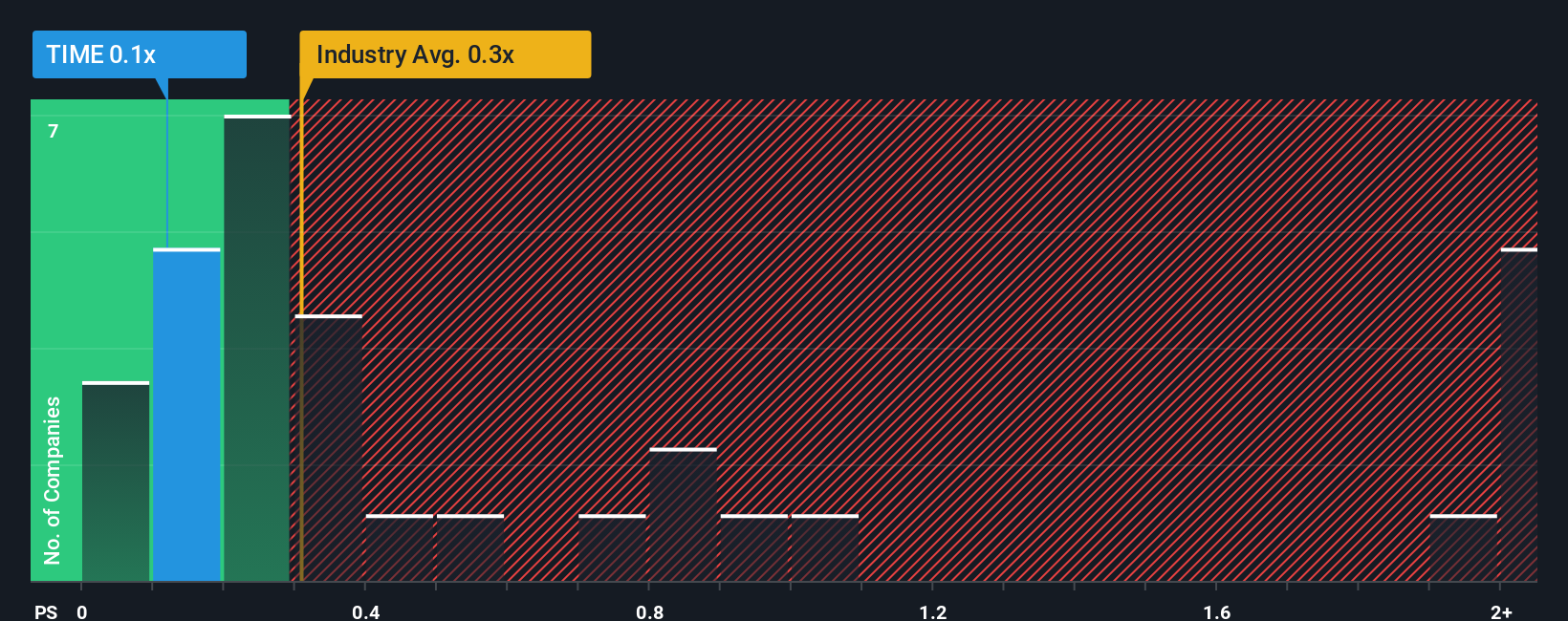

Even after such a large jump in price, it's still not a stretch to say that Compagnia dei Caraibi's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Retail Distributors industry in Italy, where the median P/S ratio is around 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Compagnia dei Caraibi

How Has Compagnia dei Caraibi Performed Recently?

Recent times have been advantageous for Compagnia dei Caraibi as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Compagnia dei Caraibi will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Compagnia dei Caraibi?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Compagnia dei Caraibi's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has also seen an excellent 40% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 5.0% each year as estimated by the one analyst watching the company. With the industry predicted to deliver 10% growth per annum, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Compagnia dei Caraibi's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Compagnia dei Caraibi's P/S?

Compagnia dei Caraibi's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of Compagnia dei Caraibi's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It is also worth noting that we have found 3 warning signs for Compagnia dei Caraibi that you need to take into consideration.

If these risks are making you reconsider your opinion on Compagnia dei Caraibi, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:TIME

Compagnia dei Caraibi

Engages in scouting, selection, import, promotion, and distribution of spirits, wines, and craft beer in Italy and internationally.

Good value with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026